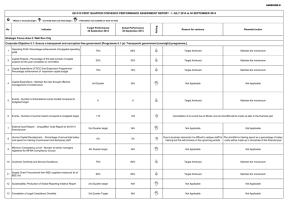

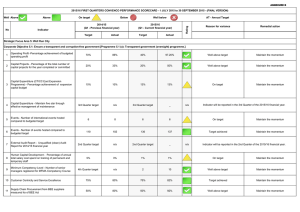

Annexure A Target Actual Status

advertisement

Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above Actual 2014/15 (current financial year) Target On target Actual Below Reason for variance Remedial action Status Well below AT - Annual Target An Opportunity City 1.A % of building plans approved within statutory timeframes (30-60days) 1. Impact of back-log cases migrated from IPOS. 2. Electronic circulation for comments to line departments. 3. System and operating consistency/reliability related issues. A comprehensive departmental action plans for the 8 Planning Districts. Responsible persons: Emil Schackenberg / Pieter Terblanche Due date: end January 2015 82% 83.64% 85% 75.1% 91% 80.23% 27.45% 27.03% R 1,8 bn R 2,2 bn R 0,62 bn R 1,10 bn 1.D % Spend on repairs and maintenance 100% 101.84% 43.70% 42.74% 1.E Number of outstanding valid applications for water services as expressed as a % of total number of billings for the service < 1% 1.01% < 1% 0.82% Well above target Maintain the Momentum 1.F Number of outstanding valid applications for sewerage services expressed as a % of total number of billings for the service < 1% 0.62% < 1% 0.58% Well above target Maintain the Momentum 1.G Number of outstanding valid applications for electricity services expressed as a % of total number of billings for the service < 1% 0.10% < 0.9% 0.14% Well above target Maintain the Momentum 1.H Number of outstanding valid applications for refuse collection service expresses as a % of total billings for the service < 1% 0% < 0.9% 0.01% Well above target Maintain the Momentum 37 500 38 305 18 000 19 680 Target achieved Maintain the Momentum The indicator has improved over the past three quarters and has only narrowly missed the December target. To calculate percentage non-revenue water (%NRW), NRW (the numerator) is divided by total water treated (the denominator). Total water treated (the denominator) declined significantly over the past year due to the successful implementation of water demand management strategies as well as wetter weather patterns experienced over this period. Future non-revenue water figures (water not billed) will be closely monitored. Well above target Maintain the Momentum 1.B % Spend of capital budget 1.C Rand value of capital invested in engineering infrastructure 1.I Number of Expanded Public Works programmes (EPWP) opportunities created 1.J Percentage of treated potable water not billed 20.20% 21.84% 20% 20.28% 1.K Number of passenger journeys on the MyCiti public transport system 5,3 million 7,7 million 3.6 million 7.6 million The actual is slightly below target of 27.45%. Even though the target was not achieved, the variance is not considered material at this stage. Well above target Maintain the Momentum The actual is slightly below target of 43.70%. Even though the target was not achieved, the variance is not considered material at this stage. 1 Responsible person: Peter Flower Due date: On-going Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above 1.L Percentage development of an Immovable property asset management framework Actual 2014/15 (current financial year) Target On target Actual Reason for variance Remedial action Status Below Well below AT - Annual Target 48.66% 48.66% 60.50% 60.50% Target achieved Maintain the Momentum 1.M Number of external trainee and bursary opportunities created 950 1 487 820 1 041 Well above target Maintain the Momentum >>>1.M(a) Number of external trainee & bursary opportunities (excluding apprentices) 700 1160 550 681 Well above target Maintain the Momentum >>>1.M(b) Number of apprentices 250 327 270 360 Well above target Maintain the Momentum 2.A Community satisfaction survey(Score 1-5)-safety & security 2.8 3.1 AT n/a 2.B Reduce number of accidents at 5 highest frequency intersections 367 178 174 36 A Safe City 2.C %Response times for fire incidents within 14mins 2.D Number of operational specialised units maintained 80% 14 83% 14 80% 14 77.40% 13 Annual target for reporting in the 4th quarter of the 2014/15 financial year _ Well above target Below the target due to the higher than normal December Monitor scenario on a continuous basis. incident response rate and minimum staffing levels. Vacancies and resignations of staff have contributed to the low staff level. Responsible person: Richard Bosman Due date: on-going Safety and Security Directorate have managed to successfully New target of 13 will be reflected in the next performance reporting cycle. maintain its number of specialised units without appointing additional resources. During December 2014, three of the specialised units were merged into a newly formed specialised unit i.e. the substance abuse unit, the tactical response unit and the K9 unit was merged into a specialised unit called the Gang and Drug Task team. So NEW target is now 13. Due to changes in the latest Project Steering committee approved project plan, the appointed service provider cannot realistically deliver the expected services before the end of June 2015, this therefore would impact our ability to spend the budget associated to these services and related progress. 2.E Percentage of SmartCop system implemented 15% 20.84% 30% Maintain the Momentum 6% In process to: 1) Negotiate with the service provider to get them to deliver more functionality before June 2015 period. 2) Negotiate parallel works streams that will ensure concurrent deliverables can be achieved during this period which will improve deliverables and ultimately increase project spend. 3) Agree on a revised project plan to take into account the delays faced in preceding months to ensure effective delivery of what is expected by June 2015 Responsible person: Richard Bosman Due date: end June 2015 2 Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above Actual 2014/15 (current financial year) Target On target Actual Reason for variance Remedial action Status Below Well below AT - Annual Target 2.F Percentage staff successfully completing occupational specific training interventions 70% 73.28% 30% 73.05% Well above target Maintain the Momentum 2.G Percentage of Neighbourhood Watch satisfaction survey 60% 93.10% 40% 94.44% Well above target Maintain the Momentum 7 7 AT n/a 40 40 40 40 On target Maintain the Momentum 1 343 1. Sir Lowry's Pass Village: The Contractor's contract was cancelled via Supply Chain Management and Legal Services processes. A New Contractor will be appointed, however, due diligence checks are being conducted as per SCM regulations. 2. BOSASA: Community protest action brought the project to a halt. All attempts at finding a solution met with failure and an alternative i.e. Security Guards will be moved on site. 1. As soon as the due diligence checks has been completed the contractor will move on site. 2.A Security Company has been appointed to form a security ring around the project and they will move on site within the next two weeks. 2. Security measures on the Bosasa project will be escalated and an application for funding from the Special Operating Account(SOA) to the MEC will be submitted. A Caring City 3.A No of social development programs implemented (AT) 3.B No of recreation hubs where activities are held on a minimum 5 days a week Annual target for reporting in the 4th quarter of the 2014/15 financial year _ 3.C No of housing opportunities provided per year Serviced sites 4 400 5 718 2 650 Responsible person: Norah Walker and Johan Gerber Due date: 31 March 2015 Top structures 4 242 3 647 2 595 1 056 1. The People's Housing Projects are still delivering at a slow rate due to increased subsidy applications to Province. 2. Gangsterism is still hampering the Kleinvlei Project. 3. The Scottsdene Project is still experiencing a shortfall towards the construction of 191 Top Structures. 4. The BOSASA project is still being hamstrung by protesting community members. 1. The ED: Human Settlements and the Minister arranged a meeting to fast - track approvals which would attempt to resolve the issue. 2. Power Construction will be approached to deliver /- 800 units by the end of the financial year. 3. A Motivation for additional funding towards the Scottsdene Project will be submitted as soon as possible. 4. Security measures has been escalated i.e. a Security Company is to be contracted. Responsible Person: Norah Walker and Johan Gerber Due Date: 31 March 2015 Other (Community Residential Unit (CRU) upgrades and shared services provision to Reblocked Informal settlements and backyarders) A new Contractor has been appointed on an RFQ. Supply The Contractor will move on site as soon as the issue with SCM is Chain Management is in the process of resolving a discrepancy resolved. This will enable the project material to be sourced more in rates charged by the successful contractor. effectively. 4 641 2 048 2 150 692 Responsible Person: Norah Walker and Johan Gerber Due Date: 21 March 2015 3 Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above 3.D Number of Deeds of Sale Agreements signed with identified beneficiaries on transferrable rental units Actual 2014/15 (current financial year) Target On target 2 500 Actual Below 1 046 1 100 610 Reason for variance Remedial action Status Well below AT - Annual Target The uptake by qualifying tenants is still slow, however, progress Issues regarding the payment of the Administration - and Insurance is being made i.e. costs still need to be resolved i.e. a Report requesting additional funding 1. Total DoS signed by beneficiaries for the quarter: 459 to cover transfer costs is to be submitted soonest. 2. Total Registrations finalised: 61 Responsible person: Grace Blouw Due date: 31 March 2015 3.E Improve basic services Number of water services points (taps) provided 1 020 2 028 400 274 Installations in informal settlements are on track. Backyarder pilot projects have been completed and the responsibility for backyard taps and toilets installations has been transferred to Human Settlement. This transfer only realised after current targets had been approved. Taps installed in backyards are thus no longer included in W&S actual figures and the exclusion resulted in the target being missed. Revision of targets in process to adjust for the exclusion of the backyarder component. Installations in informal settlements are on track. Backyarder pilot projects have been completed and the responsibility for backyard taps and toilets installations has been transferred to Human Settlement. This transfer only realised after current targets had been approved. Taps installed in backyards are thus no longer included in W&S actual figures and the exclusion resulted in the target being missed. Revision of targets in process to adjust for the exclusion of the backyarder component. Responsible person: Pierre Maritz Due date: Target revision process to be finalised during the third quarter. Where possible the implementation plan will be revised to expedite the provision of full flush toilets, which require a more time consuming installation process. Responsible person: Pierre Maritz In addition, the sanitation rollout strategy has been revised to Due date: Target revision process to be finalised during the third quarter. focus on the provision of full flush toilets and with less emphasis on other sanitation technologies such as portable flush toilets. Full flush toilets are more time consuming to install resulting in slower progress towards the set target. Number of sanitation service points (toilets) provided 3 100 5 916 1 000 634 Percentage of informal settlements receiving a door-todoor refuse collection service 99% 99.73% 99% 99.74% Target achieved Maintain the Momentum 3.F Number of electricity subsidised connections installed 1 500 4 391 700 1 985 Well above target Maintain the Momentum 3.G Percentage compliance with drinking water quality standards 98% 99.83% 98% 99.78% Target achieved Maintain the Momentum 3.H Number of days when air pollution exceeds RSA Ambient Air Quality Standards < 25 0 < 25 1 Well above target Maintain the Momentum 3.I New Smear Positive TB Cure Rate 83% (Q2 2013) 83% 83% (Q4 2013) 81% The actual is slightly below target of 83%. Ongoing review of figures and monitoring of scenario. Even though the target was not achieved, the variance is not considered material at this stage. One has to take into account Responsible person: Executive Director, Manager: Specialised Health that each quarter represent different patient populations. and TB Project Manager Due date: On-going 4 Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above 3.J Number of New Clients screened at the Substance Abuse Outpatient Treatment Centres Actual 2014/15 (current financial year) Target On target Actual Reason for variance Remedial action Status Below Well below AT - Annual Target 1 520 1 621 786 926 Well above target Maintain the Momentum 100% 93.77% 100% 109.44% Target achieved Maintain the Momentum 3.1 3.2 n/a n/a 5.A Number of Municipal meetings open to the public 174 193 80 85 5.B Percentage of employees who are truly motivated and will go above and beyond the call of duty, as measured in a biennial Staff Engagement Survey (AT) 39% 34.60% n/a n/a _ Bi-annual target - Survey will be completed in the 2015/16 financial year 5.C Community satisfaction survey (Score 1 -5) - city wide (AT) 2.8 2.9 n/a n/a _ Annual target for reporting in the 4th quarter of the 2014/15 financial year An Inclusive City 4.A % Adherence to Citywide service standards external notifications 4.B Customer satisfaction survey community facilities (1-5 Likert) (AT) Annual target for reporting in the 4th quarter of the 2014/15 financial year _ A Well-Run City The positions in levels 1-3 are characterised by scarce skills categories in terms of senior management and leadership category. The City is not the only competitor for these skills and despite the City attraction strategy we are not always able to attract, appoint and retain designated groups at this level 5.D Percentage of people from employment equity target groups employed in the three highest levels of management in compliance with the City's approved employment equity plan (EE) 78% 5.E Percentage budget spent on implementation of Workplace Skills Plan (WSP) for the City 95% 96.85% Clean Audit _ 5.F Opinion of the Auditor General 5.G Opinion of independent rating agency Target achieved 65.55% 80% 66.23% Maintain the Momentum Continuous monitoring of this indicator. Coupled with the guiding EE presentations to all line Directorates, the City's Corporate Services Directorate is looking broadly at the City's attraction and retention strategies. Succession planning and identification of talent in the designated groups at lower levels and positioning them for identified senior positions is seriously considered and an on-going priority. Responsible person: Michael Siyolo Due date: On-going (end of the EE plan) High investment rating (subject to sovereign rating) High investment rating - Aa3 30% 30.54% Target achieved Maintain the Momentum Clean Audit Clean Audit for 2013/14 for 2013/14 Target achieved Maintain the Momentum High investment rating (subject to sovereign rating) Target achieved Maintain the Momentum High investment rating A1.za 5 Annexure A 2014/15 SECOND QUARTER CORPORATE PERFORMANCE SCORECARD (SDBIP) 1 JULY 2014 to 31 DECEMBER 2014 - (DRAFT VERSION) Perspectives, KPIs 2013/14 (previous financial year end) Target Well Above Above 5.H Ratio of cost coverage maintained 5.I Net Debtors to Annual Income [Ratio of outstanding service debtors to revenue actually received for services] 5.J Debt coverage by own billed revenue Actual 2014/15 (current financial year) Target On target Actual Below Reason for variance Remedial action Status Well below AT - Annual Target 2:1 2.17:1 2:1 1.11:1 Target achieved Maintain the Momentum 20.50% 19.90% 21.5% 14.40% Well above target Maintain the Momentum 2.5:1 4.13:1 2:1 4.71:1 Target achieved Maintain the Momentum 6