NEGOTIATING ANTI-DUMPING AND SETTING PRIORITIES AMONG OUTSTANDING IMPLEMENTATION ISSUES IN

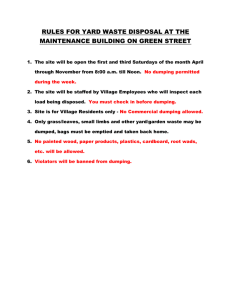

advertisement