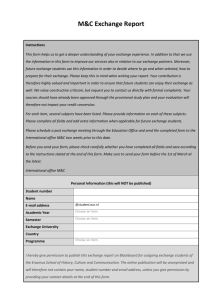

I M A F

advertisement