Product Development Processes and Their Importance to Organizational Capabilities

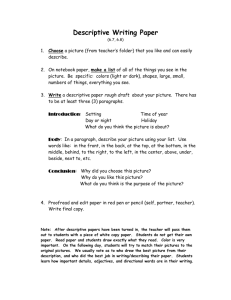

advertisement