Essay

advertisement

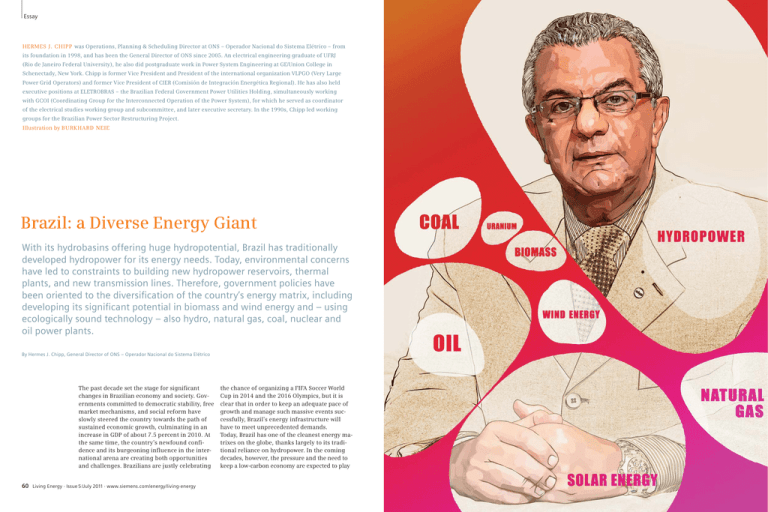

Essay HERMES J. CHIPP was Operations, Planning & Scheduling Director at ONS – Operador Nacional do Sistema Elétrico – from its foundation in 1998, and has been the General Director of ONS since 2005. An electrical engineering graduate of UFRJ (Rio de Janeiro Federal University), he also did postgraduate work in Power System Engineering at GE/Union College in Schenectady, New York. Chipp is former Vice President and President of the international organization VLPGO (Very Large Power Grid Operators) and former Vice President of CIER (Comisión de Integración Energética Regional). He has also held executive positions at ELETROBRAS – the Brazilian Federal Government Power Utilities Holding, simultaneously working with GCOI (Coordinating Group for the Interconnected Operation of the Power System), for which he served as coordinator of the electrical studies working group and subcommittee, and later executive secretary. In the 1990s, Chipp led working groups for the Brazilian Power Sector Restructuring Project. Illustration by BURKHARD NEIE Brazil: a Diverse Energy Giant With its hydrobasins offering huge hydropotential, Brazil has traditionally developed hydropower for its energy needs. Today, environmental concerns have led to constraints to building new hydropower reservoirs, thermal plants, and new transmission lines. Therefore, government policies have been oriented to the diversification of the country’s energy matrix, including developing its significant potential in biomass and wind energy and – using ecologically sound technology – also hydro, natural gas, coal, nuclear and oil power plants. By Hermes J. Chipp, General Director of ONS – Operador Nacional do Sistema Elétrico The past decade set the stage for significant changes in Brazilian economy and society. Governments committed to democratic stability, free market mechanisms, and social reform have slowly steered the country towards the path of sustained economic growth, culminating in an increase in GDP of about 7.5 percent in 2010. At the same time, the country’s newfound confidence and its burgeoning influence in the international arena are creating both opportunities and challenges. Brazilians are justly celebrating 60 Living Energy · Issue 5 /July 2011 · www.siemens.com/energy/living-energy the chance of organizing a FIFA Soccer World Cup in 2014 and the 2016 Olympics, but it is clear that in order to keep an adequate pace of growth and manage such massive events successfully, Brazil’s energy infrastructure will have to meet unprecedented demands. Today, Brazil has one of the cleanest energy matrixes on the globe, thanks largely to its traditional reliance on hydropower. In the coming decades, however, the pressure and the need to keep a low-carbon economy are expected to play Essay Facts & Figures Brazil is the largest Latin American country in land surface area, population (over 190 million people in the 2010 census), and GDP (US$2.18 trillion, although the per capita figure is just over US$11,000, similar to countries like Libya and Lithuania). It is the world’s seventh-largest economy in terms of purchasing power parity (PPP). Brazil’s economic size is naturally reflected in energy consumption: The country is the world’s tenth-largest energy consumer, and its fourth-largest carbon dioxide emitter. Most of those emissions (57.5 percent) come from deforestation, and are therefore relatively easy to mitigate. Emissions from agriculture come next (22.1 percent of the total amount), followed by energy emissions (16.4 percent). Annual inventories are not available – the data refers to 2005. The discovery and exploitation of hydrocarbon energy sources have increased dramatically in the last couple of decades. Brazil is now the 15th-largest oil producer in the world – in 2006, the national output was a little above 11.2 billion barrels. The country has become a net exporter of oil this year, but there are still some imports of light oil from the Middle East because of the infrastructure of certain refineries that are unsuited for the processing of the heavier oil found in Brazilian territory or territorial waters. Natural gas supplies, on the other hand, still have to be supplemented by imports from Bolivia and Argentina, for example. Coal reserves amount to about 30 billion tons. Also significant are Brazil’s uranium reserves – the sixth largest in the world, distributed across eight states. Despite this asset, plans for a greater share of nuclear power in the country’s energy matrix have been slow to materialize, and there is considerable public opposition to such an idea. a significant role in any country’s international standing, and all the more so in the case of Brazil. Juggling all of these sometimes conflicting demands will be a difficult balancing act, but one can be confident that Brazilian society will be able to pull it off. Energy generation and transmission will have to expand on a diverse and flexible basis, building upon the country’s current strengths without fear of innovation – of going into somewhat uncharted territory. The diversity of available natural and human resources in Brazil’s vast land mass can be harnessed in a way that may benefit both the economy and the environment. The development and strengthening of a biofuel portfolio has enjoyed much more support. With both the largest sugarcane crop and the biggest exports of ethanol in the word, Brazil has also developed the so-called “flex” technology, with which drivers can fill up their cars alternatively with gasoline and/or ethanol – even mixing the two fuels. The “flex” models of cars are now the default in most of the country. The refuse from the sugarcane industry is also showing promising results in biomass energy facilities, and there has been progress in the production of biodiesel and its incorporation in diesel from fossil sources. Natural-gas-fueled vehicles are also quite common. Solar and wind energy are still largely untapped, despite their huge potential in a country with Brazil’s climatic conditions. That will soon change dramatically, however. By 2015, while the relative participation of hydropower in the Brazilian energy matrix is set to decrease slightly from 79.3 percent to 71 percent, the presence of wind energy is expected to rise to 3.8 percent – almost the same proportion as that of oil in the current energy matrix and amounting to an increase from 3.9 to 7.3 percent. While the use of oil and coal is also expected to increase significantly – by 138 percent and 127 percent respectively – their relative shares compared to other energy sources would be just 7.3 percent and 2.3 percent, probably not enough to justify concerns of a “carbonizing” Brazilian energy matrix. Nonetheless, industry and academia are already discussing carbon storage and capture (CSS) schemes in connection with future thermoelectric facilities, although the costs are still a liability for any such mitigation measure. Rivers of Dreams Energy Generation by Source (MW and %) Hydro 2015 Hydro 79.3% 85,690 97,968 71.0% 1.5% Nuclear 2,007 8.9% 12,257 1.9% Nuclear Coal 2,007 8.6% 5.3% Gas/LNG 4.2% 3.9% Wind 826 0.8% 3.8% 7.3% 1.3% 1,415 Biomass 4,577 Oil 4,211 2.3% 3,205 Biomass 9,308 Coal Gas/LNG Wind 5,194 Oil 10,011 7,271 Source: ONS Annual Energy Planning – PEN – 2010/2015 Graphics: independent 2010 The predominance of hydropower in Brazil’s current energy matrix (it amounted to 79.3 percent of the country’s installed capacity last year and, by means of operations optimization, achieved a 90 percent average over the last decade) is natural enough when one looks at it in terms of Brazilian history, when the country’s economic powerhouse throughout the 19th and 20th centuries was initially exporting agricultural commodities, mainly coffee, and then going through a significant phase of industrialization. There are a dozen hydrobasins in the Brazilian Highlands suited for hydropower exploitation. In the late 1950s, Brazil accelerated its hydropower program, mainly in the southeastern and southern states, concentrated in the Grande, Paranaíba, Paraná and Iguaçú River Basins. Meanwhile, exploitation of the São Francisco River Basin, traversing part of the southeastern and most of the northeastern regions, was begun. Later, in the 1980s, exploitation of the Amazon River Basins began with the most easterly of them, the Tocantins River Basin. By that time, the Uruguay River Basin hydroplants were beginning to be built, as well as new plants with run-of-the-river capacity, in the mature basins. That is one of the main reasons why hydropower became such a fundamental part of Brazilian energy policy. Another reason, as we shall see, was the 1973 global oil crisis and the need for the country to wean itself away from hydrocarbon energy sources at a time when its oil production was just a small fraction of what it is today. A vigorous program of dam building ensued, culminating in the construction of the Itaipu Dam on the border between Paraguay and the Brazilian state of Paraná. Itaipu began operations in May 1984, and it is still the largest operating hydroelectric facility in the world in terms of annual generating capacity, 91.6 TWh in 2009. Itaipu and other large hydroelectric facilities built at the time had huge reservoirs. Flooding an extensive area of land was deemed necessary as insurance against the diminished levels of the dam’s water during the dry season (most of Brazil, as a rough approximation, can be said to have basically a dry season and a wet season, despite regional variability). Massive reservoirs help to provide a steady flow of water, which is crucial to a yearround capability for energy generation. Environmental concerns have changed, and the new generation of hydroelectric facilities in Brazil will follow suit. The backbone of the country’s energy system expansion is a network of plants in the Amazon region, two of which are already under construction in the Madeira River (the Santo Antônio and Jirau power plants), and one is planned “The diversity of natural and human resources in Brazil can be harnessed in a way that may benefit both the economy and the environment.” in the Xingu River (the Belo Monte power plant). Controversy with environmental and indigenous groups has surrounded the three projects, but there is no denying they are a dramatic improvement on the previous model, mainly because they are not based on the concept of huge water reservoirs. The Madeira River power plant dams are good examples of this new model. This means that those plants will need to flood just a little over 100 square kilometers of the Madeira flood plain, respectively. It is practically the same area that the river would naturally flood in the Amazonian wet season. That also applies in the case of the Tapajós-Teles Pires Basin, which will be the next to be exploited. Thus, the environmental advantages are obvious. In Short Reliable Heat In terms of cost, hydropower will continue to be the least expensive energy source in Brazil for quite some time, amounting to less than US$50 per MWh. There is a different price to pay in the new model for hydroelectric facilities, though. Their design involves a natural decrease in reliability of generation, especially when the rain season is not favorable and, of course, during the dry season. That is why a diversification of the Brazilian energy matrix, particularly with the thermoelectric facilities component, as well as other plants fueled by renewable sources, are key to the safety of the system as a whole. Fortunately, the country also has what could be fairly said to be a privileged position in that regard. In the last couple of decades, thanks largely to the efforts of the state company Petrobras, Brazil has achieved a major leap in its oil and natural gas production. With the exploration of the extremely deep presalt layer off the coast during this decade and the next, it’s fair to expect a much more comfortable situation in terms of fossil fuels supply for the foreseeable future. At the same time, a flourishing ethanol industry – building upon the tradition of sugarcane agriculture in the country and originally stimulated by the government as a means to further reduce the national reliance in hydrocarbon sources – has made Brazil a leader in biomass production. And it must not be forgotten that the southern state of Santa Catarina possesses important reserves of coal. All this is auspicious news for the reliability of the Brazilian energy system, if we manage to use thermoelectric facilities as a way to supple- Efficient Solutions for Unconventional Gas The subsea grid from Siemens: a safe, reliable, environmentally friendly solution for the oil and gas industry. Siemens Strengthens Position in Subsea Power Market Photo: XXXXXX Siemens “In terms of cost, hydropower will continue to be the least expensive energy source in Brazil for quite some time.” ment the low points of hydropower generation rationally. That could be done without making our energy matrix significantly dirtier (see Facts & Figures). Furthermore, the use of thermoelectric energy fired by renewable sources is promising when we look at the potential complementarity between biomass and hydropower. The sugarcane harvest goes from May to October – almost exactly coinciding with the dry season in most of the Brazilian territory, and particularly in the southeast, where energy demands are most exacting. Wind energy is another nearly untapped source in Brazil, with great potential to increase regional energy generation in a clean way. The vast Brazilian shore, particularly in the northeastern states, is at least theoretically in a better position to exploit wind power than most sites in Europe that are leaders in the field today. That has to do mainly with natural conditions that seem to make the Brazilian winds less prone to generate fluctuations in the power system’s production. In terms of price, the current tendencies indicate that wind power may soon become as competitive as thermoelectric energy. A challenge to this purpose is to integrate what we hope would be a diverse and flexible matrix in a national system that is both interconnected and able – for example under extreme climatic circumstances – to behave regionally in an independent way, so that disruptions will not swamp the entire system. To that end, huge advances in transmission (an increase of 36,000 kilometers in extra-high-voltage transmission lines – 230 kV and higher, or around 30 percent of the existing network – in just twelve years) are a major focus. Particularly significant for the Madeira power plants, and probably for the Belo Monte power plant interconnection to the main grid, is the use of DC transmission links, as well as the integration of the Itaipu power plant into the Brazilian grid. During the last few years, this very large, fast-growing transmission grid has been equipped with the so-called smart grid equipment and control systems, and no doubt this will be progressively implemented. Finally, it should be mentioned that the most important current challenges to the operation of the Brazilian power system are the integration of very geographically sparse renewable-energysourced power plants, the operation of the long, high-capacity DC links, and – last but not least – the linking, both legal and operational, of the Brazilian power system to those of neighboring countries, especially in the Southern Cone. Siemens has acquired Norwegian subsea specialists Bennex Group AS and Poseidon Group AS. Bennex develops and manufactures subsea components such as marinized cable connections for power supply to oil and gas production operations at depths of as much as 3,000 meters. Poseidon Group AS provides subsea marinization, engineering and consulting for companies in the oil and gas industry and is capable of marinizing existing Siemens equipment and technology to the subsea environment. The two companies posted combined revenues of €75 million in 2009. “Subsea processing is a fast-growing and technologically challenging market in the oil and gas industry,” says Tom Blades, CEO of the Siemens Oil and Gas Division. “With the acquisition of Poseidon and Bennex, we’re strengthening our portfolio and competence in subsea power grids.” Siemens anticipates that the subsea market will enjoy double-digit growth, especially in power grid applications, to become a multibillion market in 2020. Siemens has received an order to supply up to ten compressor trains to Australia Pacific LNG (APLNG) in Queensland, Australia, with delivery starting in early 2012. Each compressor train consists of two compressor skids, one low pressure and one high pressure. The trains are designed to transport about 84 million standard cubic feet of gas per day. The APLNG project involves the development of coal seam gas fields in south central Queensland over a 30-year period and includes construction of upstream gas-gathering and processing facilities as well as a 450-kilometer main transmission pipeline from the gas fields to the facility being built on Curtis Island near Gladstone, where it will be compressed and cooled into liquefied natural gas. Coal seam gas is a natural gas which is mainly composed of methane. It is a by-product of ancient plant matter that has formed over millions of years by the same natural processes which produce coal. Living Energy · Issue 5 /July 2011 · www.siemens.com/energy/living-energy 65