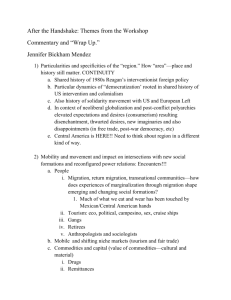

The Impact of CAFTA on Poverty, Distribution, and Samuel Morley

advertisement