PROGRAM AGENDA 2012 MAY 2 - 4th, 2012, MIAMI, FLORIDA

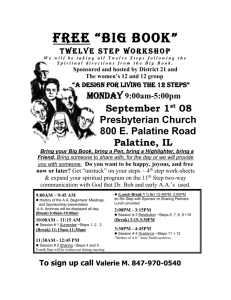

advertisement

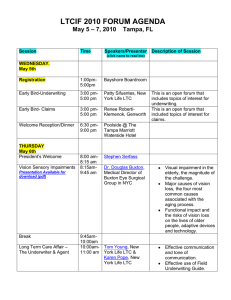

PROGRAM AGENDA 2012 MAY 2nd - 4th, 2012, MIAMI, FLORIDA WEDNESDAY MAY 2nd Time Speaker Registration 1:00pm – 5:00pm Early Bird- Underwriting 3:00pm- 5:00pm This is an open forum that includes topics of interest for underwriting. Early Bird - Claims 3:00pm – 5:00pm This is an open forum that includes topics of interest for claims. Jacqueline BencomoCarreno, CHCS Services Welcome Reception/Dinner 6:30pm - 9:30pm Session Description Speaker(s) Joline Allen, RGA Reinsurance Company THURSDAY MAY 5th Breakfast 7:00am 8:00am SESSIONS TIME President’s Welcome 8:00am – 8:15am Valvular Heart Disease 8:15am – 9:30am Break 9:30am–9:45am Evaluation of Movement Disorders 9:45am-11:00am Neurogenerative Disorders Claims in LTC Insurance Margaret Czellecz, Lifeplans This session will provide you with an understanding of the impact valvular heart disease has on Long Term Care including co-morbid cardiac histories and its’ implications relative to morbidity and mortality. Dr. Vincent E. Friedewald, M.D., Associate Editor, The American Journal of Cardiology, New York, NY • Dr. Bryan Yanaga, MD, Medical Director, Bankers Differentiate between significant and nonsignificant movement disorders, expected diagnostic tests and results. Dr. Stephen Holland, MD, Chief Medical Officer, Univita • • Boomers and Below 11:00am-12:00 noon • Identify the risks, pros and cons of underwriting the younger applicant. Are obtaining the right requirements to adequately assess the risk for the risk pool? What could I be missing? Discuss the types of claims that are seen in the younger population and identify some of the associated challenges with adjudication and reassessment of the young insured. Denise Liston, RN, Vice President, Lifeplans During this session, we will explore the three most common mental disorders in the aging population: Delirium, Dementia, and Depression. Many people tend to confuse the three conditions, especially delirium and dementia because all of them have symptoms in common. However, there are quite a number of marked differences between them. Whether you are underwriting an application for long term care coverage or adjudicating a claim for long term care benefits, our speakers will explore and help you understand these three D’s and their distinct signs/behaviors, symptom and treatments. Dr. Jeffrey Davids, Sr. Adjudication Specialist, Genworth • • • LUNCH 12:00 – 1:00pm A Brain Mystery – Is It Cognitive Impairment, Normal Aging or Something Else? 1:00pm- 2:00pm Evaluate the risk associated with inconclusive testing and recommendations for repeat testing in the future. Provide a claims perspective on the adjudication of a claim and potential for improvement vs. a reasonable progression of the symptoms over time. Sally Lord, LTC Consultant, Genworth Dr. Stephen Holland, Chief Medical Officer, Univita Break 2:00pm – 2:15pm Genetic Testing 2:15pm – 3:15pm Overview on genetic testing and the latest updates as it pertains to long-term care insurance. Dr. Shelly Rahn, MD, Mass Mutual, Denise Liston, RN, Vice President, Lifeplans Mike Rafalko, Drinker, Biddle & Reath, LLP The Doctors Challenge 3:15pm – 4:45pm Take advantage of the opportunity to share in real case studies and get the opinion of our Medical Directors regarding both the underwriting and claims cases. Bring your own case for presentation and discussion during this valuable session. Dr. Bruce Margolis, Medical Director, Genworth Dr. Dan Elliott, Sr. Vice President and Medical Director, Univita Dr. Sheila MacDonnell, Medical Director, John Hancock Dr. Deborah Van Dommelen, Assistant Medical Director, Northwestern Mutual FRIDAY MAY 4th Breakfast 7:30am -8:25 am Lining Up for Joint Replacements 8:30am – 9:30am • • • • Break 9:30am -9:45am What are the challenges associated with underwriting? What is key to determining the initial eligibility and assessing the recovery for ongoing eligibility? How do I interpret the therapy notes? This very interactive session will look back on the industry experiences and discuss future opportunities. Dr. Shelly Rahn, MD Mass Mutual Financial Group Elizabeth Roberge, Mass Mutual Financial Group Joseph Furlong, RGA Reinsurance Company LTC Police Academy: A Cadet’s Guide to Navigating Contestable Claims, SUI Investigations and Related Landmines Wrap up 9:45am – 11:00am 11:00am – 11:30am Congratulations! You have each been selected to the prestigious Miami LTC Police Academy, and training starts immediately. This ain’t no “Mission to Moscow”; it’s “Assignment: Miami Beach”. An insurance carrier inundated with bad claims is like a “City Under Siege” and claims professionals should consider it “Their First Assignment” to identify those bad claims and take appropriate steps to mitigate risk. You are, in effect, the carrier’s “Citizens on Patrol”. Follow your instructors –each a bona fide LTC Police Officer—through a series of stern-to-stem, real life contestable claim case studies, from identification of issues, to SUI involvement and surveillance, to rescission and litigation avoidance. Your skills will be tested. Promotions will be offered to those who pass. Failure will result in you being placed “Back in Training”. Command Lassard awaits your participation. Mike Rafalko, Drinker, Biddle & Reath, LLP and others TBD Bob Russ, Prudential, VP of SIU Stephen Holland, MD, Chief Medical Officer, Univita