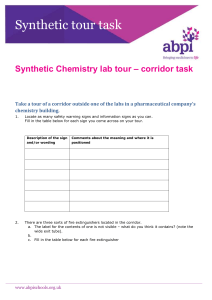

C - B

advertisement