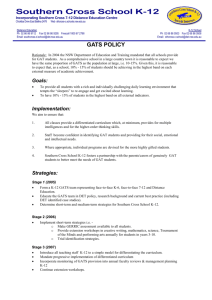

WORLD TRADE ORGANIZATION 3.13 GATS

advertisement