FINANCIAL STATEMENT ECONOMIC AND FINANCIAL POLICIES

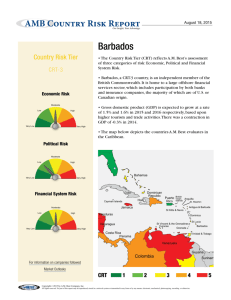

advertisement