TILEC Annual Report 2008

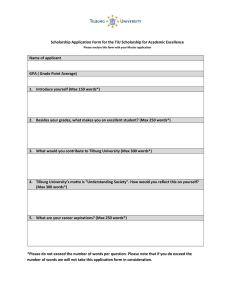

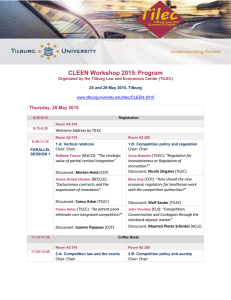

advertisement