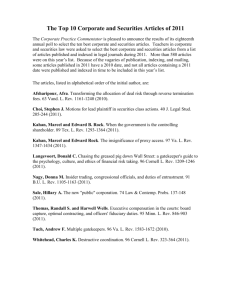

2008 FACT BOOK MUNICIPAL SECURITIES RULEMAKING BOARD

advertisement