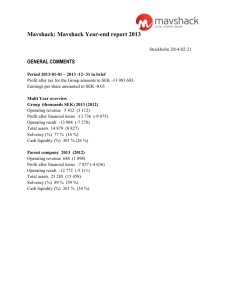

SCA Year-end Report Jan Åström 1 January–31 December 2005 President and CEO

advertisement

SCA Year-end Report 1 January–31 December 2005 Jan Åström President and CEO 1 Highlights Positive momentum remains Price increases in main segments towards the end of the year Realized savings from efficiency programs Successful product launches within Personal Care 2 Group – Quarterly Development* Improvements in H2 compared to H1 SEK M 18% 35,000 30,000 EBITDA (%) 15.0% 14.1% 13.7% 14.3% 14.3% 16% 14% 25,000 12% 20,000 10% 15,000 8% 10,000 23,128 22,518 23,986 24,740 25,141 6% 4% 5,000 2% 0 0% Q4 2004 * 3 Q1 2005 Excluding items affecting comparability Q2 2005 Q3 2005 Q4 2005 Sales EBITDA margin Financial Summary Excluding items affecting comparability* Net sales, SEK M Earnings after financial items, SEK M Earnings per share, SEK Dividend per share, SEK * 4 Q4 2005 Change Q4/Q3 (%) FY 2005 Change Y05/Y04 (%) 25,141 +2% 96,385 +7% 1,574 +2% 5,798 -19% 5:06 -6% 18:89 -15% 11:00* +5% Board proposal Earnings in the third quarter 2005 were affected by items affecting comparability of SEK 4,940 M before taxes and SEK 3,667 M after taxes. Earnings in FY 2005 were affected by items affecting comparability of SEK 5,365 M before taxes and SEK 3,981 M after taxes. In FY 2004 earnings were affected by items affecting comparability of SEK 600 M before taxes and SEK 41 M after taxes SCA Group Sales and EBIT* Q4 compared with Q3 2005 Sales SEK M 26,000 25,000 24,740 +110 +192 -79 +85 +93 25,141 Tissue Packaging Forest Products Other Sales Q4 24,000 23,000 22,000 Sales Q3 Personal Care EBIT* SEK M 2,000 1,937 +64 -49 Personal Care Tissue -26 +37 +12 1,975 Packaging Forest Products Other EBIT Q4 1,800 1,600 1,400 1,200 1,000 EBIT Q3 * 5 Excluding items affecting comparability SCA Group Sales and EBIT* FY 2005 compared with FY 2004 Sales SEK M 100,000 90,000 89,967 +1,588 Sales 2004 Personal Care +3,105 +858 +981 Tissue Packaging Forest Products -114 96,385 80,000 70,000 60,000 50,000 Sales 2005 EBIT* SEK M 10,000 Other 8,439 +45 -449 8,000 -829 +109 -22 7,293 6,000 4,000 2,000 EBIT 2004 * 6 Personal Care Excluding items affecting comparability Tissue Packaging Forest Products Other EBIT 2005 Energy Costs Significantly higher energy costs than expected in Q4 Energy cost increase of SEK 240 M in Q4 compared with Q3 Volatile gas and electricity markets in central Europe is the main explanation Updated energy cost estimates: Cost 2005: SEK ~5 bn Increase in Q1 2006 compared to Q4 2005: SEK 80-100 M Distribution of energy costs: electricity ~50%, natural gas ~50% Hedges in place for 2006: Natural gas: ~35%, electricity: ~50% 7 Cash Flow Analysis FY 2005 compared with FY 2004 Operating cash flow SEK 7.5 (8.8) bn Lower operating cash surplus Slightly increased current capex Improved change in working capital Increased cash outflow related to structural costs Cash flow before dividend SEK +1.8 (-6.3) bn Lower taxes paid No major acquisitions Debt equity ratio: 0.70 (0.63) 8 Personal Care – Quarterly Development SEK M 6,000 19.1% EBITDA (%) 17.6% 16.8% 17.1% 20% 17.7% 18% 5,000 16% 14% 4,000 12% 3,000 2,000 10% 4,568 4,462 4,727 5,026 5,136 8% 6% 4% 1,000 2% 0 0% Q4 2004 Q1 2005 Sales 9 Q2 2005 Q3 2005 EBITDA margin Q4 2005 Q4/Q3 comments: Cost savings realized Good volume development Personal Care Incontinence products Continued growth, especially within the retail segment Baby diapers Strong development of branded products Improved position and growth within retailers’ brands Feminine hygiene products Launch of new “secure fit” products in the beginning of 2006 10 Tissue – Quarterly Development SEK M 10,000 EBITDA (%) 12.4% 12.4% 11.8% 12.6% 14% 10% Impact from previous price increases in North America 8% Increased volumes 11.6% 12% 8,000 6,000 4,000 7,336 7,144 7,531 7,917 8,109 6% 4% 2,000 2% 0% 0 Q4 2004 Q1 2005 Sales 11 Q2 2005 Q3 2005 EBITDA margin Q4 2005 Q4/Q3 comments: Price increases (SEK 60 M) have partly offset the higher energy costs (SEK 120M) Tissue Consumer tissue Fair volume development in Western Europe. Strong growth in Eastern Europe and Russia Price increases in Europe under implementation, further impact in Q1 2006 New tissue machine in Valls, Spain decided AFH-tissue Europe: stable demand and extensive product launches in early 2006 North America: effects from increased prices in Q3 2005 12 Packaging – Quarterly Development SEK M EBITDA (%) 12,000 13.3% 14% 11.8% 11.4% 10.8% 10,000 10.2% 12% 10% 8,000 8% 6,000 6% 4,000 7,804 7,642 8,351 8,094 8,272 4% 2,000 2% 0 0% Q4 2004 Q1 2005 Q2 2005 Sales 13 Q4/Q3 comments: 16% 14,000 Q3 2005 EBITDA margin Q4 2005 Increased energy costs (SEK 90 M), partly offset by lower costs Rebuilding in the testliner mill in Aschaffenburg Packaging Corrugated board Higher prices within containerboard supports increased corrugated prices in H1 2006 European restructuring develops according to plan Strong growth in China Containerboard Price increases under implementation, EUR 40/ton realized in Q4, further increase of EUR 50/ton announced for Q1 North America Price increases and cost savings towards the end of the year have resulted in improved earnings 14 Forest Products – Quarterly Development SEK M EBITDA (%) 5,000 22.4% 21.0% 19.6% 4,000 18.4% 21.4% 20% 15% 3,000 2,000 3,814 3,762 4,116 3,986 4,071 10% 1,000 5% 0 0% Q4 2004 Q1 2005 Sales 15 25% Q2 2005 Q3 2005 EBITDA margin Q4 2005 Q4/Q3 comments: Higher prices for publication papers High capacity utilization in pulp, timber and solid-wood products Forest Products Improved performance within publication papers Strong development of German advertising market Increased mill efficiency Fair volume development Pulp, timber and solid-wood products Stable market for softwood pulp Increased prices on pine and high-quality spruce 16 Cash Flow Requirement for Value Creation SCA’s ongoing efficiency enhancement programs and current market conditions induce the need for a complementary cash flow requirement Based on SCA’s cash flow model the cash flow requirement is set at the level where the required return and accordingly value to shareholders is met. The EBITDA margin and return on book values is derived from the new cash flow requirement Cash flow requirement for value creation 2005 2006 Operating cash surplus 14.1 14.6 5.1 5.2 which implies: Cash flow from current operations* EBITDA-margin ROCE 9% ROE 8% *Adjusted for cash outflow related to restructuring 17 15% Summary Positive momentum remains Challenges in 2006 Leverage on our strategic strengths Consumer and customer insights Regional presence combined with global capabilities Excellence in production and supply chain Manage higher energy costs Attain targeted savings 18 19