Document 10436410

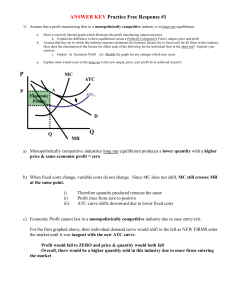

advertisement