TITLE 6500 - FINANCE AND ACCOUNTING 9/82 R-1 SUPPLEMENT 265

advertisement

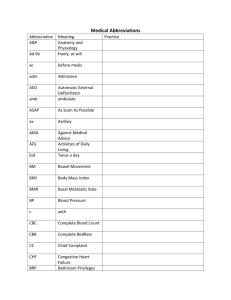

TITLE 6500 - FINANCE AND ACCOUNTING 9/82 R-1 SUPPLEMENT 265 6585.33 - Subsistence Service Accounting Procedures Regional policy requires subsistence facilities be operated through the WCF except in the following circumstances: -When activity devotes most of its resources to the service of one program, with little or no service to other Forest Service programs; and when cnservation center and Job Corps mess operations are an extension of the program for which it provides services and costs of meals will be charged to the benefiting program. Mixed financing will never be used at a single camp location. -Government subsidized meals (WCF or project) will not be provided when commercial facilities are available. -In fire emergency, meals may not be contracted at commercial facilities. This should not be interpreted to preclude contracting meals in lieu of WCF mess. -When WCF facility is located at or near a major fire area, the facility will remain financed from WCF and the prescribed records and rates will apply. If the situation requires additional people, those people should be hired under regular appointment and paid out of WCF. 2. Subsistence Inventories. Inventories will be taken monthly during the operating period and forwarded to the Supervisor's Office for pricing. The total Forest inventory value shall be reported to Administration by letter on March 1 and September 1. Supplies taken from WCF facilities for use in temporary fire camps will be priced on a Form AD-742 charging FFF and crediting WCF. If fire supplies become surplus and can be used economically by WCF, they must be capitalized in WCF by journal voucher, debiting function 652 (MC905652), Stock Received Without Reimbursement, and crediting function 351 (MC905351), Donated Capital. A charge to WCF and a credit to FFF is prohibited. 4. Deductions and Billings for Meals a. Deductions for Meals (1) Rates. The Region 1 employee meal deduction will be reviewed annually by the WCF Financial Manager. Deductions for meals will be treated as reimbursements to the applicable appropriation rather than appropriation refunds. Refer to (4)d of this supplement for current meals deduction rates. (2) Except where existing contracts specify otherwise, contractors and others who are required to reimburse the Government for meals consumed in a Government mess will be charged the same rate as our own appropriations. This will be the same rate as established for the unit involved. Where contracts specifically state the amount to be charged, WCF will still receive the billing rate amount. Any excess or deficit will be absorbed by the project paying for the contracted service. (3) Meals Furnished on Weekends and Holidays. Adjustments in meal rates will not be made during short absences from the camp over weekends, holidays, or lieu days. Generally, the cook prepares a considerable portion of the food for employees before leaving, and employees are not required to spend an appreciable amount of time preparing their own meals. (4) Furnishing Fewer than Three Meals a Day. Forest Service mess operations are conducted to facilitate most effective accomplishment of project work or program objectives. Whenever a mess operation (either Forest Service or contract) is established, employees are expected to take their meals there regularly during the workweek unless other arrangements are administratively approved. Employees will give their supervisor at least 4 hours advance notice of any departures from regularly established meal schedules or authorized absence at mealtime. Failure to give such notification will result in charges for meals prepared but not eaten. If an employee, due to his work schedule or by advance approval, obtains one or more meals at home or elsewhere, he will be charged only for the actual meals taken in a Government camp. (5) Furnishing Meals at Facilities for Job Corps Enrollees or Staff. Separate meal records will be maintained for Job Corps personnel eating at WCF facilities. Copies of these records will be transmitted to the individual's payrolling unit to facilitate processing of timeslips and travel vouchers. (a) Enrollees - The full cost of meals eaten by enrollees will be charged to the benefiting program. Reimbursement to the WCF will be accomplished by Form AD-742 adjustment as described in B.(2) of this supplement. (b) Job Corps Staff - Job Corps Staff personnel will be charged the established Regional meal deduction rate if the individual is not in a travel status. All meals must be entered on the employee's time and attendance report with the applicable meal code as described in B(4) of this supplement. If the individual is in travel status, the standard per diem rate deduction shall be used on the individual's travel voucher for each meal eaten. (6) Policy Regarding Meals Furnished at the Aerial Fire Depot WCF Mess Operation. (a) Cash collections will not be made for meals served to Government employees eating at this facility. Meals will be processed through the automated payment procedure for employees assigned to the AFD or by reduction in per diem for employees in a travel status. (b) Under no circumstanaces will free meals be provided at this facility. (c) Non-travel Status Meals 1. Season employees whose duty station is the AFD will be charged the established Regional deduction rate for all meals eaten in this facility. 2. All regular Government employees or seasonal employees not covered by item 1 will be charged the full meal cost for meals eaten. An exception may be made by the work leader, AFD, when assignments extend beyond the regular tour of duty or it is administratively determined to be advantageous to the Government to provide meals, in which case employees will be charged the established Regional deduction rate and the benefiting program will pay the balance. B. Billings for WCF Meals: (1) Home Forest Employees (a) Nontravel Status. Meals eaten in per diem or subsistence in lieu of status will be recorded on the employee's timeslip with the applicable meal code (ref. (4)d). These meals will be processed automatically through the accounting system. (b) Meals in a Travel Status. Meals eaten in per diem or subsistence in lieu of status will be recorded on lthe employee's timeslip using meal code 01 or 02. WCF will be reimbursed for 01 meals by processing an Ad-742 adjustment charging the benefiting program and crediting the appropriate WCF Income Account. (c) Casual Employees. Meals eaten by casual employees in WCF Mess Operations require a 742 adjustment charging the benefiting program and crediting income to WCF at the full meal cost. (2) Meals Furnished Personnel Assigned to Other Units Within the Region (a) Billing Unit. Complete the Collections Section of form AD-742 using Bill No., and Fund Code of appropriate Collecting Unit. Submit original and one copy of AD-742 along with copy of 6500-120 to Billed Unit. Submit two copies of AD-742 to Collecting Unit, if other than subsistence unit. (b) Billed Unit. complete Disbursements Section of Ad-742 and forward original to NFC for processing. Posting employee's timeslip with MODE Code is optional. (3) Meals Furnished Personnel Assigned to Other Regions/Other Federal Agencies. Prepare 6500-120 for each Region, Agency to be charged. Bill on an SF-1080, Ad-742, or SF1081, as appropriate. (4) Meals Furnished Cooperators, Contractors, etc. (a) Cash Collection. When contracts do not provide for Government-furnished meals or for a reduction in contract payments for meals eaten, the full meal cost will be charged to the individual supported by bill for collection prepared by collection officer and funds deposited to the WCF, account 905444. (b) Contract Adjustment. when the contract provides for adjustments for meals the unit will prepare AD-742 charging the benefiting appropriation and collecting income into WCF, management code No. 905444. A copy of the 6500-120 meal record will be sent to Contracting for deduction from the contract payment. (c) Contract Meal Provided. When no reduction on contract payment is required, unit will prepare AD-742 as above with no copy to Contracting. (d) Regional Meal Codes . The following code numbers will be used to identify meal payroll deductions rates at WCF and project mess operations. Under PAMARS, only odd number meal codes will be used by WCF and even numbered meal codes will be used on project subsistence operations. MODE CODE PAYROLL DEDUCTION RATE Meals served personnel in a travel status or on subsistence in lieu of per diem. WCF operation 01 none Meals served personnel in a travel status or on subsistence in lieu of per diem. Project yperation. 02 none Meals served Job Corps, YCC, and YCC staff personnel at official station. Project operation. 1/ 1/ Meals served at camps without cooks. WCF operation. 53 2.00 Meals served at camps without cooks. Project 54 2.00 Meals served at AFD employees assigned to Unit 52 where employee pays full meal cost. 74 75 3.00 3.00 DESCRIPTION 1/ The meal deduction rate is established annually by unit based on cost analysis. Refer to FSH 6109.36, page 317, Mode Time and Attendance Handbook, for the proper Mode Code to be entered on the employee's time and attendance report.