FOREST SERVICE HANDBOOK NORTHERN REGION (REGION 1) MISSOULA, MT

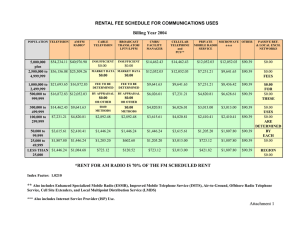

advertisement

2709.11_30 Page 1 of 23 FOREST SERVICE HANDBOOK NORTHERN REGION (REGION 1) MISSOULA, MT FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION Supplement No.: 2709.11-2015-1 Effective Date: March 13, 2015 Duration: This supplement is effective until superseded or removed. Approved: DAVID E. SCHMID Acting Regional Forester Date Approved: 03/09/2015 Posting Instructions: Supplements are numbered consecutively by Handbook number and calendar year. Post by document; remove the entire document and replace it with this supplement. Retain this transmittal as the first page of this document. The last supplement to this Handbook was 2709.11.11-2005-2 to Chapter 60. New Document 2709.11_30 23 Pages Superseded Document(s) by Issuance Number and Effective Date 2709.11_30 (2709.11-2004-4, 9/21/2004) 16 Pages Digest: This supplement includes minor editorial and format changes throughout the text. 31.1(3)(i) – Removed reference to Cultural Resources, which is addressed in FSM 2367.17 of parent text. Updated the sequential lettering convention to match parent text. 31.21 – Adds direction to clarify current national interpretation of law and Rural Electrification Act of 1936 (REA) facility exemptions, which is that facilities only need to be eligible in order to be exempt and do not need to be financed through the REA. Added paragraphs four and five to address noncommercial group use and grants issued by other agencies. 31.22 (3) - Revised to include “Cost Recovery” and appurtenant reference to parent text. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 2 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 31.22 (5) - Added the word “facility” as it pertains to being subject to fee waivers. 31.22 (6) - Replaced reference from FSM 2721.34 to 2721.4 to match parent text. 31.22(10) - Added paragraph ten setting the standard that discretionary cost recovery fee waivers should rarely be granted unless there is good cause. 31.22(b)(11) – Removed reference to “linear right-of-way” and worded the first sentence to address that ancillary uses subject to full waiver are not limited to linear rights-of-ways. Added clarification of regional and parent text references at the end of the first sentence. Added last sentence to clarify policy that fees should be charged for ancillary uses unless holder submits written documenting that shows use is clearly ancillary to the primary use. 31.23 – Changed the wording from “All nonuse must be granted …” to “All nonuse must be requested and granted…” in the last paragraph. 31.3 – 31.31 – Removed section on “Administrative Fees” and “Transfer Fees”, which are no longer valid direction now that Congress has permanently authorized Cost Recovery (FSH 2709.11, Chapter 20) under the Consolidated Appropriations Act, 2014 (Public Law 113-76; H.R. 3547 – Division G, Title IV). The exception to this is for Recreation Residences, whereby a Transfer fee is appropriate according to the Cabin Fee Act in Section 3024(h)(1) of the National Defense Authorization Act for Fiscal Year 2015, Pub. L. No. 113-291, but that will be addressed in parent text. 31.51(1) – Removed reference to Cultural Resources, which is addressed in FSM 2367.17 of parent text. 31.51(2) – Removed reference to parent text FSM 2722.1. 31.51(2)(a) – Added the last sentence regarding nongrazing under Outfitter and Guide permits. 31.51(2)(b) – Corrected reference from FSH 2709.15 to 2709.11. Replaced “Custer County” with “Carter County” in paragraph three. Reworded paragraph four by removing reference to a letter to line officers and simplified to say that “written communication” will occur to allow for the efficient use of email. Added the last sentence to paragraph four to clarify the use codes that apply to the livestock area fees. Updated the hyperlink and website referenced in paragraph five. Clarified the last paragraph to say that the calculation process may be reviewed as needed instead of saying it “should” be “reviewed at 5-year intervals or sooner”. 31.51 - Exhibit 01 – Replaced 2002 rates and references within the table and pertinent text to reflect the most current and applicable rates (2015). R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 3 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 31.51a - Revised to account for the current regional minimum fee. As directed by the Washington Office, the fee will be updated annually instead of at 5-year intervals as it was in the past. The last sentence was added to address that the minimum fee should not be prorated. 31.51a (1) – Added reference to parent text FSM 2721 which address minimum fees for several recreation uses. 31.51a (2) - Revised to reflect current Region 1 minimum fee and document June 16, 2011 OIG direction for annual inflation indexing. 31.51a (3) – Replaced reference to use code “134” to “144” to match parent text. 31.52 (1) – Replaced reference to use code “134” to “144” to match parent text. 32.21 – Reworded this section to change “lump-sum” to say “consolidated” throughout to match parent text. Removed the second sentence as it is redundant to the parent text. The sentence removed read: “For permits and term permits (FSM 2711.2 and 2711.3), limit consolidated payments under any of these situations to a period of 5 years or less.” 32.21(1) – Revised the first sentence by adding in a clarifying point that for less than $100, there is no limitation on applicability to consolidated payments by noting: “regardless of who was issued the authorization.” Added the second sentence and items (a) and (b) to set the default billing cycle to be consolidated. 32.21(2) – Added the last sentence to reflect policy set under 32.21(1). 32.23 – Added clarification throughout and examples of trespass. Paragraph four is a new situation that clarifies that a trespass bill may be issued to address unauthorized commercial filming after the fact and allow for the film to be utilized. The requirement to coordinate with Forest Service law enforcement and cost recovery applicability are new additions. 32.33 – Added clarification that the current late-payment clause will be included in all new, reissued, or renewed special use authorizations, even those with fees that are exempt or waived. Removed outdated reference in second paragraph to “Clause VI(D) in Form FS-2700-4 (10/09))”. 32.43 – Added the word “new” in the second sentence of the first paragraph. This clarifies that bills may be sent with termination or revocation letters regarding past delinquent debt, but it should not be the first time that bill was sent. 32.43(2) – Changed the word “agreements” to “cases”. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 4 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 36.42 (7) – Added direction for determining the annual land use fee for area special use permits with no prescribed fee determination schedule or method. This regional direction has been in place and was taken from a 2/23/2009 letter, file code 2710/5410, signed by the Director of RMLHW and sent to Forest and Grassland Supervisors. 36.71(1) – Added a second paragraph including an example of how to assess fees for intermittent use. This is consistent with and substantiates how several units have been operating and interpreting national policy. Added a third paragraph including examples of how to determine whether a special use permit is required when filming is associated with outfitting and guiding. 36.71(3) –Removed reference to “section 45.5” and replaced it with reference to “FSM 2726.31d.” 36.71(4) - Added the last sentence of paragraph four stating that a national fee, if implemented (and that is expected), will supersede the regional fee for commercial filming and photography. 37.21c – Updated direction for minimum fee for short-stop fee. Removed reference to obsolete “Outfitter - Guide Administration Guidebook”. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 5 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 30.5 – Definitions 1. Public Interest. The public interest is served when an action benefits the general public, not solely the holder’s interests. 2. General Public. The whole of the National public of the United States, not solely those living in a particular area (state, county, city). 3. Public Benefits. Public services that are made possible or facilitated by the authorized use and that are oriented toward the general public rather than toward a particular holder, group, or segment of the public. Benefits so offered must be fully available to the general public without undue restriction or limitation, and be of such a nature that most people would consider them necessary or desirable. 31 – ESTABLISHING FEES 31.1 – Methods for Determining Fair Market Value 3. Fee Systems and Schedules. Use the appropriate Northern Region schedule or fee system to establish fees for the following uses of National Forest System lands. f. Outfitter and Guide - for short-stop fees, see sec. 37.21c, paragraph three; for unauthorized additional use, see sec. 37.21f. g. Communications Site Fee Schedule – for local exchange networks, passive reflectors, and wireless internet service providers, see Regional interim directives for chapter 90, sec. 97, Exhibit 08. j. Commercial Filming and Still Photography – sec. 36.7. k. Recreation Lodging - sections 31.51a, paragraph three; and 31.52, paragraph one. l. Livestock Area – sec. 31.51, paragraph two. 31.12 – Fee Reviews Document all fee reviews with a new fee determination statement (sec. 31.4). When the date specified for fee review is missed, the fee revision should be made as soon as practical and implemented on a regular fee-year basis. The new fee can only be imposed for the remainder of the original fee review period and does not establish a new review interval for subsequent periods. Do not bill for revised fees for a given payment period if the holder has already been billed or otherwise notified of a previous fee for that payment period. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 6 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION During the fee review, check the authorization for a current late payment clause, and amend in a new clause if necessary (sec. 32.33). 31.2 – Fee Waivers and Exemptions 31.21 – Fee Exemptions 2. Facilities Eligible for Rural Electrification Act Financing. Electric or telephone facilities that are eligible for financing under the Rural Electrification Act of 1936 (RE Act) are exempt from land use fees, pursuant to Section 504(g) of the Federal Land Policy and Management Act of 1976 (43 U.S.C. 1764(g)) as amended by Public Law 98-300, May 25, 1984, and Public Law 104-333, November 12, 1996. RE Act financing programs are administered by the USDA Rural Utility Service (RUS), formerly known as the Rural Electrification Administration (REA). Note that this exemption: a) applies to the facilities, not the utility company or owner; b) requires the facilities be eligible for financing under the authority of the Rural Electrification Act of 1936; c) requires the facilities be eligible for financing, whether or not actually financed; d) does not apply to some programs that RUS administers under other authorities, such as the Broadband Initiative Program, which is authorized under the American Recovery and Reinvestment Act of 2009. Acceptable documentation that a facility is eligible for financing under the RE Act can be found in records of actual financing, or in an eligibility determination issued by the RUS. The holder or applicant is responsible for providing documentation to the Forest Service to support a request for an exemption to land use fees under the RE Act. Use the following designations only for facilities that qualify for RE Act financing: 641 (powerline, RE Act financed), 642 (other utility improvement, RE Act financed), 822 (telephone line, RE Act financed), and 832 (other communication improvement, RE Act financed). This exemption may occasionally apply (for qualifying facilities) to use codes 803 (microwave common carrier), 805 (local exchange network), 806 (private mobile radio service), 807 (passive reflector), 810 (cellular/telephone and personal communication services), 811 (wireless internet service provider), and 823 (fiber optic cable). R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 7 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION Do not use the following designations for facilities that qualify for RE Act financing: 643 (powerline), 644 (other utility improvement), 821 (telephone line, non-RE Act), and 831 (other communication improvement). 4. Noncommercial Group Use. Under 36 CFR 251.57(d), noncommercial group use is exempt from fees for use or occupancy of National Forest System lands. This exemption applies to use code 191. 5. Grants Issued by Other Agencies. Grants made by other agencies for the use and occupancy of National Forest System lands may be administered by the Forest Service and tracked in the Special Uses Data System (SUDS) as special uses. When the authority used by the other agency does not provide for use fees, such uses should be designated exempt. Examples include Department of Transportation easements (use code 741), Federal Energy Regulatory Commission hydropower licenses (use code 611), and United States Department of Interior grants for ditches, canals, and reservoirs under such authorizes as the Act of 1891. If the authorizing statute does provide for use fees, and the granting agency collects the fees, then the authorization should be designated as exempt in SUDS and noted in the remarks. 31.22 – Fee Waiver 3. The Authorized Officer must consider the primary intent and purpose of the land use when considering whether a cost recovery or land use fee waiver is appropriate. Even when a use provides public benefits, such benefits are often incidental or secondary to the primary purpose when the authorization is for a commercial use. See FSH 2709.11, sec. 23.6 of parent text for waiver of cost recovery fees. 4. A holder's inability to pay the rental fee is not a valid basis for waiving fees. 5. Waivers are applicable to land use and facility rental fees. Do not waive GrangerThye facility-use fees (FSM 2715.13). However, Granger-Thye facility-use fees may be offset by holder performance of landlord (Government) responsibilities. Waivers must not be extended to maintenance and operating costs, or any other fees and charges except land use rent. 6. Recreation lodging (FSM 2721.4) land use rental fees authorized through the recreation fee demonstration program or similar programs may be waived if the authorized officer determines the use to be in the best interest of the Government. For example, fees could be waived for a service group staying in a Forest Service cabin while performing deferred maintenance activities such as roofing or log replacement. 7. Do not waive fees for term permits (FSM 2711.3), easements (FSM 2711.4), or leases (FSM 2711.5), either in full or in part, except in reciprocation for similar grants to the United R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 8 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION States. These types of authorizations create a compensable obligation against the United States and commit National Forest System lands for a considerable period of time. 8. In considering fee waiver applications from State and local governmental agencies, be guided by the discretionary intent of 36 CFR 251.57(b) and by the general public benefits of the particular use. Give greater weight to those projects and services directly relating to general public health, safety, and welfare. Uses supporting governmental administration, freely provided over a wide geographic area, may qualify for a full waiver. Services directed toward specific groups or local areas may not. Some authorizations may include different uses that may have more than one waiver category; for example, a highway maintenance station containing residential units, rented to employees at fair market rent, and equipment and storage yard. Full fee would be required for the area occupied by the residential units. The area occupied by the equipment and storage yard would probably qualify for a full waiver. See R1 Supplement, FSH 2709.11, sec. 14 for further guidance on consolidated uses in a single authorization. 9. Fee waiver amounts, authorities, and current billing period rent sheets must be listed in the Special Uses Data System (SUDS). 10. A determination to waive cost recovery or land use fees must meet a high standard of deliberation as to the public benefit or the benefit to the programs of the Secretary of Agriculture. Cost recovery and land use fees should be assessed unless the applicant or holder provides appropriate documentation to convince the Authorized Officer that they qualify for a waiver and that it makes sense to grant that waiver. In particular, waivers for cost recovery should not commonly be granted because there is an actual cost to the Forest Service to process or monitor a special use, and cost recovery fees are retained at the local unit to offset those expenses. 31.22a – No Waiver Do not grant a waiver if any of the following conditions apply: 6. An easement has been granted, except as provided in 36 CFR 251.57 or when the holder has made a reciprocal grant of substantially equal value to the United States. 7. The holder does not, would not, or statutorily cannot waive fees for the United States in similar uses. 31.22b – Full Waiver 10. The authorized use is for utility distribution lines that exclusively serve Federal facilities (51 FR 44015, 12/5/86). R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 9 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 11. The use would fit under a defined fee schedule, but is a minor secondary use, clearly ancillary to a primary use listed in the same authorization, and rent is assessed to the primary use under a different fee system (R1 Supplement, FSH 2709.11, sec. 14, paragraph one; and sec. 36.42, paragraphs one and two of parent text). Assess a fee for ancillary uses unless the applicant or holder requests in writing that the use be considered as being clearly ancillary to the primary use. 31.22c – Partial Waiver The Authorized Officer may waive that portion of a land-use fee that equals the value of a reciprocal grant from the holder to the United States. Except when granting a full waiver (sec. 31.22b), do not reduce the land-use fee to an amount less than the established minimum fee for the particular special use designation (FSM 2720.5, paragraph C), the Regional minimum fee (sec. 31.51a), or the holder’s charge to the United States for similar activities or services, whichever is greater. 31.23 – Temporary Fee Adjustments 1. Non-Use. Normal seasonal weather fluctuations and decreased patronage do not justify granting non-use status. Usually, restrictions to use caused by normal weather variations are among the factors considered for establishing fees. Do not grant non-use merely for the holder's convenience; rather, limit it to unusual cases such as: a. A livestock area authorization may be granted non-use status if range rehabilitation requires that the holder keep livestock off the area. b. A special use relies on water that is unavailable due to drought. c. A recreation residence or resort holder may be granted non-use if denied authorized privileges for the season because of prolonged fire hazard closure or inaccessibility caused by extensive road construction. All non-use must be requested and granted in writing for a definite period; ordinarily a particular season, but for no longer than the current fee year. Unless otherwise provided, rental fees paid in advance of an approved non-use period should be credited toward the rental fee for the subsequent season or year. 31.4 – Documentation When a partial fee waiver is granted, the fee documentation must show the derivation of the reduced amount from the full fee. The full fee amount, the amount waived, and the net amount R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 10 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION to be paid must be itemized on the billing and listed in the SUDS Billing Period screen (Rent Sheet button and Adjustment tab). Document fee determinations by using the print screen capture feature in SUDS (Rent button in the Uses tab on the Special Uses Authorization screen). 31.5 – Fees Established by Field Units 31.51 – Fees Established by Regions 2. Livestock Area: See FSM 2722.15, 2722.32, and 2722.41 for definitions of livestock area uses. For fee determination purposes, classify livestock area uses as either “nongrazing” (paragraph a) or “grazing” (paragraph b). a. Nongrazing: Annual fees for livestock area permits that do not authorize grazing must be established by analysis of local market rental information (sec. 31.1, paragraph one), provided the area occupied is extensive enough that an appraised value would likely exceed the Regional minimum fee (sec. 31.51a). For nongrazing under outfitter and guide permits, see parent text FSH 2709.11, sec. 37.21(i). b. Grazing: When grazing is authorized under this designation, include clause R1A3 in the permit (FSH 2709.11, sec. 52.1). Annual fees for livestock area permits authorizing grazing are established and revised according to the “Fee Basis Report – Livestock Area Special-Use Permits” dated May 29, 1986, and approved by the Deputy Regional Forester on June 13, 1986 (notice published in Volume 51 of the Federal Register, page 30682, August 28, 1986). The 1986 report provides both private and public land base rates in six price areas for three livestock categories (mature cattle and horses, yearling cattle, and sheep). The base rates were derived from 1983 data published in the “Appraisal Report Estimating Fair Market Rental Value of Grazing on Public Lands” prepared for the Forest Service and the Bureau of Land Management, published July 27, 1984 (PB84242205). The price area boundaries coincide with county lines. Only Price Areas 1, 3, and 4 apply to the Northern Region. For the Northern Region, Price Area 1 comprises all of South Dakota, the Sheyenne National Grassland in North Dakota, and Carter County in Montana; Price Area 3 comprises all of Montana except Carter County; and Price Area 4 comprises all of Idaho and Washington (see Exhibits 01 and 02). Annually, on or about February 15, Regional Office Recreation, Minerals, Lands, Heritage, and Wilderness Staff will communicate the revised fees for the pending R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 11 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION billing period in writing to the field. Because this timing will not allow for billings in accordance with the traditional fee and permit year (January 1 through December 31), the fee year for "Livestock Area (Grazing)" permits (sec. 42.15) may be adjusted to May 1 through April 30. Bills should be prepared and mailed to holders by March 15 and made payable by May 1. Round bill totals to the nearest whole dollar. This applies only to use codes 215, 232, and 241. Calculate the pending year fees by applying the inflation adjustment index (provided annually by the Regional Office, as discussed above) to the base year (1983) appraised values for each price area. The inflation adjustment index is the quotient of the previous year’s 11-state average animal unit rate (as reported by the USDA National Agricultural Statistics Service on January 31 each year (http://www.nass.usda.gov/Charts_and_Maps/Grazing_Fees/index.asp), divided by the 11-state average animal unit 1983 base year rate of $8.68. See Exhibit 01 for base rates and an example indexing for Calendar Year 2015. The Director of Recreation, Minerals, Lands, Heritage, and Wilderness may review this fee basis if there are indications of significant change in the market. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 12 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 31.51 – Exhibit 01 Fair Market Value of Grazing on NFS Lands in Region One 1983 Base Rates and Example Indexing for 2015 MATURE CATTLE & HORSES (Over 18 months of age; Head Month or Pair Month*) Price Area 1 3 4 1983 Base Rate $9.50 $7.60 $5.90 2015 Rate** $19.95 $15.96 $12.39 YEARLING CATTLE (Under 18 months of age; Head Month) Price Area 1 3 4 1983 Base Rate $7.10 $5.90 $5.40 2015 Rate** $14.91 $12.39 $11.34 SHEEP (Head Month or Pair Month*) Price Area Westwide 1983 Base Rate $1.05 2015 Rate** $2.21 *Pair Month: cow-calf, ewe-lamb, mare-colt. **The 11-state average animal unit rate for 2014, reported on January 31, 2015, by the USDA National Agricultural Statistics Service, is $18.20. Therefore, the Region One adjustment index for 2015 livestock area fees is 2.10 ($18.20 divided by the 1983 base rate of $8.68). Fees for 2015 are the product of the adjustment index multiplied by the 1983 base rate for the price area and type of livestock. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 13 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 31.51 – Exhibit 02 Maps of Price Areas for Cattle and Horses, and Westwide Area for Sheep R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 14 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 31.51a – Regional Minimum Fees Except as provided in paragraph two, the Northern Region minimum annual special-use rental fee for Calendar Year 2015, is $72. If a holder elects or is required to make a lump-sum payment (sec. 32.21), the current annual minimum fee applies to each year comprising the lump sum. The lump sum must not be less than the product of the Regional minimum fee multiplied by number of years covered. In the event that a National minimum fee is implemented, the Region will charge the greater of either the National or Regional minimum fee. Do not pro-rate the regional minimum fee. 1. Fee Implementation. The Regional minimum fee applies to all special uses in the Northern Region except recreation lodging and use types for which a higher minimum fee is established (see parent text FSM 2721 and for outfitters and guides, see sections 37.21a and 37.21h). Minimum annual rental fees are not subject to partial payment procedures or proration for portions of a year. Minimum fees may be fully waived if the holder and the nature of the use qualify (sec. 31.22). 2. Minimum Fee Adjustment. The base minimum fee and the inflation indexing process were published in the Federal Register November 27, 1989 (54 FR 48785). The Office of Inspector General Audit Report No. 08601-55-SF, published June 16, 2011 recommended and the agency subsequently agreed to update minimum fees. As a result, the fee is adjusted annually by the cumulative percent change in the Implicit Price Deflator-Gross Domestic Product (IPDGDP), which is annually published through Interim Directive FSH 2709.11, sec. 36. Multiplying the former fee by the cumulative change in IPD-GDP and rounding to the nearest dollar derives the adjusted fee. For example, the Calendar Year (CY) 2015 fee is calculated as follows: Previous Fee (CY2014) $71.00 x IDP-GDP 1.016 CY2015 Fee (Rounded to nearest dollar) = $72.00 3. Recreation Lodging: The Regional minimum fee for recreation lodging (use code 144, sec. 41) is $15 per night. 4. Consolidated Uses. When more than one use is included in a single authorization, the Regional minimum fee applies separately to each use designation for which rent is not exempt (sec. 31.21) or waived (sec. 31.22-31.22c). For example, consider a single authorization including two separate use designations and the rent for each use calculated at less than the R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 15 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION Regional minimum fee. In that case, assess the minimum fee separately for each use and bill for two minimum fees under a combined bill for the authorization. 31.52 – Fees Established by Forests and Grasslands 1. Recreation Lodging. Forest and Grassland Supervisors may establish fee schedules for recreation lodging (use code 144, sec. 41), subject to the Regional minimum fee for recreation lodging (sec. 31.51a, paragraph 3). Differential pricing may be used for seasons, holidays, or weekends, but no rate may be less than the Regional minimum, and the fee may not be waived (sec. 31.22a). Higher rates may be set for facilities with capacity for more than four people or for those facilities providing additional services or convenience improvements such as electricity, potable water, or flush toilets. 2. Forest and Grassland Minimum Fees. Forest and Grassland Supervisors are authorized to establish minimum fees for unique kinds of uses after consultation with and concurrence of the Director of Recreation, Minerals, Lands, Heritage, and Wilderness. 3. Outfitter and Guide Flat Fees. Forest and Grassland Supervisors are authorized to establish flat fees for outfitter and guide uses. See sec. 37.21c, paragraph four. 32 – FEE ADMINISTRATION 32.2 – Payment of Fees 32.21 – Consolidated Payments Advance payments for multiple years may be collected under the following situations (43 U.S.C. 1764(g) and 36 CFR 251.57(a)(2)). Consolidated payment periods for easements and leases (FSM 2711.4 and 2711.5) may exceed 5 years, but only upon review and approval of the Regional Office, Director of Recreation, Minerals, Lands, Heritage, and Wilderness. 1. When annual fees are $100 or less, regardless of who was issued the authorization, the Authorized Officer may require either annual payment or a payment covering more than 1 year at a time. The default approach is to consolidate bills where law, regulations, and National policy allow in order to minimize billing frequency and administrative expenses. This is a recommendation from the national study: Special Uses Reengineering Implementation Team Final Report, September 1999, Stretch Goal 1 – Item 5. a. Issue bills for 5-year consolidated payments unless there is a compelling reason to bill more frequently. For example, an individual with a private road special use permit who would normally pay the regional minimum fee each year ($72.00 in CY 2015) – should be issued a single bill for a 5-year consolidated payment of $360 ($72.00 per year x 5 years). R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 16 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION b. This sound business management practice will help reduce the administrative time spent on billing and tracking payments (36 CFR 251.57(a)(1)). Instituting consolidated bills will increase administered-to-standard accomplishments while at the same time allow the holder to submit one payment and avoid the annual inflation index increase. Consolidated billing is the default approach to new authorizations and may be addressed through an amendment to existing uses or as opportunities allow. 2. When annual fees are more than $100 and the holder is a private individual (that is, acting in an individual capacity), as opposed to commercial, corporate, business, or government entities, the holder may, at their option, elect to make either annual payment or payment covering more than 1 year at a time. The Forest Service shall offer and advise that the holder make consolidated payments based on the rationale outlined in sec. 32.21(1)(a) and (b). 3. When annual fees are more than $100 and the holder is other than a private individual, the holder may request to make consolidated payments, but the Authorized Officer may require either annual payment or a payment covering more than 1 year at a time. 32.23 – Payment for Trespass Trespass includes any unauthorized use or occupancy, regardless of the cause for a lack of authorization. Absent any resource or property damage, it is the loss of revenue to the Forest Service or U.S. Treasury in the form of lost rental fees that constitutes the trespass and cause for action. In such cases, the trespass claim is the amount that would have been charged for rent had the use been authorized. See FSH 6509.11h, sec. 21.12d. The Special Uses Data System (SUDS) may be used to generate bills for unauthorized occupancy in the following situations. 1. On initial issuance of an authorization for a use previously in trespass. For example, in the case where a non-Forest System Road on National Forest System land that was built by the user 5 years ago without authorization and is being used is discovered or is being addressed, but is just now being authorized – the Authorized Officer has the discretion and is encouraged to assess a trespass fee for the previous 5 years. In this example, the current rental fee should be the value used. 2. For a period between authorization expiration and reissue (in the case where bills were not assessed in the interim). 3. For a period between revocation or termination and satisfactory removal of improvements or site restoration. 4. For cases where commercial filming (or like activities) occurred without a permit and the Authorized Officer determines that the most reasonable and appropriate course of R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 17 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION action is to assess a fee for the use and allow the product to be used by the trespasser in a commercial capacity. An example may be where filming occurs without a special use permit and the product or content of the film is such that it was unintended to be commercial, but is so unique or valuable that there is a desire for it to be used commercially. Consider if the commercial filming was willful or accidental. In this case, it may be appropriate to accompany the bill for trespass with a letter from the Authorized Officer stating that future commercial filming activities are expected to be authorized before the fact. For paragraphs one, three, and four above, Forest Service Law Enforcement and Investigations (LE&I) shall be consulted prior to taking action. The issuance of a bill for trespass does not alone mean that an LE&I warning or citation is not also appropriate or warranted (36 CFR 261.10(k)). When issuing trespass bills, include bill remarks to indicate which fees are assessed under an authorization, and which fees are assessed for unauthorized use. Cost Recovery fees are also appropriate to assess in these cases. 32.3 – Billing Procedure 32.33 – Late Payments Late payments must be billed in accordance with the terms and conditions of the particular special-use authorization. When there is no late-payment clause in the authorization, late charges and penalties must be assessed in accordance with the Debt Collection Improvement Act of 1996, as amended (31 U.S.C. 3717, et seq.), and direction in FSM 6530 and FSH 6509.11h, sec. 24. The Authorized Officer shall include the current late-payment clause in all new, reissued, or renewed special use authorizations, even those with fees that are exempt or waived. Consult the Regional Office, Land Uses Group for current clause language. 32.43 – Termination or Revocation Action Send the certified letter referenced in the parent text to the former holder of the terminated or revoked authorization. Do not send additional new bills for collection with this letter. 1. Use proper terminology for termination or revocation, depending on provisions in the specific authorization. See also sections 32.41 and 32.42 of the parent text. 2. Consider previous cases and consistency with other similar situations. 3. State that unauthorized-use fees are still due and payable. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 18 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 4. If an authorization terminated under its own terms, also inform the former holder of the now terminated authorization that they have no administrative appeal rights. Send a bill for collection for all applicable charges once the improvements have been removed (FSM 2716.4). The fees for unauthorized occupancy and use (sec. 32.23) shall include the period from the first day of the billing cycle through and including the date upon which the improvements have been removed, and the previously authorized site has been completely restored to Forest Service standards. If the former holder fails to remove the improvements and/or restore the site to the authorized officer’s satisfaction, include and bill for charges necessary for the Forest Service to complete this work. 33 – RECREATION RESIDENCE FEES 33.1 – Base Fees and Indexing 6. Recreation residence fees ordinarily account for associated improvements such as short access roads, outside toilets, bath/shower houses, well houses, garages, and storage sheds (FSM 2721.23c); no extra charge is necessary. Improvements not considered part of the authorized lot might require separate authorization, which should be assessed separate fees. Examples include authorized off-lot improvements such as docks, buildings, or other structures that are physically and functionally separate from the lot. 36 – FEE SYSTEMS AND SCHEDULE 36.42 – Exceptions to Fee Schedule 7. The following procedure may be used to determine the annual fee for a special use permit authorizing use of an area of National Forest System (NFS) land for which there is no other prescribed fee determination schedule or method. This procedure may be used for uses occurring within a location with average or below average land values, and where there are no other known factors that significantly affect land value. Examples where this method may apply include, but are not limited to, small agricultural fields, gravel stockpile areas, seismic sensor sites, research plots, spring developments or water impoundment areas. Do not use this valuation method where the expected land value, if determined by an appraisal, would likely be ten (10) or more times the value from the schedule (FSH 2709.11, sec. 36.42 para. 5). Use this method only for land area special use permits other than communication sites. Determine land use fees for communication uses using the appropriate communication site fee schedule. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 19 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION Note that the values in the LROW fee schedule reflect a 50 percent encumbrance factor, meaning that, on average, the value of the authorized use would be 50 percent less than the full fee value of the land. Step 1: Determine if average land values are appropriate for this fee determination. a) Is the expected land value for the permitted area significantly higher than average land values for the remainder of the county in which the permit will be located? (For this purpose, consider ten (10) or more times the scheduled fee to be “significant.”) b) Are you aware of other factors that may affect the permit area such that average land values would not accurately represent the value of the land authorized for use? If the answer to either (a) or (b) above is “yes,” consult the Regional Appraiser for valuation advice. If the answer to both (a) and (b) above is “no,” proceed to Step 2. Step 2: Obtain the average land value for the area. Determine the value using the current Linear Right-of-Way (LROW) fee schedule for the county in which the use will occur (FSH 2709.11, Sec. 36.41, Ex. 02). Step 3: Determine the land use fee. The annual land use fee is calculated by multiplying the authorized area (acres) by the LROW scheduled fee ($/acre/year). (See the following Exhibit 01 for a worksheet to document this approach for the case file) R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 20 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 36.42 - Exhibit 01 Special Use Permit Area Land Use Fee Determination Worksheet (ref. FSH 2709.11, secs. 31.1 and 36.41) Step Step 1 Step 2 Step 3 Task Is the special use permit area located within an area where land values differ significantly from average land values for the county in which the permit will be located, or are there other factors that would significantly affect land value? Obtain average land value for the area from the current LROW fee schedule. Result Yes – Consult Regional Appraiser No – Proceed to Step 2 LROW $/acre/year: $________ Land Use Fee Determination Annual Land Use Fee: $_______ Permit Area: ______acres X _______ LROW fee $/ac./yr. (round to the nearest whole dollar) Note: If the calculated fee is less than the Regional minimum fee, charge the minimum fee. File this Worksheet in the case file. Prepared by: __________________________________ (signature) Name: __________________________________ Title: __________________________________ Date: __________________ R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 21 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 36.7 – Commercial Filming and Still Photography Fees 36.71 – Determining Commercial Filming and Still Photography Fees Establish fees for commercial filming authorizations (sec. 45.5 and FSM 2725.5) using the following direction. 1. Basic Daily Fees. Determine basic daily fees based on the number of people that the holder has on the location each day, during all phases (preproduction, production, and postproduction) of actual filming activity on National Forest System lands. Actual filming activity includes the use of actors, models, props, sets, or camera equipment. Exclude reproduction activity such as scouting if it does not include the use of actors, models, props, sets, or cameras, and would not otherwise require a special-use permit (FSM 2719). See Exhibit 01 for fees for each filming type. The Authorized Officer may adjust the rental fees in special circumstances such as minimum number of people or exceptionally short duration of use. Do not assess less than the Regional minimum fee (sec. 31.51a). Round total fees to the nearest whole dollar. In an example where a hunter and a small film crew with nominal equipment and resource impacts will be out on National Forest System lands for up to 2-weeks, but only intend to engage in commercial filming of the hunt for 3 of those days – the Authorized Officer has the discretion to assess fees for only the 3 days. The purpose statement of the permit and term of the authorization would articulate that filming will take place within the defined 2-week period with commercial filming authorized for 3 days. In this example where the benefit is to the applicant/holder, the hunter should not be doing anything or going anywhere that the general public would not be allowed to go. This example is not limited to hunting, but is intended to address activities that take place over a longer period of time and rely on unpredictable events, such as the success of harvesting or seeing game animals. Focus on the use and time that is reasonable to assess a fee for the use of public land. If the hunt or event is unsuccessful in capturing commercial/usable footage, a refund should rarely be accommodated. Another situation is filming associated with outfitting and guiding. Use the following guidelines to determine whether a commercial filming or commercial still photography special use permit is required: a. If an outfitter/guide has a crew on a scheduled trip performing filming for the purpose of giving the video to his client; it is a service provided under the outfitter and guide permit and is not subject to a commercial filming permit. b. If the outfitter/guide is performing filming for the purpose of advertising his business (such as posting to a website, to show at trade fairs, to give “free of charge” to potential clients, etc.); it is considered advertising pursuant to the outfitter and guide permit and is not subject to a commercial filming permit. R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 22 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION c. If the outfitter/guide performs filming either with the intent to provide the product to a broadcasting company or sport show, or subsequently gets such a request to do so; then it becomes commercial filming and a separate commercial filming permit would be required. d. If the outfitter/guide is contracting with a third party to conduct filming; then the third-party contractor needs to have a commercial filming permit (regardless of whether the outfitter/guide intends to provide the footage to clients or intends to use the footage for advertising). 2. Additional Fees. The Authorized Officer may assess additional fees for temporary disruption of administrative or public use. Additional fees should be based on actual administrative cost and lost revenue attributable to the disruption caused by the holder’s activities. 3. Administrative Cost Reimbursement. The Authorized Officer may charge the holder for administrative costs incurred in processing the application and administering the authorization. This can include salary and expenses for environmental analysis and for an onsite Forest Service Representative responsible for approving site-specific changes and decisions during filming. See FSM 2726.31d of parent text. 4. Fee Review. The Director of Recreation, Minerals, Lands, Heritage, and Wilderness should review this fee schedule at 10-year intervals to ensure that it reflects fair market value. In the event that a National fee schedule for commercial filming and still photography is developed, the Northern Region Fee Schedule for Commercial Filming will no longer be applicable. 36.71 – Exhibit 01 Northern Region Fee Schedule for Commercial Filming Number of Persons on Location 1-10 11-30 31-60 More than 60 Basic Daily Fee Motion Picture, Still Television, Video Photography $150.00 $50.00 $200.00 $150.00 $500.00 $250.00 $600.00 R1 SUPPLEMENT 2709.11-2015-1 EFFECTIVE DATE: 03/13/2015 DURATION: This supplement is effective until superseded or removed. 2709.11_30 Page 23 of 23 FSH 2709.11 – SPECIAL USES HANDBOOK CHAPTER 30 – FEE DETERMINATION 37 – OUTFITTER AND GUIDE FEES 37.2 – Commercial Services Not Associated with Public Service Site 37.21 – Fees 37.21c – Fee for Commercial Use After a permit is issued with fee option A or B (paragraphs one or two of parent text), the holder may not change the fee option during the permit term. The holder may only make a fee option election on issuance of a new permit. Do not use fee options A or B when the Forest or Grassland has implemented flat rate fees (paragraph four). 3. Short-Stop Fee. The Northern Region short-stop fee is $1.00 per client, or the Regional minimum fee (sec. 31.51a), or minimum outfitter and guide fee (sec. 37.21a), whichever is greater. 4. Flat Rate Fees. Forest and Grassland Supervisors may develop and implement flat rate fee schedules as an alternative to fee Options A and B listed in paragraphs one and two. Fee schedules must be adopted as Forest or Grassland supplements to this handbook. Flat rate fees must be based on the weighted average of the advertised and/or actual service day rates charged by outfitters or guides for different categories of uses. Once the weighted average service day charge has been determined, the rate is then applied to the standard Option A (paragraph one) schedule, or multiplied by 3 percent to identify the flat user day fee for a specified activity or service category. The flat user day fee then becomes the service day fee for commercial use. Forest and Grassland Supervisors shall annually adjust flat rate fees using the Implicit Price Deflator – Gross Domestic Product (IPD-GDP), and shall review flat rate fees at 5year intervals, and adjust as necessary, to ensure the fees reflect fair market value. Do not establish flat fees for areas smaller than a National Forest or Grassland. Include all currently authorized, or otherwise locally recognized, outfitter and guide activities in the flat fee schedule. Consult with potentially affected outfitters and guides in the development and implementation of flat fees. Forest and Grassland Supervisors shall consult with the Director of Recreation, Mineral, Lands, Heritage, and Wilderness when developing flat rate fee schedules. 37.21f – Fee for Additional Use If the holder does not receive advance approval for additional use, then calculate fees for unauthorized additional use, whether associated with priority or temporary assignments, at a rate one-third greater than (133 percent of) the applicable rate (option A standard schedule, option B gross revenue, or flat rate).