Regionalism versus Globalization in the Americas:

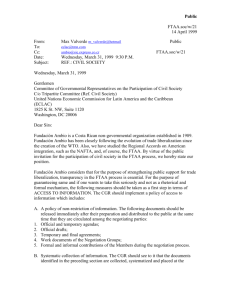

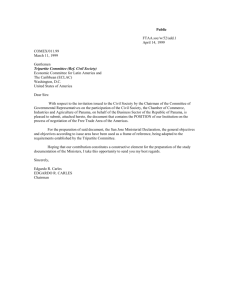

advertisement