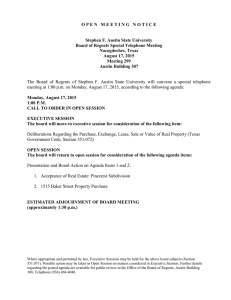

Stephen F. Austin State University M

advertisement