EMERGING ISSUES IN FOREST ECONOMICS

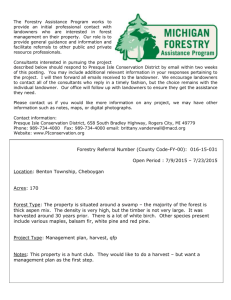

advertisement