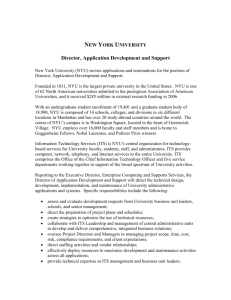

TOBIAS SALZ NEW YORK UNIVERSITY

advertisement

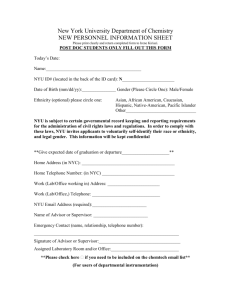

TOBIAS SALZ https://sites.google.com/site/tobiassalz/ salz@nyu.edu NEW YORK UNIVERSITY Address Phone 19 West Fourth St., 6th Floor New York, NY 10012-1119 917-855-0313 (mobile) 917-855-0313 (office) Placement Director: Alberto Bisin Graduate Administrator: Marjorie Lesser alberto.bisin@nyu.edu marjorie.lesser@nyu.edu 212-998-8916 212-998-8923 Education PhD. In Economics, New York University, 2010-2016 (expected) Thesis Title: Essays in Empirical Industrial Organization. Diplom in Economics, University of Bonn, 2010 Visiting Student, University of Chicago, 2008-2009 References Professor Guillaume Fréchette (co-chair) 19 West Fourth St., 6th Floor New York, NY 10012-1119 212-992-8683 (office) frechette@nyu.edu Professor Alessandro Lizzeri (co-chair) 19 West Fourth St., 6th Floor New York, NY 10012-1119 212-998-8907 (office) alessandro.lizzeri@nyu.edu Professor John Asker Bunche Hall 8363 405 Hilgard Avenue, UCLA Los Angeles, CA 90095-1477 USA 310-794-4892 (office) johnasker@econ.ucla.edu Professor Kei Kawai Department of Economics 530 Evans Hall #3880 Berkeley, CA, 94720-3880 kei@berkeley.edu Teaching and Research Fields Primary fields: Industrial Organization Secondary fields: Applied Econometrics and Experimental Economics Research Experience and Other Employment Summer 2014, 2015 Summer 2013 Summer 2012 Summer 2011 Summer 2009 2004-2008, 2010 NYU, Research Assistant for Professor Alessandro Lizzeri Visitor, Max-Planck-Institute for Research on Collective Goods NYU, Research Assistant for Professor Alessandro Gavazza Chicago-Argonne Institute on Computational Economics University of Chicago, Research Assistant for Professor Ali Hortacsu Student Researcher, Max-Planck-Institute for Research on Collective Goods Teaching Experience Spring, 2012 Spring, 2013 Spring 2014 2007-2008 Principles of Microeconomics, NYU, TA Principles of Microeconomics, NYU, TA Principles of Microeconomics, NYU, TA Statistics, University of Bonn, TA Professional Activities Referee RAND Journal of Economics, Discussant NET Institute Conference NYU Stern Presentations 2015 2014 2013 IIOC Boston, NYU Stern Applied Micro EARIE Milan, NYU Stern Applied Micro, CREED-CESS Amsterdam ESA Santa Cruz, NYU Stern Applied Micro, Max-Planck Institute for Research on Collective Goods Scholarships and Fellowships 2015-2016 2010-2015 2008-2009 Dean’s Dissertation Fellowship MacCracken Fellowship DAAD North America Fellowship for studies at the University of Chicago Job Market Paper Intermediation and Competition in Search Markets: An Empirical Case Study In many decentralized markets buyers rely on intermediaries to find sellers. The study of this important class of markets requires an understanding of the competitive and welfare effects of intermediaries. Intermediaries can affect buyer welfare both directly by reducing search expenses of buyers with high search cost but also indirectly through a search externality that affects the prices paid by those buyers that do not use intermediaries. To investigate these two distinct effects this project uses data from the New York City trade-waste market in which all businesses in the city contract individually with private waste carters to arrange for their waste disposal. Search in this market is costly for buyers because of the large number of sellers and the idiosyncratic nature of the contractual arrangements. There are a large number of suppliers (carters), and buyers can either search and haggle by themselves or through a waste-broker. Combining elements from the empirical search and procurement-auction literature, I construct and estimate a model for such a decentralized market setting. Results from the model show that buyers both in the broker market and in the search market benefit significantly from the activity of intermediaries. Intermediaries also improve overall welfare by reducing the cost of price discovery and the mis-allocation of sales to higher cost sellers. Additional Research Papers Frictions in a Competitive, Regulated Market Evidence from Taxis (with Guillaume Fréchette and Alessandro Lizzeri) This paper presents a dynamic general equilibrium model of a taxi market. The model is estimated using data from New York City yellow cabs. Two salient features by which most taxi markets deviate from the efficient market ideal is the need of both market sides to physically search for trading partners in the product market as well as prevalent regulatory limitations on entry in the capital market. To assess the relevance of these features we use the model to simulate the effect of changes in entry and an alternative search technology. The results are contrasted with a policy that improves the intensive margin of medallion utilization through a transfer of medallions to more efficient ownership. We use the geographical features of New York City to back out unobserved demand through a matching simulation. Estimating Dynamic Games of Oligopolistic Competition: An Experimental Investigation (with Emanuel Vespa) We evaluate dynamic oligopoly estimators with laboratory data. Using a stylized entry/exit game, we estimate structural parameters under the assumption that the data are generated by a Markov-perfect equilibrium (MPE) and use the estimates to predict counterfactual behavior. The concern is that if the Markov assumption was violated, we would find biased estimates and errors in counterfactual predictions. The experimental method allows us to compare estimates to the true induced parameters, and counterfactual predictions to true counterfactuals implemented as treatments. Our main finding is that restricting attention to MPE is, in fact, not very restrictive. Robust Decisions for Incomplete Models of Strategic Interaction (with Konrad Menzel) We propose Monte Carlo Markov Chain (MCMC) methods for estimation and inference in gametheoretic models with a particular focus on settings in which only a small number of observations for a given type of game is available. In particular we do not assume that it is possible to concentrate out or estimate consistently an equilibrium selection mechanism linking a parametric distribution of unobserved payoffs to observable choices. The algorithm developed in this paper can in particular be used to analyze structural models of social interactions with multiple equilibria using data augmentation techniques. This study adapts the multiple prior framework from Gilboa and Schmeidler (1989) to compute Gamma-posterior expected loss (GPEL) optimal decisions that are robust with respect to assumptions on equilibrium selection, and gives conditions under which it is possible to solve the GPEL problem using one single Markov chain. The practical usefulness of the generic MCMC algorithm is illustrated with an application to revealed preference analysis of twosided marriage markets with non-transferable utilities. Work in Progress Learning and Adjustments in a Competitive Industry (with Guillaume Fréchette and Alessandro Lizzeri) Regulatory Interventions in the Gasoline Market (with Dominik Grafenhofer and Klaus-Peter Hellwig) We collect a high frequency price panel (in 15 minute intervals) that covers the universe of gasoline stations in Austria. The regulator in this market collects price data in real time and makes the prices of the cheapest 50% of all gas stations in a regional market available to consumers. This leads to discontinuous pricing incentives for firms to compete for the spots that grant better price discovery. This discontinuity lends itself to an identification strategy in which extremely small price changes by competing firms are used as instruments for the presence in the observable part of the price distribution. We explore how gasoline stations pricing incentives are affected by this regulation.