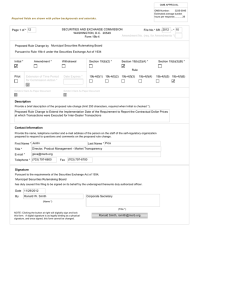

SECURITIES AND EXCHANGE COMMISSION 01 - * 2012

advertisement