Firms and the Economics of Skilled Immigration

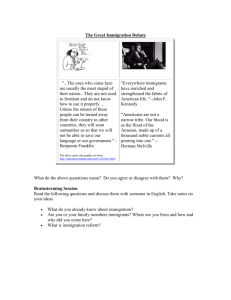

advertisement