Document 10571418

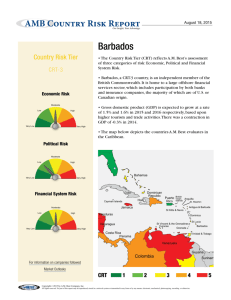

advertisement