Proposal Information Quick Reference Sponsored Project Services Office

advertisement

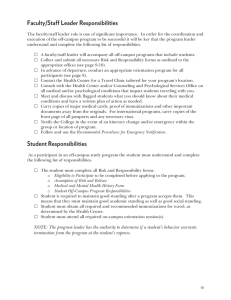

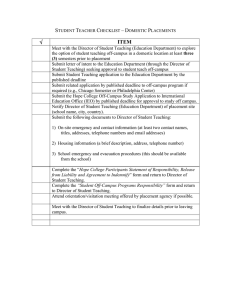

Proposal Information Quick Reference Sponsored Project Services Office Contact Information www.sps.arizona.edu Proposal Review Fax 520-626-4130 Phone: (520) 626-6000 Express Mailing Fax: (520) 626-4137 Address E-mail: sponsor@email.arizona.edu 888 N Euclid Room 510 Tucson AZ 85719 Institutional Information Applicant/Applicant Organization Organization Type Tax Exempt Status Employer Identification Number (EIN) DUNS Number Authorizing Official for the University of Arizona Administrative Official/Fiscal Officer Checks Made Payable to US Mail Payment Address Express Mail Payment Address State Legislative District House of Representatives Congressional District DHHS Rate Agreement Date Entity Identification Number (ALL NIH/PHS proposals) Arizona Board of Regents, University of Arizona A land-grant STATE EDUCATIONAL INSTITUTION; Law passed 1862; established in 1885 Exempt from income tax under Section 115 of the Internal Revenue Code; State Tax License #: 20221243 742652689 806345617 Kimberly Andrews Espy, Ph.D. Senior Vice President for Research University of Arizona P.O. Box 210158, Rm 510 Tucson AZ 85721-0158 Sherry L. Esham, Director Sponsored Projects Services University of Arizona P.O. Box 210158, Rm 510 Tucson AZ 85721-0158 The University of Arizona University of Arizona Sponsored Projects Services/Bursar Office 1303 E. University Blvd, Box 3 Tucson AZ 85719-0521 University of Arizona Sponsored Projects Services/Bursar 888 N Euclid Room 104 Tucson AZ 85719 27 3 June 16, 2015 1742652689A1 Codes Commercial And Government Entity (CAGE) Standard Industrial Classification (SIC) Contractor Establishment IRB North American Industry Classification (NAICS) National Science Foundation (NSF) Organizational Office of Postsecondary Education Number (OPE) (Department of Education) Federal Interagency Committee on Education (FICE) 0LJH3 8221 04-201-7848 01NR 611310 00-1083-5000 00108300 00-1083 Assurance Human Subjects Assurance Animal Assurance Compliance Scientific Misconduct Policy Assurance FWA00004218; Expires 08/05/2016; IRB Code 01NR A3248-01; Effective 9/19/2011 - 08/31/2019 Annual Research Misconduct report filed: 03/13/2009; ORI Certification Expires: 04/30/2010 Miscellaneous Form 1411 – Contract Pricing Proposal Cover Sheet (NASA and DoD) State Clearing House Supplemental Compensation Rate Contract Administration Office: Cognizant Audit Agency: Office of Naval Research DHHS Audit Agency San Diego Regional Office Regional Inspector General for Audit 140 Sylvester Rd, Bldg 140, Rm 218 50 United Nations Plaza, Room 171 San Diego CA 92106-3521 San Francisco CA 94102 Telephone: (619) 221-5490 Telephone: (415) 437-8360 Effective 11/1/99 Box 16 of the SF424 should be marked "No" - "Program is not covered by E. O. 12372" NSF – 2/9’s of the academic year salary General University Policy – 3/9’s of the academic year salary Facilities and Administration Cost Rates Project Type On-Campus Organized Research Off-Campus Organized Research On-Campus Instruction Off-Campus Instruction On-Campus Other Sponsored Activities Off-Campus Other Sponsored Activities Clinical Trial Rate Effective Date 07/01/13 – 06/30/14 07/01/14 – 06/30/15 07/01/15 – 06/30/16 07/01/16 – 06/30/18 07/01/13 – 06/30/18 07/01/13 – 06/30/14 07/01/14 – 06/30/18 07/01/13 – 06/30/18 07/01/13 – 06/30/14 07/01/14 – 06/30/18 Rate 51.5% 52.5% 53.0% 53.5% 26.0% 51.5% 50.0% 26.0% 51.5% 47.0% 07/01/13 – 06/30/18 26.0% The University will accept a 25% Total Direct Cost F&A rate for clinical trials that meet the eligibility requirements and use the standard University agreement. The University must ensure that federal sponsors do not in any way subsidize the F&A costs of other sponsors. The clinical trial F&A rate of 25% Total Direct Costs is a fair rate and adequately reimburses the University for theF&A costs associated with conducting clinical trials. Studies not meeting all the eligibility criteria or those studies not using the standard agreement or similar terms will be budgeted at the full on campus research F&A rate. Fringe Benefit Rates UA Employees Full-Benefit Faculty Ancillary Classified Temporary Student Employees Graduate Assistants Definition of Off-Campus: The off-campus rate is applicable to those projects that are conducted in facilities not owned or leased by the University. However, if the project is conducted in leased space and lease costs are directly charged to the project, then the off-campus rate must be used. A project is considered off-campus if more than 50% of its salaries and wages are incurred at an off-campus facility. If a project is determined to be off-campus, it shall be considered wholly off-campus. Separate on and off-campus rates will not be used for a single project. Employee Related Expenses (ERE RATES) 7/1/15 - 6/30/16 See Rate Agreement for more 34.7% detailed information. The rate 31.7% agreement date changes every 11.0% year before the beginning of the 3.5% fiscal year (July 1) when the fringe 13.9% benefit rates are negotiated.