Is The Hardwood Market on The Rebound, Maybe then Maybe Not

advertisement

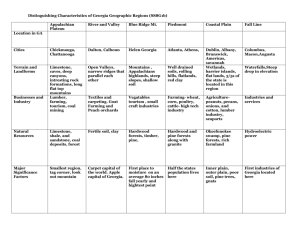

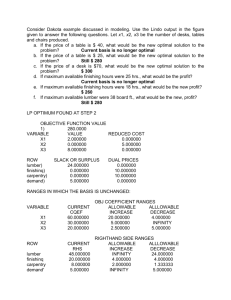

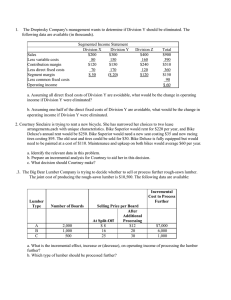

Is The Hardwood Market on The Rebound, Maybe then Maybe Not William Luppold USDA Forest Service, Princeton, WV Opening Statement • Hardwood lumber production has decline by 40 percent between 1999 and 2010 and has only increased modestly since then • We have permanently lost as much as a third of our hardwood lumber production capacity in the last 5 years – Liquidated or abandon • Demand in the first half of 2010 looked promising but started to decline in late 2010 and has continued to be poor -- except for --residue, crossties, pallet material, crane matts and exports 2400 1800 1200 600 0 Million board feet 3000 Consumption by Major Non-Industrial Users of Hardwood Lumber in 1977 Millwork Flooring Exports Cabinets Furniture 2400 1800 1200 600 0 Million board feet 3000 Consumption by Major Non-Industrial Users of Hardwood Lumber in 1997 Millwork Flooring Exports Cabinets Furniture 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Thousands of workers Non-Supervisory Employment in the Wood Household Furniture Industry 1990 to 2012 120 110 100 90 80 70 60 50 40 30 20 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Millions of 1982 dollars Wood Furniture Imports 1990 to 2012 7000 6000 5000 4000 3000 2000 1000 0 Europe N Am E Asia Other Housing Starts 1990 to 2005 Thousands of starts yearly 2,400 2,000 1,600 1,200 800 400 Non-Supervisory Employment in the Kitchen Cabinet Industry 1990 to 2005 140 Thousands of workers 130 120 110 100 90 80 70 60 1200 800 400 0 Million board feet 1600 Consumption by Major Non-Industrial Users of Hardwood Lumber in 2005 Millwork Flooring Exports Cabinets Furniture 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Thousands of starts yearly Housing Starts 1990 to 2012 2,400 2,000 1,600 1,200 800 400 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Thousands of workers On-Supervisory Employment in the Kitchen Cabinet Industry 2006 to 2012 150 140 130 120 110 100 90 80 70 60 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Millions of 1982 dollars Kitchen Cabinet Imports 1990 to 2012 500 450 400 350 300 250 200 150 100 50 0 Europe N Am E Asia Other 1200 800 400 0 Million board feet 1600 Consumption by Major Non-Industrial Users of Hardwood Lumber in 2005 Millwork Flooring Exports Cabinets Furniture 1200 800 400 0 Million board feet 1600 Consumption by Major Non-Industrial Users of Hardwood Lumber in 2009 Millwork Flooring Exports Cabinets Furniture Hardwood Lumber Consumption 1999, 2005, 2009, 2012 4500 Million board feet 4000 3500 3000 2500 2000 1500 1000 500 0 Flooring Funiture Cabinets Millwork 1999 2005 2009 Pallets 2012 Exports Crossties 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Million board feet Hardwood Lumber Exports 1990 to 2012 by Region 1400 1200 1000 800 600 400 200 0 Asia Europe N America Other The Percent of Hardwood Lumber Consumed for Industrial and Non-Industrial Applications User Group 1972 1982 1992 2002 Industrial 32% 40% 34% 37% NonIndustrial 68% 60% 66% 63% The Percent of Hardwood Lumber Consumed for Industrial and Industrial Applications User Group 2005 2006 2007 2008 2009 Industrial 41% 42% 44% 52% 60% NonIndustrial 59% 58% 56% 48% 40% The Percent of Hardwood Lumber Consumed for Industrial and Non-Industrial Applications User Group 2009 2010 2011 2012 Industrial 60% 58% 63% 61% NonIndustrial 40% 42% 37% 39% Pallets Cants Crossties #1C Lumber 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 Deflated price index winter 2000 = 100 Industrial Lumber Versus Grade Lumber Price Trends 130 120 110 100 90 80 70 60 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Deflated 1982 dollars Historic Trends for Deflated #1 Common Appalachian Hardwood Lumber Price 550 500 450 400 350 300 250 Eastern Hardwood Lumber Production 13000 Million board feet 12000 11000 10000 9000 8000 7000 6000 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Hardwood lumber production in Europe, Japan, North America, and China 1990 to 2011 14 10 8 6 4 2 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Billion board feet 12 Europe Japan N. America China Changes in 1C Lumber, Premium Log and Low Grade Log Prices Since the Mid 2000s Species Product Price high point Price low point Hard Maple 1C Lumber Spring 2006 Prime log Red Oak Black cherry % change high point and low point % change high point and fall 2011 Spring 2009 -45.7 -42.1 Fall 2006 Spring 2009 -43.0 -39.1 Low grade log Fall 2006 Fall 2008 -15.6 11.8 1C Lumber Spring 2004 Spring 2008 -42.2 -34.1 Prime log Spring 2004 Fall 2008 -43.8 -30.7 Low grade log Spring 2004 Fall 2008 -12.7 8.3 1C Lumber Fall 2004 Fall 2009 -60.3 -58.4 Prime log Spring 2004 Fall 2009 -50.3 -50.3 Low grade log Spring 2004 Fall 2009 -15.4 6.9 Eastern Hardwood Sawtimber Volume 1952 to 2011 1400 Billion Board Feet ¼” Int. 1300 1200 1100 1000 900 800 700 600 500 400 1952 1962 1977 1987 1997 2011 Growth of the Five Most Important Species Group 1963 to 2011 Species group Sawtimber volume 1963 (million bf) Sawtimber volume 2011 (million bf) Change between 1963 to 2011 Select W. Oaks 42,847 132,426 209.1% Select R. Oaks 35,020 116,009 231.3% Other R. Oaks 55,397 176,083 217.9% Soft Maple 19,216 108,154 462.8% Yellow-poplar 21,202 138,637 553.9% Utilization and Sustainability for Major Hardwood Species Groups Used in the North Species group Proportion of inventory Proportion of harvest Relative utilization Growth harvest ratio Hard Maple 15.6 19.8 1.26 2.07 Soft Maple 18.0 14.7 0.82 3.6 Cottonwood/ Aspen 7.0 12.5 1.79 1.62 Select R Oak 13.8 11.8 0.85 3.56 Utilization and Sustainability for Major Hardwood Species Groups Used in the South Species group Proportion of inventory Proportion of harvest Relative utilization Growth harvest ratio Other R Oaks 27.2% 34.7% 1.27 1.73 Sweetgum 13.9% 18.6% 1.34 1.58 Select W Oaks 9.9% 9.3% 0.94 2.48 The Near Term Outlook • • • • • A never ending stream of new regulations Rising energy prices Economic Uncertainty Continued consumer pessimism My crystal ball shows no rapid improvement in the economy Longer Term View • When the market for hardwood lumber picks up the greatest bottleneck will be loggers and truckers • The bad market has forced logger out of business and the remaining logger will be operating old equipment • Trucker that carried logs out of the woods have found employment in gas and oil drilling industry and probably will not return to log hauling Longer Term View • The shortage of loggers and truck drivers will most likely be less in states that have a large industrial product sector and no drilling • This means that New England will be in better shape than West Virginia and Pennsylvania once demand increases.