6530 Page 1 of 16 FOREST SERVICE MANUAL

advertisement

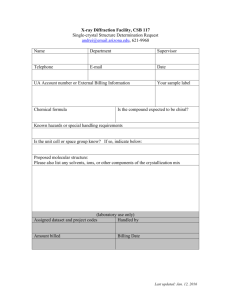

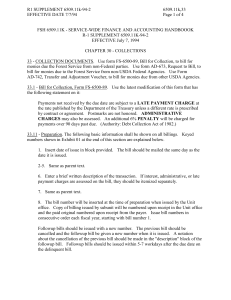

6530 Page 1 of 16 FOREST SERVICE MANUAL DENVER, CO FSM 6500 - FINANCE AND ACCOUNTING R2 Supplement No. 6500-92-4 Effective October 1, 1992 POSTING NOTICE. Supplements to this title are numbered consecutively. Post by document name. Remove entire document and replace with this supplement. Retain this transmittal as the first page of this document. The last supplement to this Title was Supplement 6500-92-3 to 6520. Document Name 6530 Superseded New (Number of Pages) 17 15 Digest: Reissues in electronic format and makes minor editorial corrections. ELIZABETH ESTILL Regional Forester R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 2 of 16 TITLE 6500 - FINANCE AND ACCOUNTING 6530.3 - Policy. 1. Collection in Advance. Maps may be furnished in advance of collections for mail requests under $25 which did not include the full amount for the maps. (Does not apply to over-the-counter sales.) Maps which are furnished in advance of payment shall be accompanied by a preprinted form showing amount due, and requesting payment and return of a copy of the form (see exhibit 01). Such amounts due shall be excluded from accounts receivable and formal billings, Form FS-6500-89, shall not be prepared until payment is received. Internal controls such as separation of duties, inventory controls and analysis, followup notices using standard forms, etc., shall be implemented to reduce potential losses from both nonpayment and fraud. Amounts remaining unpaid for 60 days after one followup notice shall be removed from the file and retained for analysis purposes but shall not be considered an uncollectible billing. 6532.7 - Sale of Maps. 1. Deposit of Proceeds. Proceeds from map sales shall be deposited to Management Code 897999. The Regional Office shall withdraw the funds at least annually and/or whenever needed. These funds shall be used to reprint, update and distribute maps. A portion of these proceeds shall be returned to the units to help offset distribution costs. No distribution costs shall be returned to units for the sales of maps at wholesale. 2. Selling Procedures. To maintain proper collection control on receipts, record the map sales on Form FS-6500-115, Daily Record of Permit Sales (exhibit 02). Enter each map sale currently as it is sold. Units using a cash register are permitted to use the cash register tape as documentation in lieu of entering each map. The amount column shall be totaled and the balance cross-checked to the total quantity sold times (x) $3 (or price of map) whenever preparing Form FS-650089, Bill for Collection. See exhibit 01 for preparation of Form FS-6500-115. Map sales can be reported on the same FS-6500-89 transmitting recreation permit sales. The Collection Officers shall follow the instructions in FSH 6509.14, Section 030, Item 5, for transmittal of cash and remittances to the District Collection Officer and Unit Collection Clerk in the Forest Supervisor's Office. Goods or services valued at less than $25 may be furnished in advance of payment when it is cost-effective to do so. Mail-in requests for maps are one example where such a practice would be appropriate. See FSM 2336 for map sales policy. 3. Collection Officer Designation. Employees who sell maps must be designated as Collection Officers in accordance with FSM 6535. Collections shall be handled in accordance with FSH 6509.14, Collection Officer Handbook, Sections 030 and 040. R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 3 of 16 4. Collection Officer Files. Each office which handles map sales shall maintain a file for each Collection Officer containing: (1) Collection Officer letter of designation; (2) Copies of Form FS-6500-89 (see FSH 6509.14, section 170, item 2) and related Form FS-6500-115; (3) audit reports, and (4) related correspondence. Each Forest Supervisor's Office shall maintain a file for each Collection Officer on the unit containing (1) Collection Officer letter of designation; (2) audit reports; (3) related correspondence. 5. Audits. Audits of the map sales activity shall be performed within the first 30 days after Collection Officer designation and then annually by December 31. The auditor shall verify that the collection transmitted equals the sales documented on For, FS-6500-115. Use Form FS-6500-116, Recreation Permit Audit Report, section B and C, to document the audit. The applicable line enumerated on the reverse side of the form should be reviewed. 6. Administrative Use of Maps. A certain number of maps can continue to be given free of charge to individuals when in connection with official business or administrative use. For example, if a map is required as part of a permit, or is needed by a specific cooperator or to accomplish a given task, the map is an "administrative" map. Such maps shall be stamped "For Official Use Only - Not For Sale." 7. Map Inventory Control. Storage areas should be adequately secured to prevent theft. Forest Map Inventory Control procedures must be established to provide for the following: a. Continuous physical inventory of number of maps in stock. b. Prevent map supplies from becoming depleted beyond Forest's anticipated future 6-month supply needs. c. Allow the Forests ample time to submit a letter request to the Regional Forester indicating the total quantity of maps to be reprinted, including destinations and quantities. For planning purposes, allow a minimum of 6 months for delivery of reprinted maps following your letter request. In addition, an annual inventory report shall be completed by December 31 for each National Forest or Grassland map stocked, based upon maps sold compared to the maps purchased and current inventories. If significant discrepancies are noted, the unit map sales program shall be reviewed in depth for any inherent weaknesses or irregularities. Submit copies to the Public Affairs Office. See exhibit 03 for a sample inventory record. The use of a separate Administrative Use Map column depends upon whether a separate batch of maps are stamped initially for this purpose or whether they are stamped only when an Administrative Use Map is requested. If they are marked when given out only, then an entry to the number marked for Official Administrative Purpose block is sufficient. Auditors shall update the previous December 31 inventory reconciliations made by a unit as part of the Audit of Map Sales Collections. R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 4 of 16 6530.3 - Exhibit 01 United States Department of Agriculture Forest Service P.O. Box 25127 Lakewood, Colorado 80225 1630 Thank you for your request for National Forest Visitor and Wilderness maps. 1. / / Enclosed are the maps you requested. 2. / / The Forest Visitor and Wilderness maps are sold at a cost of $3.00 per map. If you will return your request with the correct amount due, we will fill your order. 3. / / Returned is your for $ . check, cash 4. / / The total cost of the map(s) you requested is $ . Please return your request with the correct amount due and we will fill your order. 5. / / The total cost for the map(s) you requested is $ . We have enclosed the map(s) covered by your remittance of $ . Please resubmit a request for the map(s) not received and send $3.00 for each map. 6. / / We are out of the resubmit your request after map(s) you requested. If you will days, we will try to fill your order. 7. / / Some/all of the maps you requested are not handled by our Forest/Region. National Forest (or Region) handles them. 8. / / The enclosed list contains the names and addresses of all the Regional Offices, and the Forests that have the maps. 9. / / The total cost for maps you requested is $ . We have enclosed the maps for a total amount of $ . We are temporarily out of the maps. They will be mailed to you when the maps are available unless we receive a written request from you for a refund of $ for the unavailable maps. Sincerely, R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 5 of 16 6530.3 - Exhibit 02 USDA-FOREST SERVICE 1. PERMIT NO. 2. PERMIT TITLE DAILY RECORD OF (Map Sales) PERMIT SALES 3. PERMIT 4. COLLECTION OFFICER (Ref FSH 6509.14) VALUE D. Jones DATE SERIAL NO. OR AMOUNT QUANTITY PERMITS EXPLANATION SOLD ON HAND 4/3/90 4/5/90 2 NF Maps $6.00 2 1 Wilderness 3.00 1 2 NF & 1 Wilderness 9.00 3 2 Wilderness 6.00 2 4 NF 12.00 4 Total $35.00 12 Transmittal on FS-6500-89 of 4/5/90 4/8/90 2 NF $6.00 2 4 Wilderness 12.00 4 3.00 1 4 NF/Wilderness 12.00 4 Total $33.00 11 4/10/90 1 NF Transmitted on FS-6500-89 4/10/90 GPO 874-581 FS-6500-115 (9/69) R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 6 of 16 6530.3 - Exhibit 03 MAP INVENTORY RECORD Inventory Beginning Inventory Number received and Date(s) July 16, 1989 July 28, 1989 Number Transferred to other Units Number Marked for Official Use Administrative Purposes Number Sold Number of Administrative Use Maps Given Out Ending Inventory (Book) on Hand 8/30 Ending Inventory (Physical) on Hand as of 8/30 # of Maps for Sale 500 Administrative Use Maps 1000 500 100 50 50 300 n/a n/a 10 1550 40 1545 40 Difference: (Give a Brief Explanation of Differences) Prepared by Name and Title Date R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 7 of 16 6533.3 - Date Payment is Due. Justifiable examples of Bills for Collection due date beyond 30 days from the date of issue: 1. Special use permit billings issued more than 30 days before the due date. 2. Billings for grazing may be issued more than 30 days in advance when necessary because of the volume of bills to be issued. The due date will be five days before the start of the grazing period the billing covers. 3. Unless otherwise provided by contract provision, timber payments are due within 15 days after the issuance date. The timber sale contract allows purchasers 15 days to pay the amount due. Timber purchasers make advance deposits or furnish payment bonds based on the projected value of timber to be cut within 30-60 days. Timber contracting officers shall be notified promptly when a timber payment becomes past due. 4. The Bill for Collection may be cancelled when, through compromise, the principal amount is changed in accordance with the delegated authority in FSM 6570.4. When this occurs, the original bill for both principal and all accrued late changes is cancelled, and a new bill is issued for the compromised amount, with a due date not more than 30 days from the date of the new billing. 6534 - DELINQUENT DEBTS. 6534.2 - Followup Billings. The Budget and Finance or Resources Sectionhead shall be responsible for initiating all followup action on delinquent debts. Each Forest should establish procedures and responsibility for notification and preparation of the followup billings. Special Instructions for Selected Types of Billing on Form FS-6500-89, Bill for Collection. Include in the initial demand letter the current interest rate that late payments are subject to and the Forest Service's Policy on charging interest, administrative charges, and a penalty charge. The exception to this requirement is when special laws or contractual provisions provide otherwise. See FSH 6509.11k, Sec. 72.22 for sample initial demand letter. In Region 2 we shall not follow the delinquent billing issuing date procedure shown in FSH 6509.11k, sec. 72.22 exhibits, which implies that the previous bill is cancelled each time a followup bill is issued. For followup billings, the due date for the original principal and the original Bill for Collection number shall remain the same. Interest and administrative charges pursuant to followup billings will be assigned a new bill number, and new issue and due dates. The followup bills shall reference the original bill number, principal, and purpose. In accordance with Federal Acquisition Regulations 52.232-17, the interest rate to be applied to all amounts payable by a contractor to the Government, including excess reprocurement costs, is the rate established by Treasury in section 12 of the Contract Disputes Act of 1978 (Prompt Payment Act Interest Rate). R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 8 of 16 All followup billings shall be accompanied by a demand letter. The final followup billing will include a statement of actions to be taken if payment is not received. Such actions include: reporting commercial and consumer delinquent debts to private collection agencies (FSH 6509.11k, sec. 72.42, R2 Supplement), collection by offset against money due from the Government, and referral to GAO or the Department of Justice for legal action. See FSH 6509.11k, sec. 72.4 for details. Interest is assessed on principal only, not on interest, administrative charges and penalties, except in those cases where a debtor has defaulted on a previous repayment agreement or a judgment has been obtained. Unless otherwise specified, interest will be calculated on a simple basis. 1. Resource Violations and Other Billings Due at Time of Issue. The following section applies to all delinquent debts that have resulted from resource violations (fire, timber trespass) and other debts that are due at time of Bill for Collection issue date, that are not covered in items 2 (Special Uses), 3 (Range), and 4 (Timber) following, and are not affected by other specific law or contract provisions. See FSH 6509.11k, sec. 72.22, for sample followup demand letter. a. The first followup billing (second billing) shall be sent to the debtor within 5 days of the original due date and shall include a computation of the late payment interest charge and administrative charge (FSM 6534.22c, R2 Supp). The interest shall be calculated from the date the debt was first due. In this case, that is the original issue date through the issue date of this billing. The new payment due date shall be 30 days after the first followup issue date. The reason the first followup billing includes interest is that there is an assumption that the debt was payable on the issue date. In other words, this was not an advance billing. Federal Claims Collection Standards, 4 CFR 102.13(g) provides that an Agency shall waive the collection of interest of debts which are paid within 30 days after the date on which interest began to accrue. With the exception of advance billings, the "date on which interest began to accrue" is the Bill for Collection issue date. When computing the interest charge, use the higher of the Treasury current value of funds rate, otherwise known as the "Late Payment Overdue Debts" column on the WO interest rate notification, or the Prompt Payment interest rate in effect on the date the notice of the debt to the debtor (or the date the goods or services are provided, if later), unless a different rate is required by law or by contractual provision. Use the Prompt Payment Act interest rate for procurement contract billings. Assess interest in accordance with section 52.232-17 of the Federal Acquisition Regulations. b. The second followup billing (third billing) which shall be sent within 5 days of the first followup due date shall include a new computation of accrued late payment interest charge and an additional and second R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 9 of 16 administrative charge. Interest shall be calculated from the original issue date to the date of issue for the second followup billing. The new payment due date shall be 30 days after the second followup issue date. c. The third and final followup billing (fourth billing), which shall be sent within 5 days of the second followup due date, shall include a new computation of the accrued late payment interest charge and an additional third administrative charge, and a statement that a penalty charge (FSM 6534.22b) will be assessed. Interest shall be calculated from the original issue date to the date of issue for the third followup billing. The new payment due date shall be 30 days after the third followup issue date. If a bad debt remains unpaid, see FSM 6572.4 for further action. If a payment of the fees is received within 10 days of the due date and prior to any followup action by the Forest Service, the debt will be considered paid and no further followup action will be needed. For certain resource billings such as special uses and certain collection agreements, the due date shall correspond to the time when the user has been conveyed the privilege to use the resource. Because 4 CFR 102.13(b) prevents an Agency billing interest "before a bill is actually owed," and all debtors, except certain timber ones, are allowed a 30-day grace period from the original due date to pay without being assessed interest, no interest shall be included on the first followup billing for special uses, grazing permits, and other similar advance billings. 2. Special Use Permits and Other Advance Billings. Failure to pay fees by the original due date is cause for terminating the permit or disallowing an activity. Termination action shall be delayed until the permittee has been given an opportunity to cure the delinquency (FSM 2715.23). a. In accordance with FSH 2709.11, section 53-1, clause A-6, the following procedures apply: (1) The first followup billing (second billing) shall be issued within 5 days of the original due date and shall include an administrative charge (FSM 6534.22c, R2 supp). The new payment due date shall be 30 days after the first followup issue date. Interest will begin to accrue from the date the debt originally becomes due (FSM 6534.22a and 4 CFR 102.14(b)). The interest charge, however, will not be shown on the first followup billing. In accordance with the Debt Collection Act and 4 CFR 102.13(g), interest shall be waived if the permittee pays the fees within 30 days of the original due date or when the debt becomes due, whichever is later. The new due date shall be 30 days after the first followup issue date. (2) The second followup billing (third billing) shall be issued within 5 days of the first followup due date and include a computation of the accrued interest charge and additional and second administrative charge. Interest begins to accrue from the date the billing originally became due R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 10 of 16 through the second followup billing issue date. If more than one permit is included in the same delinquent billing, apply the interest charge to each permit. Transmit this billing and the demand letter by certified mail. (FSM 27156.23a) The new payment due date shall be 30 days after the second followup billing issue date. (3) The third followup billing (fourth billing) shall be issued within 5 days of the second followup due date and include a computation of the accrued interest charge and an additional and third administrative charge. Interest begins to accrue from the date the billing originally became due through the third followup billing issue date. If more than one permit is included in the same delinquent billing, apply the interest charge to each permit. Transmit this billing by certified letter (FSM 2715.23a). The new payment due date shall be 30 days after the second followup billing issue date. (4) If full payment has not been received as specified by the third followup billing, prepare and transmit the termination letter (FSM 2715.23a). If the debt remains outstanding for more than 90 days, assess the penalty charge (FSM 6534.22b). b. For some special user permits that contain clauses other than the one provided in FSH 2709.11, section 53-1, clause A-6, the following procedures apply: (1) When payment has not been received by the original due date, assess the late payment service charge to all followup billings in accordance with the clause in the permit. (2) Include an administrative charge in the first and all other followup billings. This charge is in addition to item b(1), above. (3) If the permit is not terminated and the debt remains outstanding for more than 90 days, assess the penalty charge (FSM 6534.22b) in addition to items b(1) and b(2), above. c. If a special use permit does not contain any late payment clauses, apply the procedures as discussed in section a, above. d. When a permittee requests split payments, collect an administrative charge as part of the first bill to pay in advance for the cost associated with issuing a second bill. If more than two special use fee bills are requested, charge the administrative charge on each bill that will be followed by another bill. e. Late payment charges can only be waived in accordance with FSM 6570.43, 6572.3, 6572.4 and 4 CFR 102.13. If the delinquent debt does not fall within these regulations, then charges may not be waived. R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 11 of 16 f. When use of the land was made prior to the issuance of a permit, refer to FSM 2715.22b for guidance. g. If the permit is terminated and the debt remains uncollected, see FSH 6509.11k, sec. 72.4, for further direction. 3. Grazing Permits. The following procedures apply to all grazing permits. The original Bill for Collection shall be due 5 days before the animals are scheduled to enter the grazing area to allow for confirmation of payment before grazing begins. a. The first followup billing (second billing) shall be issued within 5 days of the original due date and shall include an administrative charge (FSM 6534.22c, R2 Supp). The new payment due date shall be 30 days after the first followup issue date, no grazing may take place until the payment has been made and confirmed by the Forest Service. A debt is considered delinquent when it is not paid by the due date on the Bill for Collection. If the due date is before grazing was scheduled, interest will be charged from the scheduled entrance date, not the due date. The delinquent date is NOT necessarily guided by the day grazing actually took place. This interest charge, however, will not be reflected on the first followup billing. Transmit this billing by letter (FSM 2231.62). In accordance with Term Grazing Permit for FS-2200-10 clause number 5, interest will not be charged if the permittee pays the fee within 30 days after the initial payment due date. b. The second followup (third billing) shall include a computation of the late payment interest charge and an additional administrative charge. Interest shall be calculated from the date the grazing was scheduled to begin until the date of issue of the second followup billing date. Transmit this billing by letter (FSM 2231.62). The new payment due date shall be 30 days after the second followup issue date. c. If full payment has not been received as specified in the second followup billing, prepare a new bill assessing the excess use rate. Cancel all previous accrued interest and administrative costs. See FSM 2230.5 and 2238.27. d. When a permittee requests split payments,m collect an administrative charge as part of the first bill to pay in advance for the cost associated with issuing a second bill. If more than two grazing fee bills are requested, charge an administrative charge on each bill that will be followed by another bill. e. If the permit is terminated and the debt remains uncollected, see FSM 6572.4 for further direction. 4. Timber Sale Contracts. For timber contracts, the payment due dates are based on the contract provisions and the Purchaser's operations. Sometimes the billings are issued several months in advance of the Purchaser's planned cutting R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 12 of 16 operations and, therefore, do not represent an outstanding debt, where interest is appropriate. Forest Fiscal Officers must consult with the Contracting Officer or their representative prior to issuing followup billings for interest and penalties. The Contracting Officer will also be taking appropriate contractual action to remedy the situation. For most timber sales, the first billing is issued manually for the initial deposits and bonds. Subsequent billings are issued by the automated Timber Sale Accounting System (ATSA). The ATSA System does not bill for interest and penalty charges. When payment is not received, manual followup billings shall be processed by the Forest. Timber sale contract late payments are handled differently than late payments governed by the Debt Collection Act and special use and grazing late payment provisions. Timber sale contracts have different interest charging provisions based on the date of the contract. For 2400-3(T) contracts refer to the specific contract provisions. The following are summaries of the different 2400-6(T) payment provisions that may be included in a particular timber sale contract: Provision B4.4 (9/73) - Interest will accrue on the unpaid amount at the rate of 6 percent per annum, compounded monthly, beginning 30 days after the end of the 15-day period allowed for payment and based on the number of days the bill remains unpaid. Compound interest is the interest resulting from the periodic addition of simple interest to principal, the new base thus established being the principal for the computation of interest for the next following period. No administrative charge allowed. Provision C4.4 and CT4.4 (2/76) - Interest will accrue on the unpaid amount at the rate of 6 percent per annum, compounded monthly, beginning 45 days after the initial billing date and based on the number of days the bill remains unpaid. No administrative charge allowed. Provision C4.4 and CT4.4 (3/80) - Interest shall accrue on the unpaid amount at the rate of three-fourths of 1 percent per month (9 percent per annum). Interest accrual will begin on the first day following the end of the 15-day period allowed for payment and will end on the date payment is received, and will be calculated on a daily basis. No administrative charge allowed. Provision C4.4 and CT4.4 (6/81 and 2/83) - Interest will accrue on the unpaid amount at the current TFRM (Treasury Fiscal Requirements Manual) rate for each 30 days or portion thereof after the end of the 15-day period allowed for payment. For timber sale billings with this clause, interest accrues on a daily rate from the due date to the date payment is received. No administrative charge allowed. Provision C4.4 and CT4.4 11/83) - Interest shall accrue on the unpaid amount billed at the current TFRM rate from the date of the bill issuance to the date payment is received. In addition a penalty charge of 6 percent of the principal R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 13 of 16 (excluding interest) shall be assessed on the 91st day that the bill is overdue. An administrative charge is allowed. Provision C4.4 and CT4. (1/84, 10/89 and 12/89) - Interest shall accrue on the unpaid amount at the current TFRM rate from the due date to the date payment is received. In addition, a penalty charge of 6 percent of the principal (excluding interest) shall be assessed on the 91st day that the bill is overdue. An administrative charge is allowed. If the payment has not been received by the original due date immediately notify the contracting officer for the sale that the payment has not been received. The Forest Service shall, in accordance with the specific contract, suspend all, or part, of the sale operations until the prescribed payment conditions are met. Remember that all timber and timber related proceeds are to be deposited in the Timber Sale Deposit Fund (TSDF). This includes sale proceeds, administrative charges, penalty and interest. See FSM 6534.23 for management codes for other than principal. a. First Followup Billing. The first followup billing shall be issued within 5 days after the original due date and in accordance with the payment provisions. It shall include an applicable administrative charge and interest form the due date to the date of issue. Note: provisions before 11/83 do not permit the Forest Service to charge an administrative charge. The due date shall be 30 days from the issue date. When the payment is received, calculate the interest according to the contract provisions. Assign the proceeds in the following order: to any penalty and administrative fees first, interest second, the remainder to the principal owed. If the remainder is less than or equal to the administrative charge, immediately send out a new Bill for Collection for the remaining principal. Allow 15 days for this Bill for Collection to be paid. b. Second Followup Billing (third Bill for Collection). Send the second followup billing within 5 days of the first followup due date and again notify the contracting officer for the sale of nonpayment. The second followup billing shall include an additional administrative charge and interest in accordance with the governing provisions, calculated from the first followup issue due date to the date of the second followup billing issue date. Note: Provisions before 11/83 do not permit the Forest Service to charge an administrative charge. The due date shall be 30 days from the second followup billing issue date. Assign the proceeds in the following order: to any penalty and administrative charges first, interest second, the remainder to the principal owed. If the remainder is less than or equal to the administrative charge, waive the amount. If it is greater than the administrative charge, immediately send out a new Bill for Collection for any remaining principal. Allow 15 days for this Bill for Collection to be paid. R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 14 of 16 c. Third and Final Followup Billing (fourth Bill for Collection). If the original principal has not been paid within 90 days of the initial due date, again notify the contracting officer for the sale and prepare a followup Bill for Collection. The third followup billing shall include an additional administrative charge and interest in accordance with the governing provisions, calculated form the second followup issue date to the date of the third followup billing issue date. Note: provisions before 11/83 do not permit the Forest Service to charge an administrative charge. If the permit is not terminated and remains outstanding for more than 90 days, assess the penalty charge (FSM 6534.22b). The due date shall be 30 days after the issue date of the third followup billing. Assign the proceeds in the following order: to any penalty and administrative charges first, interest second, the remainder to the principal owed. If the remainder is less than or equal to the administrative charge, waive the amount. If it is greater than the administrative charge, immediately send out another Bill for Collection for any remaining principal. Allow 15 days for this Bill for Collection to be paid. d. If the debt remains unpaid, see FSH 6509.11k, sec. 72.4, for further direction. 6534.22a - Late Payment Interest Charge. 1. The Treasury Interest rate referred to in the parent text is: 9 percent in CY 1984 and 1985, 8 percent in CY 1986, 7 percent in CY 1987, 6 percent in CY 1988, 7 percent in CY 1989, 8 percent in CY 1990, 8 percent in CY 1991, 6 percent in CY 1992. This rate is also referred to in various ways, such as the Quarterly Treasury interest rate, and TFRM (Treasury Fiscal Requirements Manual) rate, the rate prescribed in TFRM 6-8025-40 or quarterly TFRM bulletins, and the Treasury current value of funds rate in various contracts, permits, agreements, and other references. The other interest rate commonly used on delinquent accounts is the Prompt Payment Act (PPA) interest rate, which is also referred to as the Contract Disputes Act interest rate. The PPA rates are revised each 6 months and distributed by F&PS to units as soon as received from the Washington Office. In accordance with FSM 6572.22, apply the rate provided by the terms of contract, permit, agreement and so forth, but in the absence of direction therein, apply the higher of the two interest rates. 2. In accordance with FSH 6309.32, Federal Acquisitions Regulations, section 52.232-17, compute interest on delinquent procurement contract billings at simple R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 15 of 16 interest on the unpaid principal until paid. Use the Prompt Payment Act interest rate applicable to the period in which the amount becomes due, and then at the rate applicable for each 6-month period until the amount is paid. 3. See FSM 6572.22 for penalties, administrative charges and interest regarding State and local governments. 6534.22b - Penalty Payment. A penalty charge of 6 percent a year is required on any portion of an applicable debt that is delinquent for more than 90 days. The definition of delinquent, as contained in 4 CFR 101.2, is: "A debt is considered 'delinquent' if it has not been paid by the date specified on the agency's initial written notification.....or applicable contractual agreement, unless other satisfactory payment arrangements have been made by that date, or if, at any time thereafter, the debtor fails to satisfy obligations under a payment agreement with the creditor agency." 6534.22c - Administrative Charges. The amount of $35 is established as the rate to be charged for administrative costs in Region 2 related to preparing follow-up billings, demand letters, debtor request for multiple billings, and other incidental costs resulting from delinquent debts. The administrative cost will be assessed and included in each follow-up billing as long as the collection effort continues. The $35 administrative charge shall be used except: When a higher rate is justified (FSH 6509.11k, 72.53(3)). When another rate is prescribed by contract or permit. 6534.5 - Authorized Schedule Payment of Delinquent Accounts. If a debtor is unable to pay a debt in one lump sum, request the debtor to complete Financial Statement of Debtor, form FS-6500-40. Interest may be waived on claims for the Government if there is no indication of fault or lack of good faith on the part of the debtor and the amount of interest is large enough in relation to the size of the installments that the principal amount of the debt will never be repaid. See FSH 6509.11k, sec. 72.47, for details regarding installment payments. 6535.21 - Designating Collection Officers. 2. The Director, Management Systems and Administration, or the Assistant Director, Fiscal and Public Safety Group or his designated Acting, is hereby authorized to designate Regional Office collection officers, collection clerks and alternates. All designations of collection officer, collection clerks and alternates for the Forests are within the Forest Supervisor's authority. Include the following paragraph in the designation letter as shown in the sample letter (exhibit 01) in the parent text: R2 SUPPLEMENT 6500-92-4 EFFECTIVE 10/1/92 6530 Page 16 of 16 You are responsible for handling all funds collected in accordance with Forest Service Manual and Handbook instructions. Refer to FSM 6530, particularly 6530.2 through 6530.5, regarding Objectives, Policy, Responsibility, and Definitions; all section of FSH 6509.14; and pertinent portions of FSM 6507.