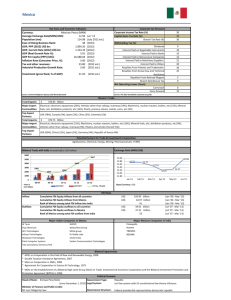

The Impact of NAFTA on Foreign Direct Investment Alexander Monge-Naranjo,

advertisement