TD United Nations Conference on Trade and

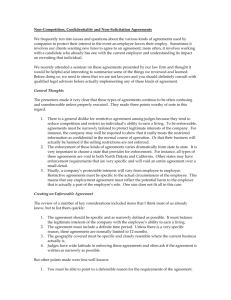

advertisement