THE POWER CENTER:

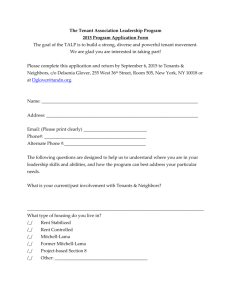

advertisement