Document 10436402

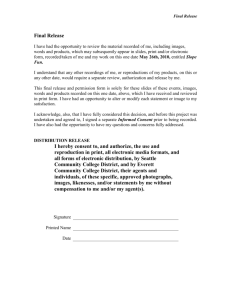

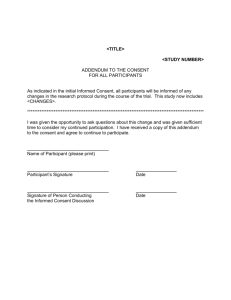

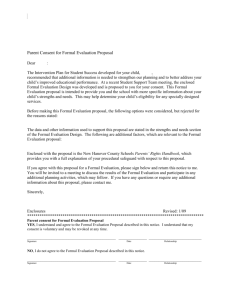

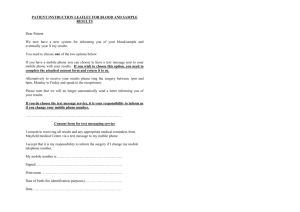

advertisement