Privacy in the Real World Stephen A. Serfass

Privacy in the Real World

Stephen A. Serfass

Stephen.Serfass@dbr.com

Introduction

Legal Landscape

Key HIPAA Terminology

Real World Case Studies

1

Legal Landscape

2

Legal Overview: Federal Law

HIPAA (amended by HITECH)

Governs covered entities’ use/disclosure of “Protected Health

Information” (PHI)

Financial consequences are significant for violations

Establishes breach notification obligation

No private right of action, but may be used to inform standard of care (e.g., state law cause of action for negligence claim)

Byrne v. Avery Ctr. for Obstetrics & Gynecology, P.C., 2014 WL

5507439 (Ct. Nov. 11, 2014)

3

Legal Overview: Federal Law (cont.)

Breach victims have had success holding employers accountable for HIPAA violations by employees

Pharmacist exposed information of a woman (suspected of having an STD) to her now-husband

Claims of negligence/professional malpractice that attach through respondeat superior liability

Indiana Court of Appeals upheld $1.4 Million verdict against

Walgreens (employer). See Walgreens v. Hinchy, No. 49A02-

1311-CT-950, (Ind. Ct. App. Nov. 14, 2014 )

4

Legal Overview: Federal Law (cont.)

Gramm Leach Bliley

Governs Nonpublic Personal Information (NPI) held by financial institutions

No private right of action

Enforced by state insurance regulators; if similar state statute, state law supersedes GLB

5

Legal Overview: Federal Law (cont.)

Other Federal private party claims under

Electronic Communications Privacy Act; Stored

Communications Act; Video Privacy Protection

Act; Driver’s Privacy Protection Act; Family

Educational Rights and Privacy Act

6

Legal Overview: State Law

Breach Notification Statutes

47 states require prompt notification (as fast as

15 days)

• 28 States – report to government & media if substantial impact (>500 people)

• Some states set thresholds for the notice requirement

(e.g., reasonable basis to believe breach will result in harm)

7

Legal Overview: State Law (cont.)

Breach Notification Statutes

Apply to data in paper format (at least 3 states)

Some states (36) establish penalties and (11) private rights of action

Statutes typically define: Data breach, Types of protected information, Type of notice required

8

Legal Overview: State Law (cont.)

State Insurance Privacy Laws

Some Go Beyond Breach Notification – Require implementation of active security measures to prevent data breaches (AR, CA, MD, MA, RI, OR,

TX, UT)

Unfair and Deceptive Trade Practices Acts –

Variation on Consumer Protection Act; Enforced by attorney general

9

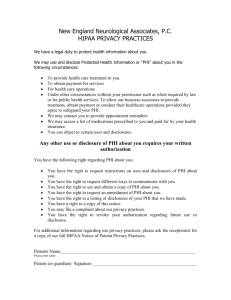

HIPAA/HITECH

10

Health Insurance Portability and

Accountability Act (“HIPAA”), enacted 1996

Title I protects health insurance coverage for workers and their families when they change or lose their jobs

Title II, also known as the Administrative

Simplification provisions, established standards for the privacy and security of health information; later codified in the Privacy Rule and the Security Rule

11

What is HITECH?

The Health Information Technology for

Economic and Clinical Health Act (“HITECH”) was enacted as part of the American Recovery and Reinvestment Act of 2009

HITECH updated and extended the Privacy Rule and

Security Rule

Created a tiered civil penalty structure for non-compliance

12

Why HIPAA Matters

HIPAA is enforceable by the Federal and

State authorities

The Federal Government: the Department of Health and Human Services’ Office for Civil Rights

Each state’s Attorney General

There is no private right of action by individuals

13

Why HIPAA Matters

HIPAA contains both Civil and Criminal

Penalties for non-compliance

Civil penalties range from $100 to $50,000 per violation

Criminal penalties: individuals, Covered Entities or

Business Associates who “knowingly” obtain or disclose

PHI in violation of the Privacy Rule

Criminal penalties can include fines and prison time

14

Recent OCR Enforcement Actions

New York Presbyterian/Columbia University

Hospital: 4.8M – May 2014

Concentra: 1.7M – April 2014

Affinity Health Plan: 1.2M – August 2013

WellPoint: 1.7M – July 2013

15

Who is Covered by HIPAA?

HIPAA applies to “Covered Entities” and their

“Business Associates”

Covered Entities include health plans, health care clearinghouses, and health care providers

“Health Plan” includes issuers of health insurance and long-term care insurance

“Health Plan” sweeps within its scope issuers of certain combination products (life/LTCi, for example)

45 CFR § 160.103.

16

Who is Covered by HIPAA?

A Covered Entity can designate itself a “hybrid” entity and only govern part of its operations under HIPAA – those aspects that include the

“health plan”

45 CFR § 160.103. 17

Who is Covered by HIPAA?

A “Business Associate” performs functions or activities that use/disclose Protected Health Information on behalf of a Covered Entity

Every Business Associate must enter into a HIPAAcompliant Business Associate Agreement with the entity it is serving (Covered Entity or “upstream Business

Associate”)

Business Associates now also are regulated directly by HIPAA

45 CFR § 164.104(a),(b).

18

What is Protected Health Information?

Protected Health Information, or “PHI”, refers to individually identifiable health information which can be linked to a particular person

Electronic PHI or “EPHI” is PHI stored electronically

(as opposed to on paper)

PHI includes spoken information

45 CFR § 160.103 (Protected Health Information).

19

What is Protected Health Information?

If the info is “individually identifiable,” that information is PHI if it relates to:

The individual’s past, present or future physical or mental health or condition

The provision of health care to the individual

The past, present, or future payment for the provision of health care to the individual

45 CFR § 160.103 (Health Information).

20

What is Protected Health Information?

Common Mistake: “PHI is just the medical records we get from doctors about our insureds”

Reality: The fact that an individual has an insurance policy at all is PHI because this fact relates to the past, present, or future payment of health care

21

What is Protected Health Information?

Examples of PHI:

List of policyholders’ names and enrollment status

Underwriter’s notes assessing the medical history of an applicant

An EOB and check issued to a policyholder

A premium bill

22

Uses and Disclosures Under HIPAA

When can a Covered Entity or Business Associate use or disclose PHI?

For purposes of “treatment, payment and health care operations”

Pursuant to a valid Authorization

Other narrow purposes where no Authorization is required

To the individual or their designated representative, regarding their PHI

45 CFR § 164.502(a).

23

Uses and Disclosures Under HIPAA

Common Mistake:

“HIPAA only covers me disclosing information improperly to third parties”

Reality:

HIPAA does limit disclosures of PHI, but it also limits use

24

Uses and Disclosures Under HIPAA

Common Examples of Use Violating HIPAA:

Looking up the PHI about individuals, in company systems, without a permissible business purpose

Using PHI in a manner other than what is authorized

(e.g., an “intended purpose” authorization specific to underwriting does not allow that PHI to be used for marketing)

25

Minimum Necessary Rule

HIPAA also requires that using/disclosing the minimum

necessary PHI required to accomplish the task

Before looking at information, ask yourself:

“Do I need to know this information to do my job?”

Before disclosing information, ask yourself:

“Does this person need the information to do his work?”

45 CFR § 164.502(b).

26

Real World Examples

27

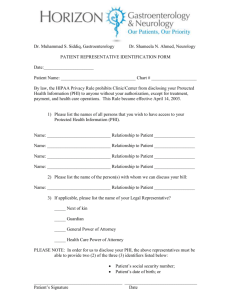

Claims Scenarios: Part I – Third-Party Involvement

Captive Agent calls on behalf of insured to facilitate filing a claim for insured who has dementia:

No known power of attorney; third-party designee deceased

Agent wants to be present during on-site Functional

Assessment and wants to do the legwork for obtaining medical records and act as primary contact for insured going forward

28

Claims Scenarios: Part I – Third-Party Involvement

How much information should the claims administration team divulge? To what extent may this agent be involved in the process?

29

Business Associate Agreements

Establish the permitted and required uses and disclosures of PHI by the business associate

Must provide

:

That the BA will use appropriate safeguards to prevent the use and disclosure of PHI other than as provided for by the BAA

45 CFR § 164.504(e) (BAA requirements).

30

Business Associate Agreements

Must provide:

That any subcontractors, “downstream business associates,” agree to the same restrictions / conditions

That the BA will comply with the requirements that apply to covered entities in the performance of any assumed obligations of the covered entity

45 CFR § 164.504(e) (BAA requirements).

31

The Security Rule and Appropriate Safeguards

The Covered Entity or Business Associate must:

Reasonably safeguard PHI from incidental uses or disclosures made pursuant to an otherwise permitted use or disclosure

Assure that data and systems are protected from misuse, unauthorized access, damage, alteration or disclosure

45 CFR § 164.530(c)(1) (safeguards).

32

The Security Rule and Appropriate Safeguards

The Covered Entity or Business Associate must:

Have in place appropriate administrative, technical and physical safeguards to protect the confidentiality, availability and integrity of PHI

Reasonably safeguard PHI from use/disclosure in violation of the Privacy Rule

45 CFR § 164.530(c)(1) (safeguards).

33

Claims Scenarios: Part I – Third-Party Involvement

Captive Agent calls on behalf of insured to facilitate filing a claim for insured who has dementia:

No known power of attorney; third-party designee deceased

Agent wants to be present during on-site Functional

Assessment and wants to do the legwork for obtaining medical records and act as primary contact for insured going forward

34

Uses and Disclosures Under HIPAA

When can a Covered Entity or Business Associate use or disclose PHI?

For purposes of “treatment, payment and health care operations”

Pursuant to a valid Authorization

Other narrow purposes where no Authorization is required

To the individual or their designated representative, regarding their PHI

45 CFR § 164.502(a).

35

Uses and Disclosures Under HIPAA

Health care operations:

Definition is broad:

Underwriting, enrollment, premium rating and other activities related to creation, renewal, or replacement

Conducting or arranging for medical review, legal services, and auditing functions

Business management and general admin. activities

Does not include sales/marketing

45 CFR § 164.501.

36

Claims Scenarios: Part I – Third-Party Involvement

Same scenario as before however now the daughter calls on behalf of her mother to facilitate filing a claim:

Daughter is not the power of attorney

Daughter is the only sibling of three available to act as intermediary and provide information

37

Claims Scenarios: Part I – Third-Party Involvement

How much information should the claims administration team divulge? To what extent may the daughter be involved in the process?

38

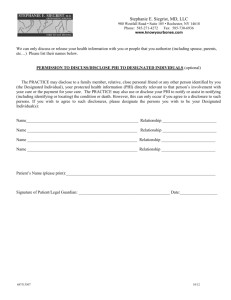

Uses and Disclosures for Third-Party Involvement

A covered entity may “disclose to a family member, other relative, close personal friend, or any other person identified by the individual . . .

PHI that is directly relevant to such person’s involvement with the individual's health care, or payment related to the same”

45 CFR § 164.510(b)(1)(i). 39

Uses and Disclosures for Third-Party Involvement

If the individual is present and has capacity:

Must obtain (1) agreement, (2) opportunity to object, or (3) reasonably infer from the circumstances the lack of objection

If the individual lacks capacity:

Only if the covered entity determines that disclosure is in the best interests of the individual

(professional judgment)

40 45 CFR § 164.510(b)(2),(3).

Claims Scenarios: Part I – Third-Party Involvement

Same scenario as above except now it is the insured’s neighbor:

Neighbor is not the power of attorney

No known power of attorney or immediate family member

How much information does the claims administration team divulge? To what extent may the neighbor be involved in the process?

41

Claims Scenarios: Part II – Claim Status Updates

Insured is considering Home Care services

Home care provider would like to provide a Plan of Care within the insured’s benefit limits

Provider calls to obtain coverage information

How much information does the claims administration team divulge? To what extent may the care provider be involved in the process?

42

Treatment, payment, or health care operations

“A covered entity may use or disclose [PHI] for its own treatment, payment, or health care operations”

“A covered entity may disclose [PHI] to another covered entity or a health care provider for the payment activities of the entity that receives the information”

“A covered entity may disclose [PHI] for treatment activities of a health care provider”

45 CFR § 164.506(c)(1)-(3). 43

Underwriting Scenarios: HIPAA Authorizations

Broker submits generic HIPAA form to underwriter requesting the release of client’s PHI from a list of companies

Underwriter has the following concerns:

Is the form HIPAA compliant?

Under HIPAA, does it matter that the form is generic, rather than specific to each company?

44

Underwriting Scenarios: HIPAA Authorizations

Core elements of a valid authorization:

Meaningful description of the information to be used

Name of “person(s), or class of persons” authorized

Name of “person(s), or class or persons” to whom the covered entity may disclose

General description of each purpose

Expiration date or expiration event that relates to purpose

Signature and date

45 CFR § 164.508(c)(1).

45

Underwriting Scenarios: HIPAA Authorizations

Required statements of a valid authorization:

A warning of the possibility of disclosure by recipient

A statement of the right to revoke authorization

An explanation of the inability (or, in limited cases, the ability) to condition treatment, payment, enrollment or eligibility for benefits on the authorization

45 CFR § 164.508(c)(2).

46

Underwriting Scenarios: Adverse Underwriting Decision

Underwriter declines based on information found in the medical records—but condition was not previously disclosed to producer

How much information should the underwriter disclose to the producer?

47

Minimum Necessary Rule

HIPAA also requires that using/disclosing the

minimum necessary PHI required to accomplish the task

Before looking at information, ask yourself:

“Do I need to know this information to do my job?”

Before disclosing information, ask yourself:

“Does this person need the information to do his work?”

45 CFR § 164.502(b).

48

Underwriting Scenarios: Privacy Notice and Right to PHI

55 year old attorney (female) applying with husband:

Admits on her application to high blood pressure only

Medical records, prescription profile, MIB reflect

HBP only

In husband’s medical records, documentation exists that wife drinks alcohol daily (almost 1 bottle of wine per night)

49

Underwriting Scenarios: Privacy Notice and Right to PHI

55 year old attorney (female) applying with husband:

Underwriter declines wife’s application based on information in husband’s medical record

Wife submits request for reason and a copy of her file

50

Requests for Access and Timely Action

Under HIPAA, “a covered entity must permit an individual to request access to inspect or to obtain a copy of the protected health information about the individual that is maintained in a

designated record set”

45 CFR § 164.524(b)(1).

51

Requests for Access and Timely Action

The covered entity must respond within 30 days or request an extension for up to 30 additional days, in limited circumstances

And a covered entity is required to document and retain “the designated record sets that are subject to access by individuals”

45 CFR § 164.524(a)(2), (e)(1).

52

Designated record set:

“(1) A group of records maintained by or for a covered entity that is: . . .

(ii) The enrollment, payment, claims adjudication, and case or medical management record systems maintained by or for a health plan; or

(iii) Used, in whole or in part, by or for the covered entity to make decisions about individuals”

45 CFR § 164.501.

53

Underwriting Scenarios: Use of Public Information

Underwriter is concerned because billing address and current residence do not match

Underwriter googles name and discovers client is in a rehabilitation house for alcohol abusers

Underwriter takes adverse action and declines coverage

Any issue using internet searches without authorization?

54

Uses and Disclosures Under HIPAA

When can a Covered Entity or Business Associate use or disclose PHI?

For purposes of “treatment, payment and health care

operations”

Pursuant to a valid Authorization

Other narrow purposes where no Authorization is required

To the individual or their designated representative, regarding their PHI

45 CFR § 164.502(a).

55

Uses and Disclosures Under HIPAA

Health care operations:

Definition is broad

• Underwriting, enrollment, premium rating and other activities related to creation, renewal, or replacement

• Conducting or arranging for medical review, legal services, and auditing functions

• Business management and general admin. activities

Does not include sales/marketing

45 CFR § 164.501.

56

Underwriting Scenarios: Prequalification

Agent sends the underwriter an e-mail requesting a prequalifying “yes”/“no” and discloses client’s name and health history

No HIPAA authorization form received

BAA agreement in place with agent

Is it a problem to provide the agent with a response like,

“based on the information, client looks Preferred?”

Is this a permitted use?

57

Questions?

58

Thank You

Stephen A. Serfass

Stephen.Serfass@dbr.com

59