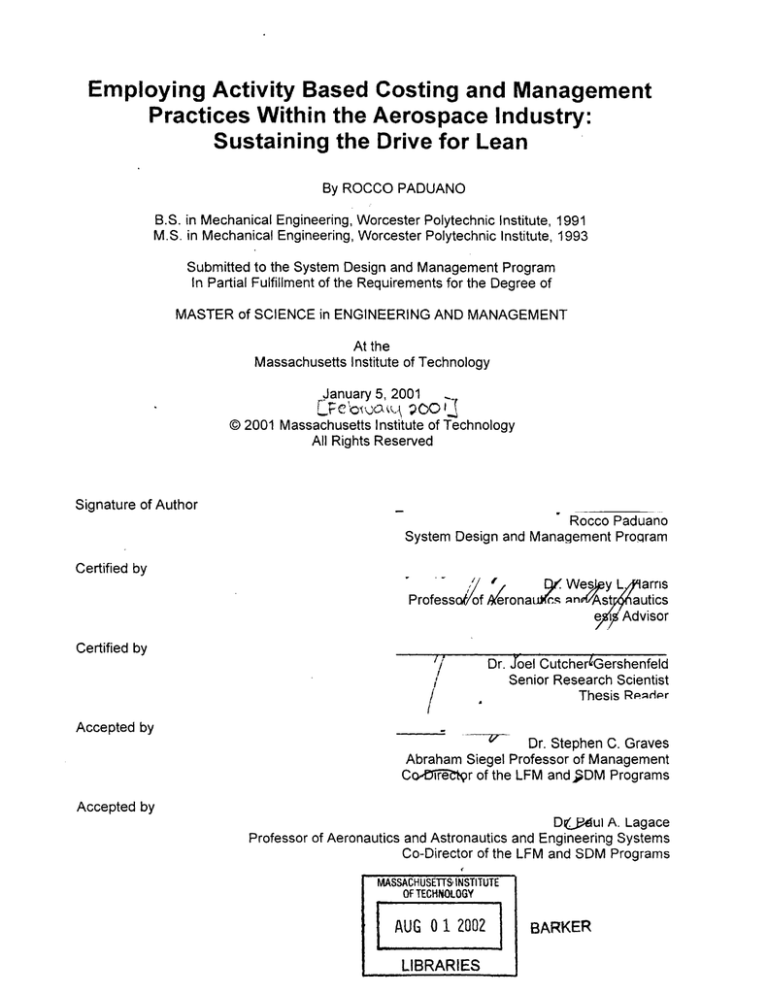

Employing Activity Based Costing and Management

advertisement