Document 10550671

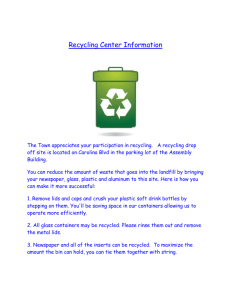

advertisement