The American Taxpayer Relief Act of 2012 Fact Sheet

advertisement

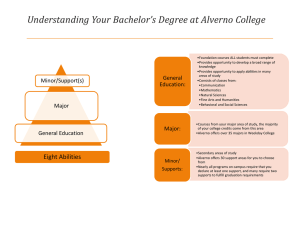

The American Taxpayer Relief Act of 2012 Fact Sheet Congress passed the American Taxpayer Relief Act of 2012 on January 1, 2013—perhaps a day late, but not a moment too soon. The wide-ranging tax law affects taxpayers in a variety of ways, and there are important new features on charitable giving donors should keep in mind—including the IRA Charitable Rollover. Here are some of the key items included in the new law: • The top tax rate is 39.6% for income over $400,000 (for singles) or $450,000 (for married couples) • The income tax “marriage penalty” is addressed through widening the 15% income tax bracket and increasing the standard deduction for married taxpayers filing jointly • Capital gains and qualified dividends have a higher top tax rate of 20% for higherincome taxpayers • The payroll tax cut was left out of the new law, which means the social security tax rate returns to 6.2% this year 2 • Several tax credits are extended, such as the child tax credit, the adoption credit and the American Opportunity Tax Credit • Certain deductions are extended, such as the option to deduct state and local sales tax (rather than the income tax) and the abovethe-line deduction for tuition and related expenses • Both the phase-out of personal exemptions and the limitation on itemized deductions (“Pease limitation”) are back • The exemption amounts for the Alternative Minimum Tax (“AMT”) are increased and set to rise with inflation from year to year (finally—a permanent AMT fix) • The top tax rate for estates, gifts and generation-skipping transfers rises from 35% to 40% (though the applicable exclusion amount of approximately $5 million remains the same, as does the option of portability for the unused applicable exclusion amount of a deceased spouse) • The enhanced deduction rules for contributions of real property for conservation purposes are kept in place • The IRA Charitable Rollover is extended through 2013, allowing someone age 70 1⁄2 or older to direct a distribution straight from an IRA to a charity as a gift without including the distribution amount on federal income tax returns Plus, there are two temporary rules to help eligible donors interested in the IRA Charitable Rollover: • If a donor took an IRA distribution in December 2012, the donor can make a cash donation up to that distribution amount before February 1, 2013, and treat it like an IRA Charitable Rollover (which excludes it from their 2012 income) • If a donor completes an IRA Charitable Rollover during January 2013, the distribution will be considered done on December 31, 2012 In sum, the new tax law looks a lot like the old tax law, except that higher-income taxpayers will pay more as a result of increased rates and dampers on the ability to take deductions and personal exemptions. But, unlike other recent major tax legislation, many of these provisions are permanent in nature. Be sure to discuss the changes with your accountant or tax advisor, and keep charitable giving in mind as a way to match your personal planning with your philanthropic goals. Alverno College Figures in our examples are based on average interest rates, and may be different at the time of a gift. Tax information provided herein is not intended as tax or legal advice and cannot be relied on to avoid statutory penalties. Always check with your tax and financial advisors before implementing any gift. ATRA0113 Carol Wacker, CFRE Office of Advancement Alverno College P.O. Box 343922 Milwaukee, Wisconsin 53234-3922 414-382-6468 Carol.wacker@alverno.edu www.alverno.edu The American Taxpayer Relief Act of 2012 — FACT SHEET