Completed version of the last few examples in the lecture... Example (c.f. Exercise 32 in the text). Joe secured a...

advertisement

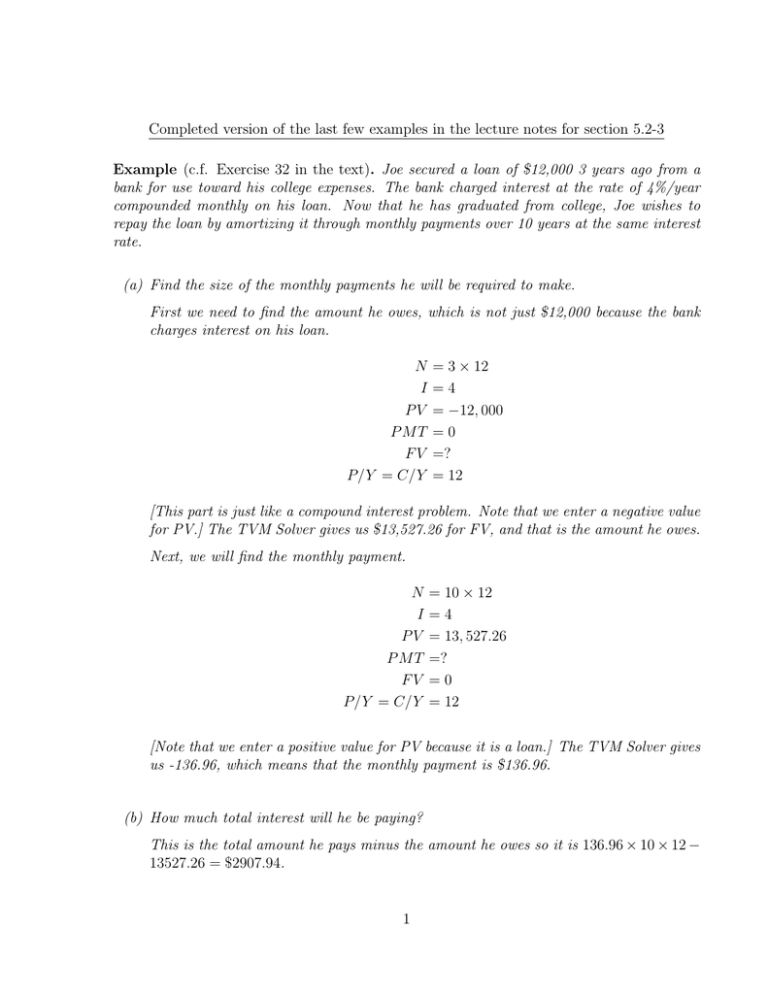

Completed version of the last few examples in the lecture notes for section 5.2-3 Example (c.f. Exercise 32 in the text). Joe secured a loan of $12,000 3 years ago from a bank for use toward his college expenses. The bank charged interest at the rate of 4%/year compounded monthly on his loan. Now that he has graduated from college, Joe wishes to repay the loan by amortizing it through monthly payments over 10 years at the same interest rate. (a) Find the size of the monthly payments he will be required to make. First we need to find the amount he owes, which is not just $12,000 because the bank charges interest on his loan. N I PV P MT FV P/Y = C/Y = 3 × 12 =4 = −12, 000 =0 =? = 12 [This part is just like a compound interest problem. Note that we enter a negative value for PV.] The TVM Solver gives us $13,527.26 for FV, and that is the amount he owes. Next, we will find the monthly payment. N I PV P MT FV P/Y = C/Y = 10 × 12 =4 = 13, 527.26 =? =0 = 12 [Note that we enter a positive value for PV because it is a loan.] The TVM Solver gives us -136.96, which means that the monthly payment is $136.96. (b) How much total interest will he be paying? This is the total amount he pays minus the amount he owes so it is 136.96 × 10 × 12 − 13527.26 = $2907.94. 1 (c) If he decides to pay $100 extra each month, then how long will it take him to amortize the loan? This means that he will pay $236.96 each month. N I PV P MT FV P/Y = C/Y =? =4 = 13, 527.26 = −236.96 =0 = 12 The TVM Solver gives us 63.4 for N, which means that it will take him 63.4 months. [Here, it is the number of months because interest is compounded monthly.] (d) How much total interest will he be paying if he pays $100 extra each month? Again, this is the total amount he pays minus the amount he owes so it is 236.96 × 63.4 − 13527.26 = $1496.00. 2 Example (Exercise 24 in the text). A group of private investors purchased a condominium complex for $2 million. They made an initial down payment of 10% and obtained financing for the balance. If the loan is to be amortized over 15 years at an interest rate of 6.6%/year compounded quarterly, find the required quarterly payment. The down payment was 10% of $2,000,000 so it was $200,000, which means that they still owe $1,800,000. N I PV P MT FV P/Y = C/Y = 15 × 4 = 6.6 = 1, 800, 000 =? =0 =4 The TVM Solver gives us -47,788.90 for PMT, so the required quarterly payment is $47,488.90. Example. Refer to the previous example. Create an amortization schedule showing the first two payments and the 51st payment. Payment 1 2 .. . 50 51 Amount Amount towards inpaid terest $47,488.90 $(1, 800, 000× .066 )= 4 $29, 700 $47,488.90 $(1, 782, 211.10 × .066 ) = $29, 406.48 4 $47,488.90 $(434, 491.62 × .066 ) = $7, 169.11 4 3 Amount towards princi- Outstanding balance pal $(47, 488.90−29, 700) = $(1, 800, 000 $17, 788.90 17, 788.90) $1, 782, 211.10 $(47, 488.90 − $(1, 782, 211.10 29, 406.48) = 18, 082.42) $18, 082.42 $1, 764, 128.68 $(47, 488.90 − 7, 169.11) = $40, 319.79 − = − = $434,491.62 (see below) $(434, 491.62 − 40, 319.79) = $394, 171.83 We use the TVM Solver to find the outstanding balance after 50 payments: N I PV P MT FV P/Y = C/Y = 50 = 6.6 = 1, 800, 000 = −47, 488.90 =? =4 The TVM Solver gives us -434,491.62 for FV, which means that the outstanding balance is $434,491.62. [In fact, one can fill in all the values in the last column of the table by changing N.] Example (Exercise 40 in the text). Paula is considering the purchase of a new car. She has narrowed her search to two cars that are equally appealing to her. Car A costs $28,000, and Car B costs $28,200. The manufacturer of Car A is offering 0% financing for 48 months with zero down, while the manufacturer of Car B is offering a rebate of $2000 at the time of purchase plus financing at the rate of 3%/year compounded monthly over 48 months with zero down. If Paula has decided to buy the car with the lower net cost to her, which car should she purchase? The net cost of Car A is just $28,000. For Car B, after the rebate, she still needs to pay $26,200 over a period of 48 months. N I PV P MT FV P/Y = C/Y = 48 =3 = 26, 200 =? =0 = 12 The TVM Solver gives us -579.92 for PMT, which means that she has to pay $579.92 each month. At the end of 48 months, she would have paid $(579.92 × 48) = $27, 836.16. Hence the net cost of Car B is lower. 4