APARTMENT PERFORMANCE AND EMPLOYMENT DISTRIBUTION

advertisement

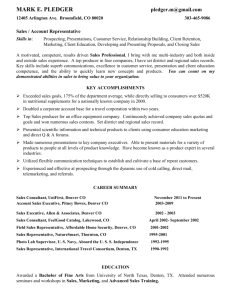

APARTMENT PERFORMANCE AND EMPLOYMENT DISTRIBUTION A STUDY OF TWO CITIES by Daniel A. Pedrotti, Jr. Bachelor of Business Administration Texas Agricultural and Mechanical University 1984 SUBMITTED TO THE DEPARTMENT OF ARCHITECTURE AND THE CENTER FOR REAL ESTATE DEVELOPMENT IN PARTIAL FULFILLMENT OF THE REQUIREMENTS OF THE DEGREE MASTER OF SCIENCE IN REAL ESTATE DEVELOPMENT AT THE MASSACHUSETTS INSTITUTE OF TECHNOLOGY SEPTEMBER, (D Daniel A. 1988 Pedrotti, Jr. 1988 The Author hereby grants to M.I.T. permission to reproduce and to distribute publicly copies of this thesis document in whoe or in part. Signature of the Author Daniel A. Pedrotti, Jr. Department of Urban Studies and Planning 29 July 1988 Certified by Lecturer, M Louargand Department of Urban Studies and lanning Thesis Advisor Accepted by Michael Wheeler Chairman Interdepartmental Degree Program in Real Estate Development SEP 2019b8 LIBRARIES APARTMENT PERFORMANCE AND EMPLOYMENT DISTRIBUTION A STUDY OF TWO CITIES Daniel A. Pedrotti, Jr. 29 July 1988 TABLE OF CONTENTS ABSTRACT.................... CHAPTER ONE INTRODUCTION................ ....................................................................... .. . . . . .............................. 1 2 CHAPTER TWO DIVERSIFICATION INDEX....... ..................................................... 6 DENVER.................................................7a PHOEN I X . . . . . . . . . . . . ................................... aw aa aa a a a a a aaaaa aaaa a10 CHAPTER THREE ECONOMIC MAKEUP .................... TOTAL EMPLOYMENT GROWTH - US, DENVER AND PHOENIX......11 .13 EMPLOYMENT TRENDS BY SECTOR... . .. . . .. .14 .. . . . .. UNITED STATES............ .16 . .. EMPLOYMENT GROWTH BY SECTOR.. . .. . .. . DENVER................... .23 . . .. .27 .. . . .. EMPLOYMENT GROWTH BY SECTOR.. . .32 . .. .. . PHOENIX.................. . .32 .. . . .. EMPLOYMENT GROWTH BY SECTOR.. . .40 . . .. .. . SUMMARY OF EMPLOYMENT TRENDS.. CHAPTER FOUR .43 .43 .45 CORRELATIONS BETWEEN RENTS AND DIVERSIFICATION INDEX .48 CORRELATIONS BETWEEN RENTS AND EMPLOYMENT LEVELS.... .50 .52 ......... a a ............................................. DENVER a a a a .56 . . . . . . .. PHOENIX ........................ .60 DENVER SUMMARY ............................................. PHOENIX SUMMARY..................................... .60 CHARACTERISTICS OF RENTAL INCOME................ ...... THE DATA........................ CORRELATIONS..................................... . CHAPTER FIVE CONCLUSIONS ......................................................62 STRATEGIES............................................ REFERENCES............................... ................. .. ............ 64 TABLES AND GRAPHS CHAPTER 2 FIGURE 1: DENVER DIVERSIFICATION INDEX.......... FIGURE 2: PHOENIX DIVERSIFICATION INDEX......... .. ... 8 9 .......... CHAPTER 3 EXHIBIT 1: TOTAL EMPLOYMENT LEVELS.............. 12 .... .... TABLE 1: UNITED STATES EMPLOYMENT DISTRIBUTION.. 15 FIGURE 3: UNITED STATES GROWTH SECTORS..... ..... a 17 FIGURE 4: UNITED STATES LOW GROWTH SECTORS. TABLE 2: ........ .... . DENVER EMPLOYMENT DISTRIBUTION.... 18 . 24 FIGURE 5: DENVER GROWTH SECTORS............ 25 FIGURE 6: DENVER LOW GROWTH SECTORS........ 26 TABLE 3: PHOENIX EMPLOYMENT DISTRIBUTION... 33 FIGURE 7: PHOENIX GROWTH SECTORS........... 34 FIGURE 8: PHOENIX LOW GROWTH SECTORS....... ...... ... .. 35 CHAPTER 4 TABLE 4: DENVER RENT DATA SUMMARY......... ................ 44 TABLE 5: PHOENIX RENT DATA SUMMARY........ ... ... ... 44 TABLE 6: UNITED STATES RENT DATA SUMMARY.. .............. 46 FIGURE 9: AVERAGE RENT COLLECTED PER UNIT. 47 FIGURE 10: RENT COLLECTED PER UNIT........ ............. 49 APARTMENT PERFORMANCE AND EMPLOYMENT DISTRIBUTION: A STUDY OF TWO CITIES by Daniel A. Pedrotti, Jr. Submitted to the Department of Architecture and the Center for Real Estate Development 29 July 1988 in Partial Fulfillment of the Requirements for the Degree of Master of Science of Real Estate Development ABSTRACT and evaluates the relationship This study examines rent sector and employment by levels of between the follows The study two cities. of levels over a several thousand apartments performance of Phoenix, Colorado and in Denver, of time period Arizona. The study examines actual rents collected salary employment wage and juxtaposition with in the in addressed questions The specific data. research process include: How do the local economies of each study area differ from the United States? from each other? Do different returns? economies create different What is the relationship between employment distribution and rent is the focus of analysis The diversification in the local economy property performance. levels? of influence in residential Thesis Advisor: Marc Louargand Title: Lecturer in the Department of Urban Studies and Planning 1 CHAPTER ONE INTRODUCTION INTRODUCTION examination of a city's economy, Upon beginning an first asked questions employer in to wn?". Given the answer, typically make a prejudgment as to that future prospects for viability. equal of share diversification stab le growth. consistent because a sectors. desirable city J. each is It the Par ry Lewis writes observer suggested will notion that the diversity with an sec tor. is believed can avoid dependence predominant eco nomy's current and is maximum in employment the t he Many have the question preferred answer to is "What sector is one of the that that on one or a What it this makes promotes occurs few economic (8), The prescription for stability of employment has several ingredients. The goods and services as diverse exported by the residents should be as possible. Any specialization in market or in product makes these residents vulnerable to (p. 25) particular fluctuations in demand. Some further Werner Z. insight Hirsch into this train of thought is offered by (5): that to mean is likely Unstable growth capacities and expectations are generated in the rapid growth phase which cannot be fulfilled in the slow growth phase, resulting not only in hardship in the latter phase, but probably also in a lower overall performance in the long run. In addition, unstable economic performance very often contributes to such ills and inefficiencies as, for example, excessive migration (and reverse migration), periodic financial difficulties of local government, and inability to plan for pleasing and efficient 263) (p. city building. 2 Stable growth is entire system study of similar Attaran (1) seen as the preferred path for logic to the looked at income-based is flawed one conducted diversity indicators of Columbia. in two counts. for in this indices and a city. This First, in a paper, Moshen unemployment all fifty states and and the District Attaran found that, ..no strict assumptions can be made regarding a clear relationship between diversification and economic growth and stability. (p. 44) Secondly, diversification that economies constant theorists do are reactive is change. the recent global'economic influence means that a to forces that are not only beyond What a is flexibility and agility to changes in The results the a few sectors varies entire mix. that, John B. "local effect. In economy its control more is subject but beyond that strong its performance in more closely with rents Corgel and economies are varied toward local economy should strive for suggest hypothesis dominant economic sector". sector local trend The only larger economies. one or study by into account in order to respond more efficiently of this paper This take and dynamic creatures. Further, planning capabilities. not is supported by Gerald D. Gay than findings (2). in across economies other words, the also saw that and varied this by a "dominant" in magnitude degree to which a a They found typically heavily influenced They the local of economy can make efficient use of its competitive advantage varies from city to city. 3 Another of a important aspect of economic performance city to determinant when housing. attract new residents. discussing a Bertrand Renaud This is the ability is a correlation with any (10) critical aspect of observed, ... population movements are predominantly determined by employment opportunities and income levels. The economic base determines private sector demands and an important part of the public resources needed to meet them.(p. 7) This connection Growth in a These new employees will for non-base sectors and the industries which idea in mind that will in time cause growth across is the best route contends that to shed some a comparison was the Denver used to and to economic growth, out. diversification is light as to about diversification's ability alternative for promoting economic an attempt influx of new there is considerable doubt is also significant doubt author this discussion. in turn create new demand to promote stability, as Attaran pointed The in influence rents. whether diversification there relevant single sector generally requires an employees. With is particularly not performance. the best This paper on this contention. To is that end made between the employment distributions in Phoenix versus United States. These data were estimate a diversification the Diversification Index index. The examination of includes an extensive 4 discussion of three employment the by sector. growth rates study examines and Subsequently, the large apartment portfolios performance of a few discusses the respective employment distributions and in the metropolitan areas. Given the apparent conflict between performance economic Taking average per unit rents collected portfolios as a measure of employment. and in some large apartment return, the further examines the relationship between individual sectors and study Number of the same rents the study documents and rents collected. relationships between divers-ification collected. it to examine the formulate some sort of test was appropriate to relationship in the theories discussed above, It employment The significance of the lies in the discovery of what tracks rents more closely. of persons employed by sector diversification. The is an input diversification index into the is used facilitate the examination of the differences between the economies. This in individual sectors. the basis of a between apartment turn, leads into an The combination discussion on examination of 5 to local the of these discussions form the correlation performance and respective employment. index and covariance distributions of CHAPTER TWO DIVERSIFICATION INDEX DIVERSIFICATION INDEX This chapter introduces a diversification index. This index is an attempt to measure the difference between the United States' employment distribution and the local employment distribution for Denver and Phoenix respectively. Beginning with the the idea entire United given sector, that States represents the index value for measure of systematic risk. of specific the employment risk. Any That variation the diversification absolute from 1. a relative a from local this distribution economy less likely index deviation from the US is the sum of sector by distribution subtracted This produces a number that ranges from almost 0 On this scale, as the index distribution approaches approaches the US never actually reach 0 because in at the US would be least in any like the US economy. Mechanically, sector total employment is it represents the absence introduces specific risk and makes to perform distribution for 1 the 1. local employment The index will distribution. there will to always be employment one of the sectors. This is a dynamic measure in that an employment a matter of constant change. distribution is As one sector slows significantly the employment base moves out of that sector and 6 into others or goes into unemployment. If all sectors suffer decline then the total employment changes and the distribution remains similar. As shown in figures 1 and 2, diversification index In Phoenix, over over the years ranges from 1971 to 80.7% to 88.7%, the years 1974 to it 1987, 1987 the in Denver. ranges from 80.6% to 84.5%. DENVER In the Denver throughout the time period 1971 the first major turn was in diverse. There were two years index followed strong down in to 1987. During increased this period 1973 when Denver began to get more of considerable increase in the by five years turn generally index diversification of slow increases. the early eighties increases in the Oil and Gas aspect due There was a primarily to of the Mining sector. Once this sector began contracting the economy showed a strong trend towards diversification. shows that the increased this index a sector employment decline, decline is economy diversity. The discussion may not It is very out of employment occurring the important proportion and subsequently total off be better to keep negative reasons. can increase for had grown in the goes may index suffering. 7 into next chapter due to this in mind that example, For with the rest of an extended the period of decline. While this is rising but the if overall economy is FIGURE 1: DENVER DIVERSIFICATION INDEX 0.89 0.88 0.87 x 0.86 z z 0.85 0.84 Li 0 0.83 0.82 0.81 0.80 , 1971 1973 1975 1977 1979 YEAR 1981 1983 1985 1987 0 .8 5 - 0.85 - 0.84 - La 0 0.84 - o 0.83 - Ii-. 0.83 FIGURE 2: PHOENIX DIVERSIFICATION INDEX .... .............. z 0.82 0.82 0.81 0.81 1974 1976 1978 1980 YEAR 1982 1984 1986 PHOENIX In Phoenix the index is subject no discernible overall decline in What was observed the index value- from equally strong by trend. another increase substantial influence in economy. It Denver. decrease substantial the study a will growth in 1982. a through employment demonstrate This serves to differentiate as both of these had overall growth rate that sectors study period. Total employer was employment growth annually, was well above the US or What follows is an in depth sectors serve distributions to from discussion serves degree of look United 10 this base than Phoenix over the had study manner as the patterns. Phoenix tremendous over in Phoenix, the at 6.86% at how the trends in specific these States' local in rents. employment distribution. to delineate which sectors influence on the trends in Denver. differentiate the and it from the US and Denver less volatile growth as an 1985 less diverse employment variety of by an There appears to be some period with Construction moving in a very similar index. was a strong This was followed from 1982 1987. There was to 1979 followed distribution of appears to be The 1977 from 1979 to again an increase from 1985 to cyclic to dramatic swings. This have the highest CHAPTER THREE ECONOMIC MAKEUP ECONOMIC MAKEUP OR EMPLOYMENT DISTRIBUTION This part of growth the discussion trends begins with in total employment and Phoenix. What follows each area's total in each sector. is of the in the United States, Denver a sector by sector distribution and Exhibit 1 an overview a look at analysis of the growth trends shows the employment levels in each of the study areas. TOTAL EMPLOYMENT GROWTH - US, DENVER AND PHOENIX Total employment rate of 2.4% points 1975 to in The for the period 1979 through last period Denver the growth inflection points. than in the years 1979 and This 1983 to in The major inflection 1983. From growth was considerably 1983 when the rate averaged only 0.1%. a return to faster growth 1987. total Generally in the United States as an annualized 1987. in the study showed from grew at 1975 to the rate was 3.9%. at a rate of 3.1% In United States this trend were 1979 less from in the the employment growth was a whole. this SMSA was 3.4% from 1975 to 1987. did not slow down during the 1979 to had slightly faster The annualized rate for Denver employment growth 1984 period as did It progressed at a fairly steady rate of 4.5% until 1984 through 1987 total employment rate of only 0.3%. 11 different the US. 1984. From growth flattened out to a EXHIBIT 1: TOTAL EMPLOYMENT LEVELS 1.10 1.00 0.90 (I- z 0 I-.' L C', 0.80 IL. 0 0 0.70 z 0.60 0.50 0.40 75 0 76 U. S. / 77 100 78 79 80 81 +DENVER 82 83 84 85 SPHOENIX 86 87 Phoenix growth had substantially in total rate the national similar employment growth rate. to the some of the slow in employment. From inflection points very 1975 to 1979 Phoenix the incredible rate of 9.3%. growth as in the US trend 1982 when local Phoenix then returned to employment The three times was 6.5%, almost Phoenix had US trend. employment grew at from 1979 to higher growth total It did exhibit but it only slowed grew at a rate of 2.2%. its growth pattern from 1982 to 1987 at a rate of 6.9%. EMPLOYMENT TRENDS BY SECTOR In an attempt to explain the States trends and the Denver what follows in that these The growth A coincide. and sectors It is act decline phases good understanding requires analysis examines share of important to total and employment compares and the One must differently do not a close points of inflection and the growth rates between This United trends in employment, the overall performance of the sectors. mind economies. and Phoenix is an analysis of each sector. look first at keep between the variation across necessary look at the these points. each sector's relative growth trends in each total non-agricultural sector's employment. The sectors employment. discussed It represent is obvious that the US distribution and a given in mind that this part of variations SMSA. the 13 It will is analysis occur between important to keep is based on the percentage employment per sector and number of persons employed in each sector. It dates relating is also to changes important in the various eight major non-agricultural 1. 2. 3. 4. 5. 6. 7. 8. to make careful note of distributions. The sectors are: MINING CONSTRUCTION MANUFACTURING TRANSPORTATION AND UTILITIES RETAIL AND WHOLESALE TRADE SERVICE FINANCE, INSURANCE AND REAL ESTATE GOVERNMENT UNITED STATES The largest employment were Manufacturing, magnitude across this these the order Government. Service is displayed By was in was and that Government in because one total and due declining or 16.71% The 21.2%, 17.7% to growth in the and 16.3% By order. in Government. in 14 that then the Trade and sector. 1987 employment had Trade; Manufacturing By this in Trade, 18.72% time These shifts grow faster or employment. and Manufacturing in Service, 23.56 a few sectors 1970 distribution Service rank was Service, distribution was 23.64% Manufacturing 1. Manufacturing, decline the in and Service in order of Government remained relatively stable. shifted such States distribution had changed such This happened and United Table 27.3%, 1980 this Trade, sectors in the Trade, Government, sectors respectively. sectors slower the in occur than does TABLE 1: MINING UNITED STATES EMPLOYMENT DISTRIBUTION CONST MFG TRANS/ UTILS TRADE SERVICE FIRE 8OVT 5.14% 17.71% 18.09% 18.10% 17.88% 18.11% 19.08% 18.73% 18.34% 18.08% YEAR 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 5.06% 27.32% 0.85% 5.20% 5.28% 0.84% 0.89% 0.98% 0.98% 0.99% 0.98% 1.07% 1.14% 1.25% 1.26% 1.06% 1.02% 0.95% 0.79% 0.73% 5.34% 5.14% 4.58% 4.50% 4.67% 4.88% 4.97% 4.81% 4.59% 4.36% 4.38% 4.64% 4.79% 4.92% 4.93% 26.15% 25.99% 26.25% 0.88% 0.86% 25.65% 23.81% 23.93% 23.87% 23.65% 23.42% 22.44% 22.13% 20.97% 20.44% 20.51% 19.75% 19.07% 18.72% 6.37% 6.29% 6.16% 6.06% 6.04% 5.90% 5.77% 5.71% 5.68% 21.22% 21.56% 21.65% 21.63% 21.70% 22.18% 5.72% 5.69% 5.67% 22.48% 22.47% 22.54% 5.67% 5.49% 5.46% 5.37% 5.26% 5.27% 22.84% 23.15% 23.39% 23.66% 23.67% 23.56% 22.37% 22.45% 22.54% 16.29% 16.57% 16.66% 16.74% 17.17% 18.05% 18.33% 18.56% 18.75% 19.05% 19.79% 20.43% 21.25% 21.83% 22.01% 22.56% 23.19% 23.64% SOURCE: BUREAU OF LABOR STATISTICS - MONTHLY LABOR REVIEW 15 5.30% 5.30% 5.27% 5.30% 5.41% 5.38% 5.42% 5.45% 5.54% 5.71% 5.81% 5.96% 6.06% 6.02% 6.11% 6.32% 6.45% 17.75% 17.96% 17.59% 17.68% 17.59% 16.96% 16.81% 16.78% 16.71% Over the study period 1975 to growth in Service Trade (2.9%). (4.8%), 1987, FIRE These were Construction (3.0%) and the sectors that showed growth at the rest sectors and average sectors which were growth or were in Mining Transportation and of these employment This makes a delineation in Figure 3. sectors This (2.4%) as is evident periods of either slower These slow growth Manufacturing (1.4%) and Government is shown "growth" between these contraction. lost relative total employment. in (-0.12%), Utility above average (3.9%), rates above the growth of total than the US had (0.4%), (1.3%). to their respective All shares of in Figure 4. EMPLOYMENT GROWTH BY SECTOR MINING US employment in 1970. It declined to confirms much Which The general period. peaked .73% in the industry. in the Mining sector In in about 1987. 1981-82 at This publicized is as trends is a major subset trend in this sector 1975 there were was .88% of total employment This was well above the total -6.9% from 1,139,000 in the Oil to persons in over growth between Gas the entire 1981 to only in this 1975 and employment 1987 dropped off This represents an annualized growth 16 and it only and 752,000 persons employed was 7.2%. from 1981 expected and was negative The annualized rate of However, 1.26% of Mining employment. industry. of 2.6%. - 1.25 1981 growth rate at a rate of 741,000 in 1987. rate of -0.12%. FIGURE 3: UNITED STATES GROWTH SECTORS 9.00 8.00 7.00 (f) z 6.00 0 L LL c 5.00 0 0 elf 4.00 ILL D z 3.00 2.00 1.00 0.00 1975 o 1976 1977 SERVICE A TRADE 1978 1979 1980 1981 1982 1983 1984 SOURCE: U.S. BUREAU OF LABOR STATISTICS + FIRE c CONSTRUCTION X TTL EMPLOYMENT/100 1985 1986 1987 FIGURE 4: U.S. LOW GROWTH SECTORS wii z 0 (0" 0) - Cw 0 22 21 20 19 18 17 16 15 14 13 12 11 ................. ..... -..... k -....... -I .............. ............. -............................. 10 9 8 7 6 5 4 3 2 1 0 0:: D z ,E3- 1975 0 MINING 1976 - B 1977 E3 .............. i Ei 1978 E3 ........ .......... -B I I I I I I I 1979 1980 1981 1982 1983 1984 1985 SOURCE: BUREAU OF LABOR STATISTICS + MANUFACTURING 0 TRANSPORT / UTILITY A GOVERNMENT X TOTAL EMPLOYMENT/10 1986 I 1987 CONSTRUCTION Construction as a component represents over 5% of the of total. only in the early seventies did as much as slight definitely US employment In the period rarely 1970 to 1987, the construction sector made up 5.34% of the total. but total Variation cyclic. The has been relatively cycles appear approximately 5-6 years from trough to trough. From 1975 to in this sector 1979, persons employed to be grew at an annualized rate of 6.1%. This period of growth was followed by a period from 1979 of contraction took place at 1982. a rate of -4.4% annually. the US construction Over the entire rate was to employment period 3.0% which 1975 to The contraction From grew 5.2% per 1987 the is above the 1982 until 1987 year on average. average annual growth national average for total employment growth at 2.4%. MANUFACTURING The US has always had a much in this field to 21 This when compared to million to 27.3% of is the two cities. people employed in this sector, the total employment due in influence in the percentage of seventies and early larger portion of total large measure Midwest total eighties. seventies but With about the US had 18.7 the manufacturing sector. to the employment heavy This declined was a manufacturing slight sector as throughout increase it has shown a decided decline since. 19 18 in and northeast. There employment a the in the Manufacturing grew at an annualized years 1975 to rate of only 0.4% over the 1987 considerably less than the employment. During this consecutive growth. time period 1975 to 1979 there were in total 4 years exhibited a growth 3.5% which was just over the rate for total However, from 1979 until growth of rate of employment at 2.4%. 1987 there was only one year of slight growth. TRANSPORTATION AND UTILITIES Nationally, this sector has declined every year terms of share of total employment. in 1987 Even From 5.9% since 1975, in in 1975 to 5.27% it showed a slow but steady decrease. as this employment sector was losing distribution, it 1975 this was growing industry employed 1987 it had about 4.5 employment 1.4%, growth rate at in the as an national employer. million people approximately 5.4 million. annualized growth rate of only the total position This and In in translates to an which was a about half of 2.4%. TRADE The national steady upward percentage employment trend throughout evaluated. There deceleration period about never been as appear to every in the this entire shows time slight contraction six years. Although either a period be large on a percentage basis as 20 sector or it has Denver or Phoenix, it has been growing as a faster rate than percentage either of numbers Between 1/5 in 1/4 (19.9% non-agricultural employees The reason the increasing of 2.9% that in 1971 in and Retail very 23.6% in country at The significant. 1987) of all are employed in Trade. is at US employment least a employment which in Denver, are to this share of total this employment metropolitan areas. sector is because the US Trade and total US the two this and Wholesale and Retail a share of total little is 2.4%. Phoenix, and trade sector sector in this sector is growing at a rate rate for faster than It is is important the US as a whole, to note the Wholesale is growing. SERVICE The service sector almost at all areas of the US. the percentage employer nationally. the total. employees employment This of total was a major for is very apparent when looking employment data. It is a major It has employed between 16.3 and 23.6% of That was nearly one quarter of the non-agriculture in the US. The Service sector demonstrated the fastest three of the study areas. In this study, growth rate of about 4.7% in the number of this This sector. employment growth area is nearly twice in the US over the same period. 21 growth across all the author found a US the people employed rate for in total FIRE In the US as a whole the stronger position in total never rose above 6.5%. It each consecutive year only 5.1% of FIRE sector employment. From did however increase growth areas covered 1987 it its percentage In 1970 it was in this study. industry in all The US showed rate than did either Phoenix or Denver, year in the period was fairly constant at well above a the total employment. positive growth each growth 1970 to during the same period. The FIRE sector represents another growth of the gradually gained 3.9% but the total employment growth a slower it exhibited studied. from 1975 to three The rate of 1987. This is rate of 2.4% GOVERNMENT Nationally, from 1976 until the percentage of government. employment 16.7%. In in This people employed by 1975 there was as this sector. is to administrations trying the deficit. mean there there was a steady decline in 1987 be to much as 19.1% expected with the earlier this does the total was only past few not necessarily decline in government employment, slight contraction always showed a small of 1987 this percentage only mean that there was a slower growth Besides a state and federal lower government spending and control As mentioned is any real By local, from positive 22 1980 than total to 1983, growth rate. From it may employment. this sector 1975 to 1980 growth was 2.0%. 1.3% the rate From 1983 to 1987 the rate was only of employment growth 1/2 of the growth rate for total from 1975 to employment At 1.8%. 1987 is about in the US. DENVER The over employment distribution the study period. employment showed FIRE (See only (4.9%), Service 3.3% over the a slight occurred 2) Generally (4.8%), (3.6%). the in this sector. fact 3.4% as than this rate Trade The Mining study period. slowing, Denver growth rate of The sectors that grew faster Transportation and Utility rate of changed significantly Table an overall compound mentioned earlier. were for Denver (3.6%) sector grew at a While this seems is that and a major to be upheaval (See Figure 5) The three remaining sectors grew at rates that were slower than total employment. These were Construction (2.0%) and Government The economy Denver sectors. Besides distributed employers major Railroad (2.0%). There are including a Inc. and terminal. the major Denver 23 the Federal ski levels total several (2.2%), (See Figure 6) healthy employment the Mining sector, well. in Denver Mint, Coors, has Manufacturing in employment was other significant Reserve Bank, resorts. most It is a U. S. also a is rather well diversified. TABLE 2: DENVER EMPLOYMENT DISTRIBUTION MINING 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1.10% 1.17% 1.25% 1.42% 1.61% 1.69% 1.81% 2.02% 2.10% 2.51% 3.17% 3.36% 2.97% 2.60% 2.37% 1.87% 1.59% CONST 6.45% 7.57% 7.82% 6.66% 5.37% 5.34% 5.66% 6.09% 6.28% 5.78% 5.41% 5.87% 6.28% 6.07% 5.80% 5.17% 4.56% MFG 17.14% 16.88% 16.93% 16.76% 15.58% 15.69% 15.65% 15.89% 15.97% 15.55% 15.55% 14.87% 15.02% 14.74% 14.19% 13.75% 13.59% TRANS/ UTILS 7.30% 7.41% 6.94% 6.95% 6.73% 6.46% 6.43% 6.76% 6.94% 6.94% 6.99% 7.23% 7.30% 7.01% 7.12% 7.13% 6.94% TRADE 24.68% 24.67% 24.29% 24.36% 24.50% 25.13% 25.22% 24.34% 24.23% 24.07% 23.85% 23.85% 24.93% 24.49% 24.62% 24.62% 25.12% SERVICE 18.18% 18.40% 18.83% 19.37% 20.29% 20.28% 20.47% 20.32% 20.41% 21.09% 21.68% 21.94% 23.06% 22.69% 23.31% 23.92% 23.83% SOURCE: COLORADO DEPARTMENT OF LABOR AND EMPLOYMENT, COLORADO LABOR FORCE REVIEW 24 FIRE GOVT 6.12% 19.03% 18.27% 17.53% 18.03% 19.36% 18.89% 18.19% 17.89% 17.28% 17.29% 16.45% 15.81% 16.16% 14.92% 15.10% 15.75% 16.53% 6.23% 6.41% 6.46% 6.57% 6.52% 6.57% 6.69% 6.78% 6.76% 6.89% 7.07% 7.50% 7.47% 7.50% 7.79% 7.84% FIGURE 5: DENVER GROWTH SECTORS 240,000 220,000 200,000 180,000 (n) z 0 160,000 (n) CL IL mu 0 cii 0:: 140,000 120,000 100,000 D 80,000 z 60,000 40,000 20,000 0 1975 1976 0 A TRANSPORT / UTILITY 1977 FIRE 1978 1979 1980 1981 1982 1983 1984 1985 SOURCE: COLORADO DEPARTMENT OF LABOR + SERVICE TRADE X MINING V TOTAL EMPLOYMENT/5 1986 1987 FIGURE 6: DENVER LOW GROWTH SECTORS 180,000 170,000 160,000 150,000 140,000 0I z 0 130,000 120,000 (L 0 110,000 100,000 90,000 80,000 70,000 60,000 50,000 40,000 30,000 1975 0 1976 1977 O MANUFACTURING GOVERNMENT 1978 1979 1980 1981 1982 1983 1984 1985 SOURCE: COLORADO DEPARTMENT OF LABOR + CONSTRUCTION A TOTAL EMPLOYMENT/5 1986 1987 EMPLOYMENT GROWTH BY SECTOR MINING In Denver, In total 1971 This rose every 1.56% by 1987. in the 16.5% 1982. From 1982 to translates to a growth rate of to 1987, just under 1981, Denver continued rate over this period was 1987 the rate was -12.8%. This 3.3% for the entire period 1975 the growth rate for which was 3.4% and considerably for total this is over introduction (5). The annualized growth in Denver. it declined dramatically to only from 1975 to Where the US showed growth through of is the classic example of volatile growth, This spoke about which Hirsch It 1.1% 1982 when year until employed 3.36% of the non-agricultural employment, three times the 1971 figure. much US as a to the in this sector comprised the employment employment. represented a when compared total employment larger share of whole. has always Mining sector the faster total Denver employment than the US rate, 2.4%, employment. CONSTRUCTION The Denver share of employment than the when construction was only employment in Denver is interesting national average. 4.56% of the total (US was 4.93%). in Denver show much more It held a construction sector has consistently to that 27 from in this sector the national 1981 in 1987 non-agricultural The cycles variability than note Except larger to. 1987 cycles. Denver to move counter - appeared The percent of total cyclically when compared to employment in construction the US. has ranged as high as 8.14%. The cyclic nature of tracking employment. about 10.5% There was 7.2% industry From 1975 to annually but from growth from 1981 and contraction entire this period considerably less rate was which to from 1975 to 1979 1987 than the 3.0%. 1979 to 1984 1984 is to the very it grew at 1981 is rate of at an annualized 1987 at -9.3%. well rate of Over annualized rate also employment growth rate for Denver a when the rate was -4.1%. US construction It evident was the 2.0%, employment growth below the total (3.4%) MANUFACTURING This is lower the single sector percentage of in which Denver has total employment a consistently than Manufacturing has employed between 13.6 and 17.1% total However employment during the very similarly is behaving losing its share of total decline than nationally, it This decline for this throughout study period. to in that the US employment. the in 13 year sector was growing of US. the Denver this sector it is steadily While this is a slower is clearly a strong trend. is occurring despite the fact that sector the Denver period. has been Until 1984 at a rate of 4.0% which 28 the growth rate basically positive the Manufacturing is slower than the Denver From to total employment 1984 to rate of 4.5% for the 1987 when the Denver nearly zero growth, slight contraction. total employment the Manufacturing Over same time frame. sector the study period the this sector was 2.2%, about half of the total rate of 3.4%. share loss levelled off suffered a growth rate in employment growth Consistently slower growth has caused discussed above, even though Denver the market Manufacturing has grown much faster than US Manufacturing. TRANSPORTATION AND UTILITIES Denver has shown industry. the largest percentage of Except always had 7% or for a better utility employment 1983 and for few years in this sector. share showed was fairly flat from an area that has Utility sector must this sector, one can see that 1986 and Transportation of annualized employment relatively This is growth. growth for level in 1987. 1978 it has The transportation and trend'from 1967. as the This 1977 to is typical Transportation and the number of persons it employed has grown every Over the time frame year This is Denver. just above This of three times the same sector. 29 is why total in in the 1975 to and Utilities have produced percentage also about 1983 to to in this keep up with the growth. the growth Denver 1975 a growth good growth In examining study except from employment 1987, a 3.6% rate the rate of total it has maintained a employment the growth rate for in Denver. the US in TRADE In Denver, stable the wholesale and throughout the employment in Denver, employment from 1971 As with retail years. With to quarter of total 1987. a continual pattern of growth in Trade industry employment. employees at a rate of 4.6 %, Until 1984 the sector a figure of Denver total the growth pattern was quite well employment. was adding above the average From flat at only 0.7%. industry grew at a rate of 3.6% or total a it has maintained a 24-26% share of total the US, Denver showed annual growth trade sector has been very 1984 to 1987 Overall, this just above the 3.4% rate for employment. SERVICE In Denver the growth employment was just to 1987 it in this less than 2%, the years 1975 sector grew at than the growth rate for for share. to 1987 still employment. 30 It made up in the Service of 5.7% which is much faster the next considerably From 1971 employment in two Denver. above In years. average growth rate for Service sector employment 1975 total 1/5 of the total. to 1985, Denver total employment flattened out in its about an annualized rate percentage of (1.94%) per year. showed a steady increase 18.2 to 23.8% of employment or During sector's 1985, The the overall was 4.8% from the rate for total FIRE In Denver 6.1% the FIRE sector was slightly more significant with a to 7.8% share of total employment. It did not grow every year but did exhibit a decidedly positive trend. The Denver From 1984. to a rate 1984, grew at 1.4%. Given the the annualized rate over one and employment a rate of 6.1% from one half significant the study period times greater 1975 to deal a great to 1987 this sector slowed down 1984 of only is almost total FIRE sector growth through was 4.9%, which than the rate for in Denver. GOVERNMENT Government is always a significant employed between enough, Denver 15.8 and upswing always in From of in this gains showed recent years. most 19.7% 1984 to the percentage employed important employer and the total. area of 1987 it Interestingly employment there was in the a definite It by the government. that the government to remember Denver in is often moves independently of market forces. In Denver almost rate of the growth exactly 2.0%. trend like the It has and a similarly small of line for the government employment the US. It has an annualized same contraction from positive growth rate. 31 looks 1980 to 1983 PHOENIX The growth changes these in all sectors are shown total in some substantial exhibited a have made areas studied. The slow Denver rates than it very by growth in in (10.0%), Service (9.1%), Utilities (6.5%). Trade than average growth for rate Trade was significant industries the US. (3.4%) and exceeded growth in the study period of growth. 6.2%, a either The rate which of the other (See Figure 7) growth or was matched or here because for much of faster rate of the study period The extraordinary Transportation and should be mentioned would 3. These were Construction (7.2%) and annualized Table employment four sectors. it led to in the distribution of employment over Phoenix FIRE in Phoenix Government in They Phoenix were different were (3.2%). Manufacturing All in either of the other two (5.3%), three of these areas. than in Mining had faster (See Figure 8) EMPLOYMENT GROWTH BY SECTOR MINING In Phoenix, the Mining sector has of total was only employment. .09% .04-.05% and For never been a significant part instance, of the total. in 1974 Mining employment This declined in increased through the eighties to 32 1978-79 .07%. to only TABLE 3: PHOENIX EMPLOYMENT DISTRIBUTION MINING 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 0.09% 0.09% 0.09% 0.08% 0.04% 0.05% 0.06% 0.06% 0.08% 0.09% 0.09% 0.07% 0.07% 0.07% CONST 7.46% 5.65% 5.30% 6.40% 8.15% 9.21% 7.95% MFG 19.05% 16.96% 17.10% 17.11% 16.94% 17.38% 17.90% 7.52% 17.82% 6.73% 7.84% 8.71% 9.21% 17.07% 16.18% 16.28% 15.52% 14.93% 14.87% 8.93% 7.58% TRANS/ UTILS 5.40% 5.37% 5.25% 5.10% 4.77% 4.76% 4.83% 5.11% 5.45% 5.30% 5.02% 4.88% 4.98% 5.37% TRADE 25.54% 26.22% 26.30% 26.25% 25.74% 25.37% 25.46% 25.77% 25.74% 25.41% 25.19% 25.58% 25.14% 25.30% SERVICE 17.84% 19.00% 19.38% 19.60% 19.80% 20.15% 20.87% 21.35% 22.27% 23.21% 24.01% 24.03% 24.78% 25.38% SOURCE: ARIZONA DEPARTMENT OF ECONOMIC SECURITY, MARICOPA COUNNTY LABOR FORCE AND EMPLOYMENT 33 FIRE 7.17% 7.51% 7.27% 7.14% 6.95% 6.99% 7.06% 7.20% 7.40% 7.42% 7.30% 7.51% 7.96% 8.20% GOVT 17.48% 19.19% 19.31% 18.32% 17.62% 16.09% 15.84% 15.18% 15.25% 14.58% 13.39% 13.21% 13.23% 13.25% FIGURE 7: PHOENIX GROWTH SECTORS 240,000 220,000 200,000 180,000 (n) z 0 160,000 140,000 0 el 120,000 LiU 100,000 80,000 z 60,000 40,000 20,000 0 1975 A 1976 1977 0 CONSTRUCTION TRANSPORT / UTILITY 1978 1979 1980 1981 1982 1983 1984 1985 SOURCE: AZ DEPT OF ECONOMIC SECURITY + SERVICE o FIRE X TRADE V TOTAL EMPLOYMENT/5 1986 1987 FIGURE 8: PHOENIX LOW GROWTH SECTORS 140,000 130,000 120,000 110,000 100,000 (I) z 0 90,000 to 0. 80,000 L. IL Lf 70,000 0 0Z 60,000 50,000 z 40,000 30,000 20,000 10,000 0 1975 c 1976 1977 1978 1979 1980 1981 1982 1983 1984 SOURCE: AZ DEPT OF ECONOMIC SECURITY 0 MANUFACTURING + MINING GOVERNMENT A TOTAL EMPLOYMENT/10 1985 1986 1987 The growth in this sector has not mirrored either Denver or the US. Most years have been either the study period the rate was 3.4% total employment (At Phoenix its positive. or about half Over of Phoenix growth. This sector employed 1987 0 growth or peak only 400 persons in 1975 and there were as many as only 600 in 700 persons). In the quarry operations are the only significant employer in the Mining track Denver sector. This helps explain why the trends do not and the US more closely. CONSTRUCTION Phoenix construction percentage of Denver. In employment the total working sector. 33.2%! consecutive annually. The Three 12.3%. in total at a higher the US or two entire cycles. of total in Phoenix grew years of rapid During either downturns have of decline employment also been the US or from was most Denver. 1975 to 1979 at a growth was followed by three an average rate growth and one of -7.9% slower growth 1987 construction employment declined at During the annualized rate growth in observe almost This tremendous years year followed. a rate of than in Phoenix as compared to either Construction employment rate of represented in 1985, as much as 9.21% in this pronounced the employment Since 1976, one can 1979 and has entire period from of growth employment was 10.0%. for Phoenix 36 to 1987 This exceeds the (6.5%). 1975 MANUFACTURING Phoenix on It was lose the other hand not until 1982 that its share of total manufacturing still left growth this faster than national employment. in all years except a declining sector as large share of either of the the tremendous growth rate growth in 1982 and 1983 have of total a component this a very to the It has always been a major employer with An annualized this sector began to From 1982 forward Phoenix employment. however definite trend. the manufacturing sector even 19% of total Uninterrupted not had such a employment. declined manufacturing sector. 14.9 to over has of 5.3% would have made other two economies, Phoenix (6.5%) has allowed lose its share of the total. TRANSPORTATION AND UTILITIES Phoenix had industry. the smallest The employment employment has peaked in 1979 and percentage once here as of a employment percentage in 1982 and has 1985. As a trend its highest point it was only of this total bottomed out twice line the graph 5.4% in is quite flat. of the total At employment and at the low point it was 4.8%. In terms of actual positive trend steady 6.5% . growth Throughout growth rate. this sector exhibited the years 1975 to This explains percentage time series. 37 a strong 1987 there was a the flatness of the TRADE As with Denver employs one quarter been between 26.2%. and recently 25.1 of While there has its people a very US as in 25.8% except and Phoenix has in the a whole, Phoenix this business. It has in 1975 flat trend been little when line in variation it it rose to this sector. does exhibit some subtle cyclic tendency. In Phoenix the actual quite fast from 1975 levelled off from and grew at year, to 1981 1981 to in the Trade producing a 1983 but, a rate of 7.0% through 1987 was 6.2%. due to employment rate of in 1983 1987. industry grew it took 7.0%. It off again The rate from 1975 to Once again a sector shows tremendous growth but the 6.5% growth the sector in the Phoenix loses part of total employment every its share. SERVICE Phoenix had of total the largest employment. employees were working increases in the Service sector share In of 1974, in the service percentage had risen to over The actual number very rapidly. 1975 it grew industry of 9.1% to employ 231,600 by 38 in this annually in Phoenix. non-agricultural sector. 1/4 of the total of people employed At a rate fastest growth 17.8% By 1987 this (25.4%). sector also grew it was the second From only 81,700 people in the end of 1987. FIRE Phoenix' FIRE employment grew faster than Denver's or However, to total it did not grow fast enough employment. not vary much. employment Over the in this sector from and 8.2% of percentages did largest 1974 In to 1983. Phoenix share of 1986 and 1987 had between 7.0 its non-agricultural employees in this field. in Phoenix grew from 1976 to 1982. From dramatically to 9.1%. in employment 1982 through This the annualized contributor its share of Phoenix had the lead in this regard. This sector boosted study period the In the study, it regained the increase the US'. a rate of 6.7% 1987 this rate increased last five years of increased growth rate to to the growth at 7.2%. This in Phoenix' total is also a major employment. GOVERNMENT Government represented employment the total during decreased its share of total faster level At for between the years studied. 13.3 and Phoenix' government sector employment. In fact than any of the other areas in this study. off from 3.2%, exhibits government employment. comparison to the local employment. of total it decreased It seemed to 1984 to 1987. Phoenix total 19.3% of the While this is other two This employment faster fastest areas, is rate somewhat favorable grew slower why government in Phoenix 39 it growth lost than elsewhere. for in than the its share SUMMARY OF EMPLOYMENT TRENDS DENVER - Looking back at the review presented employment sectors behaved rather Major differences occurred subsequently in the overall to take advantage of an industry, the began cut in backs in 1982 in Mining growth. sector in the price shale the new with the rest of the of natural never recovered and brought Oil and Denver was able and gas market and However, along employment. centered in Denver the employment severe drop 1981 or similarly to the US sectors. inflated oil economics of exploration. above, Denver gas which on massive production but this type of production was also was not enough to support the down turn in employment. The question left Denver with the is whether the or went in employment Denver from about assume that Mining very the Denver did sector. strong These 1984 forward. lose many contraction but did not fall Mining sector. off In fact, Denver diverse employment base It Denver in the Due to did not did have a significant any where near as fast may well benefit from in the future. 40 One can safely not debilitating. completely collapse as an employer. in all at total of the people employed other sectors, Even and FIRE growth Looking is evident. losses were in employment. levelling off of same trend performance Mining sector in the Trade, Service a consistent levels, leaving the other sectors for strong growth trends sectors, there is sectors into people as the a more PHOENIX - When compared to the US and Denver, Phoenix performed quite differently. in most every With exceptionally strong sector as indicated by the During Phoenix also had a fluctuations in growth patterns more volatile economy its diversification the study period, Phoenix was still enjoying the remnant benefits of the developed some sunbelt migration momentum and mega-trend. was still rate in virtually all employment fueling a This sectors. one can see similarities sector until but Construction and, the variations employment interest base is 1982 to slowly 1986 across most However, this Phoenix, the sector makes US'. in in grew it at the lost Phoenix from Denver and grew growth is occurring was subject to rate share Construction gained. 41 very dramatic the growth pattern opposite way. its added in Phoenix. in Phoenix same particular The author sees this as a natural The influence of exactly It Phoenix' Construction employer declined Of in the Transportation and Utility sector almost sector that strong growth economy when every sector as in every in Manufacturing. sector. as an when the same sector cycle changes. evident sectors Construction in the US as a whole. 1984, from its position extension of a an these so different the dramatically to in had high growth Comparing Phoenix to the US, is index. While as of the the total total is quite which moves in Transportation employment employment in when The Manufacturing Phoenix occurred area. in sector may be the next growth area A pronounced surge in 1984 at which significant contractions. time Manufacturing employment the US and Denver This is in no small to the Phoenix' desire to cultivate employment 42 for the both showed way attributable in this sector. CHAPTER FOUR CHARACTERISTICS OF RENTAL INCOME CHARACTERISTICS OF RENTAL INCOME THE DATA In this study, rent collected the apartments. vacancy and These This is most appropriate discounts. was income and The source of of for represent profit because the rental expense summaries from a portfolios course is used as a measure of return to few and income data large portfolios. apartments built development it reflects in held under the normal continuous ownership. The Denver data came apartment complexes. given year. from continuously held, There These buildings in were as many as 32 apartments complexes of were 58 to 360 apartments in number in the years 1981 1977. These are the Denver through units. The two story majority of There were between 1207 data 1987. shown in Table 4. complexes in a typically these complexes were 200 to 300 units. and 2974 privately owned base with the latter The figures go back The actual to source was the owner'?s income and expense summaries for each complex. A summary of the rent Phoenix data came and expense data came data for from two sources. summaries from from apartments each. Phoenix eleven is First, a major apartment different complexes They were typical 43 low rise in Table 5. The there were income manager. These of 135 to buildings. 402 TABLE 4: YEAR 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 DENVER RENT DATA SUMMAY MEAN RENT/UNIT SAMPLE SIZE 2,320.44 2,594.82 2,968.43 3,316.50 3,857.19 4,407.11 4,419.50 4,762.16 4,476.79 4,436.29 4,230.28 1207 1437 2037 2440 2974 2974 2974 2974 2974 2974 2974 TABLE 5: PHOENIX RENT DATA SUMMARY YEAR 1980 1981 1982 1983 1984 1985 1986 1987 MEAN RENT/UNIT SAMPLE SIZE 3,371.02 3,469.36 3,715.90 4,222.03 4,157.74 4,198.73 4,242.54 3,916.07 784 991 991 1,038 2,792 3,771 4,190 2,671 44 The second source of data was a major local This data was taken from property tax covered ten complexes. buildings with 200 the period from 1980 to per (IREM) square membership also complexes of two story The Phoenix data spanned series The (12). data Institute of Real Estate This data was collected rent is taken from (Certified Property Managers) from 1986 the 1973 to are summarized the Institute's on a voluntary basis. 1976 represent average figures are median comparison, the rent per square foot 750 square feet This data 1987. data came from an foot. The figures 1977 to protest forms. to 300 units each. United States rent Management These were management company. to arrive at rents. rents. For From purposes of figures were multiplied by a rent per unit value. These data in Table 6. CORRELATIONS UNITED STATES First the study levels in What these. coefficient (R) the correlation correlation was that US between the each of the cities there were significant correlations Phoenix displayed of 0.927. Between Denver rents and coefficient was 0.936. between the trends diversification in There rent (See Figure 9) index 45 rent in the study. and studied and the US totals. a higher the relationship the entire US and was found between examined a correlation US rents was significant in the two cities Denver generally had than did Phoenix. This may be TABLE 6: UNITED STATES RENT DATA SUMMARY YEAR RENT/S.F. 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 2.34 2.48 2.61 2.78 3.09 3.24 3.58 3.88 4.45 4.83 5.05 5.57 5.55 5.48 RENT/UNIT 1,755.00 1,860.00 1,957.50 2,085.00 2,317.50 2,430.00 2,685.00 2,910.00 3,337.50 3,622.50 3,787.50 4,177.50 4,162.50 4,110.00 (ASSUMES 750 S.F. PER UNIT) (1973 TO 1976 are average rents) (1977 to 1986 are median rents) SOURCE: INSTITUTE OF REAL ESTATE 46 FIGURE 9: AVERAGE RENT COLLECTED/UNIT $4,800 $4,700 $4,600 $4,500 $4,400 $4,300 $4,200 Q $4,100 IU La $4,000 -J $3,900 0 U I- $3,800 w p $3,700 z Id $3,600 $3,500 $3,400 $3,300 $3,200 $3,100 $3,000 $2,900 1980 0 US RENTS 1981 + 1982 DENVER RENTS 1983 1984 1985 0TEPHOENIX RENTS 1986 evidence that influence sector the on by degree of diversification rent levels. sector However, basis is has further necessary a direct analysis on to evaluate a this possibility. DENVER AND PHOENIX Looking at rents 1987, it in Denver and Phoenix over is easy between the two to see the cities as differences occurred during the time they growth and vast differences seen in Figure 1983, 1984 and to perform During years 1980 to in performance 10. The 1985. trend biggest The rest of similarly. showed the strongest positive for Phoenix. all. appeared the In 1983 the in the study period Denver on the other hand, had almost no growth at 1984, Denver in Phoenix increased the rent rent levels dropped levels at a good rate slightly. 1985 saw Denver rents dropping quickly while Phoenix rents increased. CORRELATION BETWEEN RENTS AND THE DIVERSIFICATION INDEX With respect index to the and rents collected per showed a strong ideas put forth suggested, any relationship between such the diversification unit, neither relationship. This is Denver nor Phoenix consistent with in the beginning of this study. there was correlation. no reason to anticipate In fact, As Attaran (1) the existence of the respective correlation coefficients were 0.42 for Denver and 0.37 for Phoenix. 48 the FIGURE 10: RENT COLLECTED PER UNIT $4,800 $4,700 $4,600 $4,500 $4,400 0 Id H U La $4,300 $4,200 -J -J $4,100 0 C) H $4,000 zU $3,900 $3,800 $3,700 $3,600 $3,500 $3,400 $3,300 1980 + 1981 DENVER RENTS 1982 1983 o 1984 PHOENIX RENTS 1985 1986 1987 CORRELATION BETWEEN RENTS AND EMPLOYMENT LEVELS Examining the rent levels attained over in the various employment sectors some are found. For instance, when time and the variations interesting correlations looking at the US total employment and average rents the correlation coefficient quite high at causal 0.9342. relationship, While this statistic it does merit is not (r) is proof of any closer examination. To begin this examination, both average US rent per unit and total US employment over these series' is definitely positive except 1984 to 1986 time were when compared. took rents a The trend in during the period slight downturn. correlation is strong but the is unexplained. required now is systematic What is of the information in the coefficients each employment for recent slowing previous chapter sector. distribution and This the distributions of Denver and Phoenix is both of The of the rent trend evaluation and the correlation done for respective the US employment in an attempt to pin point the closest relationships. There were several strong the US as a whole, between the Service expected as employers the highest r was 0.9783. sector and rents. the Service sector in the United States particularly sector, correlation coefficients found. probably to be fastest growing over the study period. strong correlation this was also a major This occurred This is is one of the coefficient was growth sector 50 For Another in the in the US. FIRE Both of these sectors along with the (r .9522) tracked rents = years 1984 through The combination of recent trend has shown eighties in trend in rents. with rents. many as employment Oil the Mining the strong 1980. inflation. What tracked rent employment occurred was the new price the is Until that time, Mining It closely even employment. effect of Oil sector and explosive growth on in employment levels which made Natural Gas exploration for Denver. up at It as between Mining is the This brought of new job seekers and basically represented rents a negative sector. levels very in the and production very profitable. industry industry. any of the other sectors. for this relationship on early This is still not correlation through a very only sector left the it only makes up between 0.7-1.25% of total Gas prices due to 1979. 50-55% since the and Gas dependent Mining look at The probable cause and is the has also exhibited Mining tracked rents closer than though This 356,000 people and US average rents seems that the track the sector shows negative trend losing 2,046,000 people since pronounced as the comprises about The Mining Manufacturing which interesting to during the US and yet they do not a consistent when as Along with very closely except for of these three sectors interesting correlation that trade sector 1986. the total employment most Wholesale and Retail same The same time new 51 increase in employees in a large number the birth of a new inflation pushed were looking for housing and maintained as such at higher rent least for a than coincidental. levels were time. established and The connection is More valuable insight can looking closely at the two cities less causal be gleaned from in the study. DENVER TOTAL EMPLOYMENT A close look steadily at the decreasing growth growth spurt employment surge, Denver employment performance in was flattening employment decreased slightly during Rent levels there was 1984, on the something of was growth pattern of a that total to the out and 1984 even 1986. in the although rent to Subsequent completely flattened the trend was negative through unusual out. other hand grew an abrupt stop there There was the year 1984 however, previous growth total rate. presents a steadily until growth. 1982 when Then, from it soon turned back 1987. levels? of the correlation coefficients down and What contributed What follows 1983 to to this is a discussion for Denver rents collected per unit and each sector's employment in order of significance. MINING The most likely candidate in consists earlier of in largely Oil Denver and Gas the chapter on economic 52 is the Mining sector which employment. make up, As discussed the trend in the Denver Mining sector negative through easy was 1987. to explain positive through In relation to the flattening of rent in rents during It anything that sector. The resemble the Denver economy occurred was experiencing This other by the tremendous surge in sector declined, it is even the in the in this growth in mining and rents case is that several other growth was somewhat obscured the Mining sector. the other then 1984 is more difficult. What may have happened sectors concurrently. rent levels and correlation coefficient between Mining was only 0.6448. and the Mining sector, downturn, but the surge does not 1982 sectors were So as the Mining able to support the levels for a time. TRANSPORTATION AND UTILITIES In the Transportation and Public Utility sector quite significant. trends varied in direction of the 1985 when did not. At 0.9600 this an statistic says that the two exceptionally similar two trends was the same for rents began the r value was declining and There was some difference this manner. all The years except sector's employment in the rate at which these trends grew and contracted but they are the most similar of all the comparisons made. Again note the The high correlation coefficient aspect of growth sector. the force The is what non-physical in the year 1983. is as expected as the physical drives the Transportation and Utility aspect (i.e. rates. that drives rental that population growth incline increases demand 53 employment Renaud (10) is growth) pointed out for public resources. SERVICE The Service sector employment trend in Total resemble the growth trend again-points employment The correlation the Service sector was 0.9277. in the year strong downward move in rents but increased significantly. out the similarity which the service sector had this year the rents. difference which occurred year there was a service sector for rents and There was only one major That most closely resembles the Employment for Denver, was also found to closely coefficient between 1985. which in the year The study 1984 previous to been growing much slower. characteristic up turn During mentioned earlier occurred. FIRE Finance Insurance trend that and Real Estate inspection visual the FIRE sector period. sharply uninterrupted during the had shows but the 1984 slope the year FIRE A 1964 sector particularly when the occurred. 54 In fact was 0.9164. the trend throughout between the FIRE trend in growth. that exhibited a in rents. the two series a positive evident year for of the plots The differences trend became down the trend was quite similar to the correlation coefficient as an employer when the and A line for the study the rents rents turned employment continued similar variation previously mentioned was uptick TRADE The Wholesale and Retail varied in a very similar pattern. of 0.9138. rents Trade sector employment This sector as can be seen This resulted increased in the at graph of 1987. years The trade sector What was between these trends was this year two the rate than the trends. trends appeared while rents declined. in an r value a much slower differences between the In both of these in Denver also in the years Major 1985 and employment grew striking about the relationship the growth shared in 1984. trends grew at almost exactly During the same rate 7.25% for Trade employment and 7.73% for rents. MANUFACTURING There is considerable Manufacturing 0.8146,. Although in The graph is Manufacturing particularly emerge as trends shows before that leveling rents from later. 1984 to employment. notable but, what see that employment every did other coefficient 1983, concurrent with was a decline in similarities show sector 55 is, is interesting not ,which begins rents during 1984. is the similarities. 1987 there during increase in this year. in That The a systematic uptick Construction correlation Manufacturing employment a close similarity in in the variance. of rents and their of these the decline in the decline will employment, 1982, occurs there similarity are not is what will While Mining and this surge, the reader except Government had an GOVERNMENT Another sector which was expected the Government as an employer. and reacts to move more However, in a manner which -is totally forces. The author relevance in the is of this sector that there in the The facts bear this opinion out as the r employment rent and coefficient levels is the second often acts independent of economic the opinion trends of this sector similarly was is little matter at hand. value for Government is only 0.6338. This correlation lowest. CONSTRUCTION The Construction sector varies levels. The r value here is only 0.1915. of these two roughly Other is quite differently from trends reveals cyclical, than at no the rents perform the beginning similarity. the reason. and The Looking the rent at the graph While construction as described earlier. end of the study period, author explanatory power to this sector does not is there attribute any in Denver. PHOENIX Looking at Phoenix trend the employment and rent relationships tells a considerably in rent positive trend from rates of growth. year of levels is 1980 different story. quite unique. to 1983 follower 56 by To strong with progressively higher two There begin, the is a This accelerating growth contraction in the city of is years followed by one of very low increases. The effect of this period was to hold 1986 rents to 1983 levels. year of strong contraction at the rate of approximately -6.0%. TOTAL This flattening of EMPLOYMENT Comparing the total the trend was followed by one trend discussed above employment suggests relationship. In comparison only 0.6535. is fact, that the 1982 the at a there In Phoenix, rate. compounded growth rate was is only in Phoenix a very correlation coefficient growth happened at a very fast employment grew to the growth the for 6.9%. annually. this employment After the year rate of only 1.5% total loose 1982, From While the 1980 to there is little explanatory value in this comparison, there were sectors that seemed to move more like the trend in rents. MINING example One such less than virtually any 0.1% is of the 0.9100 is total inconceivable that importance between However, sector. the Mining employment there rents and in Phoenix is a causal trends in correlation coefficient it is relationship of the Mining the relationship is definitely strong. the highest it represents Since sector. The r value of in the Phoenix analysis. CONSTRUCTION Construction was a very of the Phoenix area. significant contributor As an employer 57 to the economy of as much as 9.2% of the total, it can economy. In Construction bring examining the are somewhat comparison produces an r influence graphic sector employment similarities rents and considerable and the trend to the of the in rents, the discern. 0.7263 which Construction employment did move While there are several bear on representation difficult value of to This suggest that together somewhat. dissimilarities, there are a few points of similarity such as in the years 1985 through 1987. Also, in 1983 they grew at almost the same rate. MANUFACTURING When looking at little or trend. no the trend in Manufacturing conclusive similarity The correlation coefficient lowest score in comparison to of only (excluding government) of all is the Manufacturing sector sector there is the least 0.5066 the rent is the sectors. similar is the That trend compared to rents. TRANSPORTATION AND UTILITIES The next sector sector examined was which exhibited an r particularly helpful as an only graph look correlations Beyond that, at the value and Utility of 0.6201. This is indicator of rents either. except perhaps the trend the Transportation to see in the in employment positive growth. 58 that there years 1980 are not One need no real through 1982. in this sector is a steady TRADE to the Wholesale Going on notes a few similarities. 0.6423 this sector two although relationships. years 1981 With a correlation should vary more closely there the author and Retail Trade sector will be no coefficient of than the previous particularly strong In fact, the only similar movements were and in the 1986. SERVICE An examination along the previous sector begins second with an r highest score in this sector as 25.4% of the total 232,000 people. value of 0.6912 which excluding relevance lines applied to is the Certainly this Mining sector. fact that The real it comprises as much in Phoenix. This is nearly is a force that could housing prices. However, the similarities end there. The represents the the employment the Service similarity is striking influence through 1983. FIRE The final sector is FIRE. In studied in the Phoenix section Phoenix does not mirror this the growth is a growth in industry similar to overall total is not one of the area at It less than 8% but rents a great deal. characteristics more employment. of this paper of the total. 59 growth its growth It displays in the Phoenix larger employers in the DENVER SUMMARY There are certain characteristics contribute to the marked employment growth and interviews of it is more typical completion. the local of vacant new cause it rent to levels. This also means to crash suddenly. regulation in effect. in the Denver market has learned to do large swings in the rent market. This also forces economic forces more to make decisions about to based on that an overly This custom is quite the entire complex on the they are nearing large number sort and of self the opposite of the In the Southwest the norm the market at one time. is to effectively levels that appear a more direct current the market This constitutes a is to put during author found that not overwhelm the Southwest. trends in instance the project apartments will normal procedure For lease buildings out as of market that between the apartment builders, the the balance leasing activity. the Denver similarities This enables a builder timing of in What level out in the Phoenix relationship between and apartment rents because they builders are in touch with the leasing market. PHOENIX SUMMARY A large part of what has happened difference that becomes more Through became discussions apparent that with in in Phoenix is due to a basic apparent when compared to Denver. apartment builders most of in the Southwest Phoenix the it normal procedure is to complete an apartment project before an earnest leasing program is put in place. 60 What this opens the door for is a lot of units also an hitting the market is undercurrent of permissiveness throughout the Phoenix the addition of metro area. This permissiveness apartments to go the number of has allowed somewhat unchecked. do not track employment as closely forces. There at one time. Thus the rents in Phoenix as Denver or apartments is not driven by These forces would, as thus promote rent levels. 61 in Denver, the US because the proper economic control building and CHAPTER- FIVE CONCLUSIONS CONCLUSIONS This study that shows in economic performance as no is between diversification and this performance. into the individual correlation between employment exists as As The degree to level given of be broken down there is certainly one or a few which there However, This must see that and distribution a this performance and sectors. is largely sectors to significant some the Denver example. correlation apparent be city's employment a between relationships may there this of the relationship affected by the flow of stock into a market in the Phoenix analysis. in Denver, correlation sectors. the rents coefficients The collected when overall r value per unit compared for total showed with strong the employment various and rents collected was very high. There were a few strong r values just under Service, that such relationships do For as not FIRE and all have to be strong to be instance, Construction was expected to show correlation. should rents. increase This exhibited Looking This is based on competition and proved to be the idea Trade. These informative. low or negative that new construction thus put downward pressure on consistent with the findings as it low correlation to rents. at Phoenix, the rents correlate particularly well with 62 collected changes per unit did in employment. not There were no strong relationships between either total any one of the most the sectors. significant sector. the process of effort the economy. this level of one of However, the rent of is an economy that It is possible of growth, Phoenix the the unfettered increase that pointed out as no one construction of new apartments. constituency regulation This tremendous growth. to maintain regulate the that Construction has been most apartment do not that in the is willing to It would was in seems likely be against significant sectors in the stock levels employment or owners should of apartments closely mirror is of be. any the The the reason the increased economic activity. STRATEGIES These findings suggest correlation between rent levels. steady, an virtually all is key to can and this consistent from this analysis First, evaluate employment distribution. individual sectors least the Along should relationship between the returns sectors and the performance was a the prudent two general overall with be strong increase in stock. is that take into consideration at economy. should be employment economically viable flow in the What follows should What that there aspects of diversity of this examined investor analysis closely. the the The and "volatile" growth sectors and the contingent effects on overall expected growth should be 63 scrutinized. This will offer a potential for growth and the downturns in individual sectors. Beyond the this sort of analysis classical barriers environment will in returns. nature but growth and the investor must competition. likely be more conducive simply based of the economy's ability of the economy to survive This regulation may economy thus a to good view a tendency regulated governmental practice. In in a strong toward over-building tendency toward diseconomy in rents. 64 more to sustained growth not even be on customary there appears A look closely at REFERENCES REFERENCES 1. Attaran, M. Performance XX, No. 2, (1986). in U.S. 44-53. "Industrial Diversity and Economic Areas," The Annals of Regional Science, 2. Corgel, John B. and Gay, Gerald D. (1987). "Local Economic Base, Geographic Diversification, and Risk Management of Mortgage Portfolios," AREUEA Journal, 15, No. 3, 256-267. 3. Downs, Anthony. (1983). Rental Housing in the 1980's, (Washington, D. C.: The Brookings Institution). 4. Harmston, Floyd K. System, (Ames: The (1983). The Community as an Economic Iowa University Press). 5. Hirsch, Werner 2. York: Mcgraw-Hill) (1973). 6. Howland, Marie and Peterson, George E. (1986). "The Response of City Economies to National Business Cycles," Journal of Urban Economics, 23, No.1, 71-84. 7. James, Franklin and Hughes, James W. (1974). "Modeling Regional Growth," Readings in Urban Economics and Spatial Patterns, 227-242.(New Brunswick: Rutgers University-Center for Urban Policy Research). 8. Lewis, J. Parry. (1979). Urban Economics: Approach (London: Edward Arnold (Publishers) 9. O'Mara, W. Paul et al. (1984). Rental Housinq (WashingtonD. C.:Urban Land Institute). Urban Economic Analysis(New A Set Ltd.). 10. Renaud, Bertrand. (1984). "Structural Changes in Advanced Economies and Their Impact on Cities in the 1980's," Research in Urban Economics, 4, 1-23.(Greenwich, Connecticut: JAI Press Inc) 11. Sternlieb, George and Hughes, James W. (1981). The Future of Rental Housinq (New Brunswick: Rutgers University Center for Urban Policy Research). 12. Institute of Real Estate Management of the National Association of Realtors, "Income / Expense Analysis, Conventional Apartments," 1987 Edition, p. 16. 65 13. State of Arizona, "Maricopa County Labor Force and Employment," Department of Economic Security, Research Administration. 1974 through 1987. 14. State of Colorado, "Colorado Labor Force Review," Colorado Department of Labor and Employment. 1981 through 1988. 15. United States Department of Labor. Bureau of Labor Statistics. March 66 "Monthly Labor Review". 1983 and May 1988.