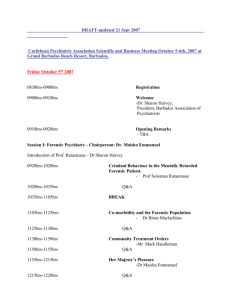

IV. TRADE POLICIES BY SECTOR (1) O

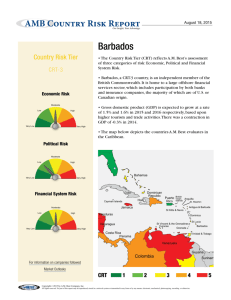

advertisement