Alan Deardor¤’s Contributions on Trade and Growth Gene M. Grossman Princeton University

advertisement

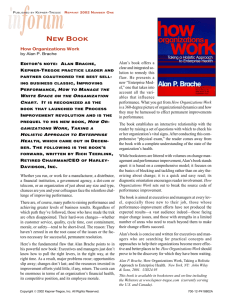

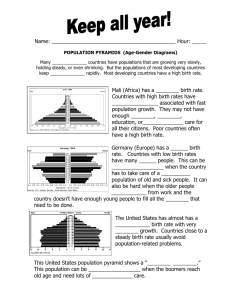

Alan Deardor¤’s Contributions on Trade and Growth Gene M. Grossman Princeton University September 2009 To be presented at Comparative Advantage, Economic Growth, and the Gains from Trade and Globalization: A Festschrift in Honor of Alan V. Deardor¤, sponsored by the Department of Economics and the Ford School of Public Policy at the University of Michigan. The festschrift will be held at the University of Michigan on October 2-3, 2009. 1 1 Introduction It has been a pleasure to re-read some of Alan Deardor¤’s papers on trade and growth, and to read others for the …rst time. These papers are typical of Alan’s work; they artfully tease new insights on important issues from simple, familiar models. It is …tting to begin my review with “A Geometry of Growth and Trade.” Alan loves diagrams and given his skill in developing them, it is easy to see why. His diagrammatic analyses are as incisive as any algebraic treatment and more pleasing to the eye. Deardor¤ (1974) provides a simple geometric tool for analyzing trade and growth in a small open Solovian economy. Consider a small economy that produces a single consumer good and a single investment good from two factors of production, capital and labor. For simplicity, take the labor force as …xed.1 Suppose that households save a constant fraction s of income and that capital depreciates at constant rate . In Figure 1, R (p; K) represents the revenue or national-product function for an economy facing world relative price p of the consumer good and having a stock of capital K. As is well known from microeconomic theory, a competitive economy maximizes the value of national output given prices. Therefore, the equilibrium allocation of capital and labor is such that R (p; K) is the economy’s national income. And, as is well known from trade theory, a two-sector economy facing a given relative price will specialize in producing the labor-intensive good when its capital stock is small, specialize in producing the capital-intensive good when its capital stock is large, and will produce both goods in an intermediate “cone of diversi…cation.”Therefore, the national-product function has two curved portions that depict the diminishing returns to capital when only one good is being produced, and a linear segment whose slope represents the constant marginal product of capital within the diversi…cation cone. With a constant savings propensity, sR (p; K) represents national savings, which fully …nances national investment in an economy that cannot borrow or lend internationally. The dashed line, K, represents aggregate deprecation, and the gap between the two is net investment. The capital stock grows when sR (p; K) exceeds K and shrinks when it is smaller. The intersection of the two curves depicts the steady state. The diagram readily yields predictions about the evolution of the trade pattern and about the e¤ects of changes in savings behavior or world prices on the growth path and the ultimate steady state. For example, an increase in the savings propensity leads to a larger steady-state stock of capital, more output of the capital-intensive good, and greater exports (or fewer imports) of that good. Deardor¤ (1974) employs the simple assumption that national savings is a constant fraction of national income. But a similar tool to his can be used to study transitional dynamics in an open economy with optimal savings behavior. Suppose the representative consumer allocates spending 1 The original paper incorporates constant, exogenous population growth by treating the capital-to-labor ratio as the state variable. 1 δK Savings R(p,K) sR(p,K) . K=sR(p,K)-δK K Figure 1: Two-Sector Solovian Trade and Growth to maximize an intertemporal utility function of the form2 Z 1 e ( t) log c ( ) d t where c ( ) is consumption at time and is a constant discount factor. Then, as is well known, the Euler equation implies E_ =i E ; (1) i.e., the households adjusts expenditure E = pc so that the rate of growth of spending is equal to the di¤erence between the interest rate and the discount rate. Capital is the only asset in the model and the investment good is numeraire, so the rate of interest i must equal the real return on capital net of depreciation; i.e., i = r (p; K) , where r (p; K) = @R=@K is the rental rate on capital. Finally, savings— which is the di¤erence between national income and spending— …nances net investment as in Deardor¤ (1974): K_ = R(p; K) E K. (2) Equations (1) and (2) can be used to construct a phase diagram that bears a strong similarity to the Deardor¤ diagram. In Figure 2, the K_ = 0 curve represents the equation E = R (p; K) K. The qualitative properties of this curve follow from those of the national-product function, which Deardor¤ has discussed. The E_ = 0 curve depicts the values of K and E such that r (p; K) = + . Two comments are in order about this curve. First, the level of spending E does not a¤ect anything in this equation, so the “curve” is in fact a vertical line. Second, the factor-price equalization theorem implies a single value of r for all values of K in the diversi…cation cone. If this value of r 2 It is easy to handle the case of a constant elasticity of intertemporal substitution; the text describes the special case where this elasticity is equal to one. 2 does not happen to equal + , as it generally will not for arbitrary p, then the E_ = 0 curve will not be located at any value of K in the diversi…cation cone. S E E=0 S K=0 K Figure 2: Two-Sector Neoclassical Trade and Growth The …gure shows the “arrows”of adjustment that apply to either side of each curve. It is readily seen that the system exhibits saddle-path stability. For given initial K, there is a single value of the initial level of spending that avoids K ! 0 and K ! 1 as time progresses. This initial value of E is the only one that allows for satisfaction of the intertemporal budget constraint and the transversality condition for optimization of lifetime utility. The economy approaches the steady state along the stable arm, denoted by SS in the …gure. The …gure can be used much as Deardor¤’s original diagram. It is easy to track the evolution of the trade pattern and to perform comparative statics with respect to changes in the discount rate or the international relative price. One conclusion di¤ers from that in the Solovian world: a small open economy with optimal savings and a constant discount rate is quite unlikely to remain incompletely specialized in the long run. I see several important substantive themes in Alan’s other writings on trade and growth that have gained traction in the more recent literature. First, trade may be harmful to a growing economy in some circumstances. Second, and related, an open economy may be trapped in poverty in a world with multiple steady states. Third, growth may be sustained by trade in a neoclassical economy that would be doomed to stagnation if it remained closed to international exchange. I take up each point in turn. In Deardor¤ (1973), Alan analyzed the e¤ects of trade on per capita consumption in steady state and in the approach to steady state. He considered an open economy capable of producing a single consumer good and a single investment good that saves a constant proportion of its income, as in Deardor¤ (1974). He proved, for example, that a small economy that saves in excess of the golden rule savings ratio will experience a reduction in steady-state consumption if the world relative price 3 of the consumption good is a bit above its autarky price.3 If its savings rate falls short of the golden rule savings ratio, then steady-state consumption falls with an opening to trade if the world relative price of the consumption good is a bit below the autarky price. Intuitively, steady-state consumption increases if a country starts in autarky with less investment than is needed on the margin to maintain a unit of capital and it exports the investment good, or if it starts with more capital than is needed on the margin to maintain a unit of capital and it imports the capital good. The paper also considers the e¤ects of trade on per capita consumption in the short run; that is, in the moments after an opening of trade. If trade causes the relative price of the consumption good to rise, thereby generating exports of this good, then per capita consumption will initially fall. If the relative price moves in the opposite direction and the country exports the investment good, per capita consumption will rise. This analysis su¤ers from two shortcomings. First, as Alan himself recognized, it is not typically optimal for households to consume a constant fraction of their current income. Alan thus relates his …ndings to the theory of the second best. But convincing second-best arguments that question the gains from trade usually refer to realistic market failures, not to empirically unsupported and somewhat arbitrary assumptions of sub-optimal behavior. Second, it is impossible to evaluate the welfare e¤ects of an opening of trade that induces short-run gains and long-run losses (or vice versa) without reference to some intertemporal utility function. The Solow model o¤ers no such utility function and therefore no metric for welfare comparisons. Subsequent to Deardor¤ (1973), Samuelson (1975) and Smith (1979, 1984) showed rigorously that a neoclassical economy with well-functioning markets always gains from trade when savings decisions derive from utility maximization, no matter what is the form of its intertemporal utility function. But the possibility of losses from trade has been emphasized in recent writings on trade and growth in non-neoclassical settings. Most common are models in which growth is driven by local knowledge spillovers. These can be spillovers in human capital accumulation, as in Lucas (1988) and Stokey (1991), or spillovers in the R&D process, as in Young (1993), Feenstra (1996) and Grossman and Helpman (1991, ch. 8; 1994). The idea is quite simple. Consider a two-sector economy, one in which technology is static and another in which technology can improve with the accumulation of human capital or knowledge. There are spillovers in the accumulation process that o¤set the private diminishing returns, so that growth can be sustained. In the autarky equilibrium, the economy is incompletely specialized and the ongoing activity in the dynamic sector ensures the continuing accumulation of knowledge. Although the autarky allocation of resources to the dynamic sector will be sub-optimally small in the absence of a Pigouvian subsidy that addresses the externality, growth is sustained. Now open the economy to trade and suppose that the country has a comparative disadvantage in the dynamic sector, either due to its relatively unsuitable resource endowments or to an initial disadvantage of history that gives its trade partner a technological head start. In either case, the opening of 3 The golden rule savings rate is the value of s that generates the golden rule capital-to-labor ratio as its steady state. The golden rule capital-to-labor ratio, in turn, is the value of K=L that makes the marginal product of capital equal to the sum of the population growth rate and the depreciation rate. 4 δK Savings R(p,K) sw(p,K) . K=sw(p,K)-δK K1 K2 K3 K4 K Figure 3: Multiple Steady States trade will cause the country to specialize relatively and perhaps fully in the industry with a static technology. Its growth in output will slow and perhaps cease as a result of trade. Even so, trade may be gainful, since the country will be able to import the good produced in the dynamic sector at a lower price than in autarky. But it is easy to construct examples where trade is harmful in these circumstances, for reasons to do with the theory of the second best. Inasmuch as the autarky equilibrium entails too little production of the dynamic good, if trade drives resources out of this industry it can generate losses by exacerbating a pre-existing distortion. Of course, losses from trade would not be possible if the opening of trade were accompanied by an appropriate Pigouvian subsidy to the externality-generating activity. Deardor¤ (2001) makes a related but di¤erent point, drawing on work by Galor (1996). He considers a neoclassical economy that potentially can produce three goods, one investment good and two consumption goods, with capital and labor. The industries di¤er in their factor intensities, so there are two cones of diversi…cation. Following Galor, he supposes that savings are approximately proportional to the wage bill, perhaps because their are overlapping generations and each generation earns capital income only in the last period of life, when it consumes all. Figure 3— analogous to Figure 1— shows the aggregate savings for this economy as a function of its capital stock. For low values of K, the economy is incompletely specialized and the wage bill rises as capital is accumulated. The region between K1 and K2 represents the …rst diversi…cation cone, where the country produces the two least capital-intensive goods. In this range, factors prices are insensitive to factor endowments, so the wage bill is constant, as is aggregate savings. Further capital accumulation leads to a range of specialization in the intermediate good, again with a rising wage bill, and then a second region of diversi…cation, for capital stocks between K3 and K4 . Finally, if capital were to accumulate beyond K4 , the economy would specialize in producing the most capital-intensive good, and savings would rise with K. As is clear from the …gure, this economy can have three distinct steady states, the …rst and third of which are locally stable. In other words, an economy such as this can get stuck in a “poverty 5 trap.”If it starts with a capital stock less than K1 and trades with an otherwise identical economy that begins with more capital, then it will accumulate capital until it reaches the …rst steady state, whereupon its growth will cease at a relatively low level of per capita income.4 Di¤erences in initial conditions are su¢ cient to generate long-run di¤erences in income and welfare for countries that are otherwise the same in terms of their technologies and savings behavior. This is an interesting …nding inasmuch as multiple equilibria are not common in neoclassical growth models. The allusion to an overlapping-generations setup is intriguing, as it seems possible to have a poverty trap together with fully optimal savings behavior and convex technologies. The potential for multiple equilibria among identical countries also arises in non-neoclassical settings. In fact, this possibility is quite natural in models with static or dynamic increasing returns to scale. Azariadis and Drazen (1990) o¤er an example with multiple steady states even in the closed economy. They consider an economy with “threshold externalities”; i.e., externalities generated by human capital that are relatively weak when the stock of human capital is small, but grow stronger as the skill level increases. In such a setting, an economy can get trapped in an equilibrium with low skills, despite the fact that it has the potential for sustained growth were it to somehow manage to escape the trap.5 Young (1993), Feenstra (1996), Grossman and Helpman (1991, ch.8) and others show the possibility for trade to generate permanent income (or growth rate) di¤erences between otherwise identical countries that di¤er in their initial levels of technological development. They consider an international equilibrium with trade between countries that di¤er only in their initial levels of technological development. Were the countries to remain closed, they would converge upon similar long-run steady state growth paths. However, with trade, the leading country gains an initial advantage in the more dynamic sector, and the advantage is perpetuated (or even extended) over time. In neoclassical growth models, diminishing returns to capital typically spell the stagnation of growth in per capita incomes as increases in the capital-to-labor ratio drive down the marginal return to investment. Growth need not peter out however, as Solow (1956) himself noted, if the return to capital is bounded from below. This idea of bounded long-run returns to capital has featured prominently in a branch of the literature on endogenous growth, where models with such features have been termed “AK models.”See, for example, Jones and Manuelli (1990) for an application to the open economy. However, many have questioned the plausibility of the assumption that marginal returns will be bounded from below as the capital-to-labor ratio grows inde…nitely. Deardor¤ (1994) was one of the …rst to point out that growth can be sustained in some circumstances in an open neoclassical economy even if the technology does not admit a lower bound on the return to capital. His explanation relies on cross-country di¤erences in population growth rates and the opportunities a¤orded by international investment.6 4 If the economy is large, the equilibrium prices may be changing in the transition, in which case the national income and aggregate savings curves will be shifting about. Nonetheless, the point remains that there can be multiple steady states and a stable equilibrium at a low level of national income. With more than three goods, the number steady states can increase. 5 One way out might be with a “big push,” as emphasized by Murphy, Shleifer and Vishny (1989). 6 Deardor¤ (1999) uses a similar framework to study the evolution of international inequality in per capita incomes. 6 Consider a pair of Solovian economies that each produce a single good. Let the population growth rates and the savings rates be exogenous and country speci…c. Alan refers to the country with the slower population growth as the North and the country with the larger population growth as the South. Technologies are such that both the North and the South with approach constant steady-levels of per capita income in their autarkic equilibria. But suppose now that the North can invest its savings in the South. Then, for some savings rates, it avoid the otherwise inevitable rise in the capital-to-labor ratio by making use of the ever-larger Southern labor force. When the North has slower population growth and a su¢ ciently large savings rate, per capita income in the North grows forever. For even larger Northern savings rates, national income growth in the North matches the rate of population growth in the South, and residents over the North come to own a signi…cant portion of the world’s capital despite being a vanishing fraction of the world’s labor force. Deardor¤ (1994) observes that, in circumstances in which the North enjoys sustained growth in per capita income but national income growth less than the rate of population growth in the South, a change in the North’s savings propensity will change its long-run growth, just as in models of endogenous growth. In short, Alan points out that, by investing abroad, a relatively small country (in terms of population) can escape diminishing returns at home. This argument bears a family resemblance to a related point made by Ventura (1997). He considers a small, Heckscher-Ohlin economy that trades freely at …xed prices. The economy has two sectors with diminishing (and non-bounded) returns to capital in each, and savings derived from intertemporal utility maximization. Without trade, this economy would approach a steady state. With trade, it will do so as well, as was illustrated in Figure 2. But, Ventura points out, the country will experience a potentially-long growth phase when its endowments are within the diversi…cation cone during which the return to capital will remain constant. The constancy of returns to capital re‡ects the factor-price equalization theorem applies during this phase. But as long as the country remains incompletely specialized, it is as if it had access to an AK technology. So the growth experience for a long time might mimic that which would be predicted by such a model. And, of course, changes in policy and in savings behavior will alter the growth rate during this episode. Deardor¤’s (1994) story of sustained growth is an interesting one that deserves further attention and development. To me, it seems to beg for the endogenization of population growth. Can populations diverge forever? Might the South of Deardor¤’s model experience a demographic transition at some stage? Or might trade postpone or even prevent such a transition? Going further, can we justify sustained di¤erences in savings behavior? Are these di¤erences “cultural” or do they re‡ect the growth experience? There is much to be done with endogenous preferences and endogenous procreation in models of trade and growth.7 Let me end this review where I began. I have long been a big fan of Alan Deardor¤, whose work is always clean, crisp and elegant. His papers on trade and growth complement the many other areas to which he has contributed, including his brilliant work on comparative advantage and his 7 See Galor and Weil (2000) for a very interesting contribution of this sort. 7 very useful applied research on trade policy. I am happy to be part of this celebration and look forward to his continued productivity for many years to come! 8 References [1] Azariadis, Costas and Drazen, Allan (1990), “Threshold Externalities in Economic Development,” Quarterly Journal of Economics 105:2, 501-526. [2] Deardor¤, Alan V. (1973), “The Gains from Trade In and Out of Steady-State Growth,” Oxford Economic Papers 25:3, 173-191. [3] Deardor¤, Alan V. (1974), “A Geometry of Trade and Growth,” Canadian Journal of Economics 7:2, 295-306. [4] Deardor¤, Alan V. (1994), “Growth and International Investment with Diverging Populations,” Oxford Economic Papers 46:3, 477-491. [5] Deardor¤, Alan V. (1999), “Diverging Populations and Endogenous Growth in a Model of Meaningless Trade,” Review of International Economics 7:3, 359-377. [6] Deardor¤, Alan V. (2001), “Rich and Poor Countries in Neoclassical Trade and Growth,” Economic Journal 111:470, 277-294. [7] Feenstra, Robert C. (1996), “Trade and Uneven Growth,”Journal of Development Economics 49:1, 229-256. [8] Galor, Oded (1996), “Convergence? Inferences from Theoretical Models,” Economic Journal 106:437, 1056-1069. [9] Galor, Oded and Weil, David N. (2000), “Population, Technology and Growth: From Malthusian Stagnation to the Demographic Transition and Beyond,” American Economic Review 90:4, 806-828. [10] Grossman, Gene M. and Helpman, Elhanan (1990), “Trade, Innovation, and Growth,” American Economic Review (Papers and Proceedings) 80:2, 86-91. [11] Grossman, Gene M. and Helpman, Elhanan (1991), Innovation and Growth in the Global Economy, MIT Press:Cambridge. [12] Jones, Larry E. and Manuelli, Rodolfo (1990), "A Convex Model of Equilibrium Growth: Theory and Policy Implications,” Journal of Political Economy 98:5, 1008-1038. [13] Lucas, Robert E., Jr. (1988), “On the Mechanics of Economic Development,”Journal of Monetary Economics 22:1, 3-42. [14] Murphy, Kevin M., Shleifer, Andrei, and Vishny, Robert W. (1989), “Industrialization and the Big Push,” Journal of Political Economy 97:5, 1003-1026. [15] Samuelson, Paul A. (1975), Trade Pattern Reversals in Time-Phased Ricardian Systems and Intertemporal E¢ ciency,” Journal of International Economics 5:4, 309-363. 9 [16] Smith, Alasdair (1979), “Intertemporal Gains from Trade,” Journal of International Economics 9:2, 239-248. [17] Smith, Alasdair (1984), “Capital Theory and Trade Theory,” in R.W. Jones and P.B.Kenen, eds., Handbook of International Economics, vol. 1, North Holland: Amsterdam. [18] Solow, Robert M. (1956), “A Contribution to the Theory of Growth,” Quarterly Journal of Economics 70:1, 65-94. [19] Stokey, Nancy L. (1991), “Human Capital, Product Quality, and Growth,” Quarterly Journal of Economics 106:2, 587-616. [20] Ventura, Jaume (1997), “Growth and Interdependence,” Quarterly Journal of Economics 112:1, 57-84. [21] Young, Alwyn (1993), “Invention and Bounded Learning by Doing,”Journal of Political Economy 101:3, 443-472. 10