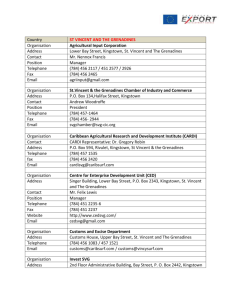

2007 BUDGET ADDRESS SAINT VINCENT AND THE GRENADINES

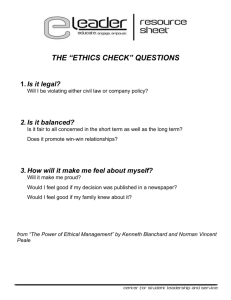

advertisement