FRED 53 Draft Amendments to FRS 101 (2013/14) Reduced Disclosure Framework

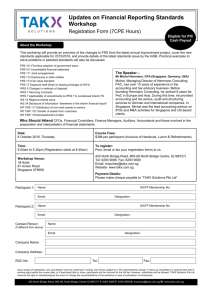

advertisement

Cover.qxd 10/12/2013 11:05 Page 1 Exposure Draft Audit and Assurance Financial Reporting Council December 2013 FRED 53 Draft Amendments to FRS 101 Reduced Disclosure Framework (2013/14) Further copies, £8.00 (post-free) can be obtained from: FRC Publications 145 London Road Kingston upon Thames Surrey KT2 6SR Tel: 020 8247 1264 Fax: 020 8547 2638 Email: cch@wolterskluwer.co.uk Or order online at: www.frcpublications.com UP/ASBD-BI13542 Cover.qxd 05/12/2013 11:32 Page 2 The FRC is responsible for promoting high quality corporate governance and reporting to foster investment. We set the UK Corporate Governance and Stewardship Codes as well as UK standards for accounting, auditing and actuarial work. We represent UK interests in international standard-setting. We also monitor and take action to promote the quality of corporate reporting and auditing. We operate independent disciplinary arrangements for accountants and actuaries; and oversee the regulatory activities of the accountancy and actuarial professional bodies. The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indrectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it. © The Financial Reporting Council Limited 2013 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN. Financial Reporting Council December 2013 FRED 53 Draft Amendments to FRS 101 Reduced Disclosure Framework (2013/14) This [draft] Financial Reporting Standard contains material in which the IFRS Foundation holds copyright and which has been reproduced with its permission. COPYRIGHT NOTICE International Financial Reporting Standards (IFRSs) together with their accompanying documents are issued by the International Accounting Standards Board (IASB): 30 Cannon Street, London, EC4M 6XH, United Kingdom. Tel: +44 (0)20 7246 6410 Fax: +44 (0)20 7246 6411 Email: info@ifrs.org Web: www.ifrs.org c 2013 IFRS Foundation Copyright * The IASB, the IFRS Foundation, the authors and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this publication, whether such loss is caused by negligence or otherwise. IFRSs (which include International Accounting Standards and Interpretations) are copyright of the International Financial Reporting Standards (IFRS) Foundation. The authoritative text of IFRSs is that issued by the IASB in the English language. Copies may be obtained from the IFRS Foundation Publications Department. Please address publication and copyright matters to: IFRS Foundation Publications Department 30 Cannon Street, London, EC4M 6XH, United Kingdom. Tel: +44 (0)20 7332 2730 Fax: +44 (0)20 7332 2749 Email: publications@ifrs.org Web: www.ifrs.org All rights reserved. No part of this publication may be translated, reprinted or reproduced or utilised in any form either in whole or in part or by any electronic, mechanical or other means, now known or hereafter invented, including photocopying and recording, or in any information storage and retrieval system, without prior permission in writing from the IFRS Foundation. A review committee appointed by the IFRS Foundation has approved the English translation of the International Financial Reporting Standards and related material contained in this publication. The English translation is published by the Accounting Standards Board in the United Kingdom and Republic of Ireland with the permission of the IFRS Foundation. The English translation is the copyright of the IFRS Foundation. The IFRS Foundation logo, the IASB logo, the IFRS for SMEs logo, the ‘‘Hexagon Device’’, ‘‘IFRS Foundation’’, ‘‘eIFRS’’, ‘‘IAS’’, ‘‘IASB’’, ‘‘IASC Foundation’’, ‘‘IASCF’’, ‘‘IFRS for SMEs’’, ‘‘IASs’’, ‘‘IFRS’’, ‘‘IFRSs’’, ‘‘International Accounting Standards’’ and ‘‘International Financial Reporting Standards’’ are Trade Marks of the IFRS Foundation. Contents Page Introduction 3 Invitation to comment 5 [Draft] Amendments to FRS 101 Reduced Disclosure Framework 6 The Accounting Council’s Advice to the FRC to issue FRED 53 9 Appendix I Republic of Ireland legal references to FRED 53 13 Consultation stage impact assessment 15 Financial Reporting Council 1 2 FRED 53: Draft Amendments to FRS 101 (December 2013) Introduction 1 In 2012 and 2013 the Financial Reporting Council (FRC) revised financial reporting standards in the UK and Republic of Ireland. The revisions fundamentally reformed financial reporting, replacing almost all extant standards with three Financial Reporting Standards: (a) FRS 100 Application of Financial Reporting Requirements; (b) FRS 101 Reduced Disclosure Framework; and (c) FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland. 2 FRS 101 allows qualifying entities to apply the recognition and measurement requirements of EU-adopted IFRS whilst reducing disclosure requirements. 3 Financial statements prepared by a qualifying entity in accordance with FRS 101 are not IAS Accounts as defined by section 395(1) of the Companies Act 2006 (the Act) but are Companies Act Accounts. Therefore the entity must comply with the Act and the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410) (the Regulations) and where applicable make amendments to EU-adopted IFRS requirements as specified in FRS 101. 4 The Accounting Council advised the FRC to update FRS 101 at regular intervals to ensure that the disclosure framework maintains consistency with EU-adopted IFRS1. 5 The Accounting Council also advised the FRC that the following principles should be applied when determining which of the disclosure requirements in EU-adopted IFRS should be applied by qualifying entities: (1) Relevance: Does the disclosure requirement provide information that is capable of making a difference to the decisions made by the users of the financial statements of a qualifying entity? (2) Cost constraint on useful financial reporting: Does the disclosure requirement impose costs on the preparers of the financial statements of a qualifying entity that are not justified by the benefits to the users of those financial statements? (3) Avoid gold plating: Does the disclosure requirement override an existing exemption provided by company law in the UK? Amendments to FRS 101 6 It has been a year since FRS 101 was issued and the International Accounting Standards Board (IASB) has issued a number of amendments during this time that have resulted in changes to EU-adopted IFRS. The FRC considers that it is an appropriate time to review FRS 101. The amendments made to EU-adopted IFRS were reviewed in the context of the reduced disclosure framework for any amendments that: (a) alter disclosure requirements, as consideration will need to be given to whether changes should be made to the disclosure exemptions permitted in FRS 101; and/or 1 Paragraph 20 of the Accounting Council’s Advice to the FRC in FRS 101 Financial Reporting Council 3 (b) are inconsistent with current UK legal requirements, as consideration will need to be given to whether changes should be made to the Application Guidance: Amendments to International Financial Reporting Standards as Adopted in the European Union for Compliance with the Act and the Regulations to FRS 101. 7 This Exposure Draft sets out proposed amendments to FRS 101 for amendments made to: (a) IFRS 10 Consolidated Financial Statements and IAS 27 Separate Financial Statements as a result of the IASB’s project Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27); and (b) IAS 36 Impairment of Assets as a result of the IASB’s project Recoverable Amount Disclosures for Non-Financial Assets (Amendment to IAS 36). 8 4 This Exposure Draft also sets out a proposed editorial amendment to paragraph 6 of FRS 101 to clarify the exemptions permitted for non-financial institutions in relation to IFRS 7 Financial Instruments: Disclosures and IFRS 13 Fair Value Measurement. FRED 53: Draft Amendments to FRS 101 (December 2013) – Introduction Invitation to comment 1 The FRC is requesting comments by 21 March 2014. The FRC is committed to developing standards based on evidence from consultation with users, preparers and others. Comments are invited in writing on all aspects of this FRED. In particular, comments are sought on the questions below. Question 1 Do you agree with proposed amendments to FRS 101 Reduced Disclosure Framework? If not, why not? Question 2 Do you agree with the proposed effective date? If not, why not? 2 Information on how to submit comments and the FRC’s policy in relation to responses is set out on page 16. Financial Reporting Council 5 [Draft] Amendments to FRS 101 Reduced Disclosure Framework [Draft] Amendments to FRS 101 1 The following paragraphs set out the [draft] amendments to FRS 101. Inserted text is underlined and deleted text is struck through. Reduced disclosures for subsidiaries and ultimate parents 2 Paragraph 4A is inserted above paragraph 5 and below the heading Reduced disclosures for subsidiaries and ultimate parents as follows: 4A Financial statements prepared by qualifying entities in accordance with this FRS are not IAS Accounts as defined in Section 395(1)(b) of the Act but are Companies Act accounts and therefore must comply with the requirements of the Act and the Regulations. 3 Paragraph 6 is amended as follows2: 6 4 6 (a) Entities should refer to the disclosure requirements of paragraph 55 of Schedule 1 to the Regulations. for financial liabilities that are held at fair value that are part of a trading portfolio or are derivatives, the qualifying entity can take advantage of those exemptions. (b) Where the qualifying entity has financial instruments held at fair value subject to the requirements of paragraph 36(4) of Schedule 1 to the Regulations, it must apply the disclosure requirements2 of paragraphs 8(e), 9(c), 10, 11, 17, 20(a)(i), 25, 26, 28, 29, 30, 31 of IFRS 7 and paragraph 93 of IFRS 13 to those financial instruments held at fair value in order to comply with the Regulations. For accounting periods beginning before 1 January 2013, paragraph 93 of IFRS 13 should be replaced with paragraphs 27, 27A and 27B of IFRS 7. Paragraph 8(l) is amended as follows: (l) 2 A qualifying entity which is not a financial institution may take advantage in its individual financial statements of the disclosure exemptions set out in paragraphs 8 to 9 of this FRS. In relation to except in relation to paragraphs 8(d) and (e) where the disclosure requirements of the Act and the Regulations must be provided for financial instruments measured at fair value, for example: The requirements of paragraphs 130(f)(ii), 130(f)(iii), 134(d) to 134(f) and 135(c) to 135(e) of IAS 36 Impairment of Assets, provided that equivalent disclosures are included in the consolidated financial statements of the group in which the entity is consolidated. Paragraph 6 of FRS 101 already contains a footnote (footnote 2) which remains unchanged. FRED 53: Draft Amendments to FRS 101 (December 2013) [Draft] Amendments to the Application Guidance to FRS 101 5 Paragraphs AG1(gA) and AG1(gB) are inserted after paragraph AG1(g) of the Application Guidance to FRS 101. (gA) Paragraph 31 of IFRS 10 Consolidated Financial Statements is amended as follows: 31 (gB) Except as described in paragraph 32, an investment entity shall not consolidate its subsidiaries or apply IFRS 3 when it obtains control of another entity if the interest is held exclusively with a view to subsequent resale. Instead, an investment entity shall measure an investment in a subsidiary at fair value through profit or loss in accordance with IFRS 9. The following definitions are inserted into Appendix A Defined terms of IFRS 10 Consolidated Financial Statements as follows: held exclusively with a view to subsequent resale held as part of an investment portfolio An interest: (a) for which a purchaser has been identified or is being sought, and which is reasonably expected to be disposed of within approximately one year of its date of acquisition; or (b) that was acquired as a result of the enforcement of a security, unless the interest has become part of the continuing activities of the group or the holder acts as if it intends the interest to become so; or (c) which is held as part of an investment portfolio. An interest is held as part of an investment portfolio if its value to the investor is through fair value as part of a directly or indirectly held basket of investments rather than as media through which the investor carries out business. A basket of investments is indirectly held if an investment fund holds a single investment in a second investment fund which, in turn, holds a basket of investments. Financial Reporting Council 7 [Draft] Amendments to Appendix IV Republic of Ireland Legal References 6 Paragraph A4.10 is amended as follows: A4.10 As this FRS does not apply to the preparation of consolidated financial statements (see paragraph 3 of this FRS), readers should note that, with a number of specific exceptions, there are no references included in the table below to the Group Accounts Regulations, 1992 or other legislative provisions pertaining to group accounts. The exceptions relate to paragraphs dealing with the scope of the standard, and the definitions of qualifying entities and the requirement under IAS 27 Separate Financial Statements, in the case where a parent, that is an investment entity, is required to measure its investment in a subsidiary at fair value through profit or loss, to account for its investment in a subsidiary in the same way in its separate financial statements. 7 8 A number of additional Irish legal references are inserted into Appendix IV to FRS 101 as a result of the amendments proposed above. These are set out in Appendix I to this FRED and will be incorporated into Appendix IV to FRS 101 when these proposals are finalised. FRED 53: Draft Amendments to FRS 101 (December 2013) The Accounting Council’s Advice to the FRC to issue FRED 53 Introduction 1 This section provides an overview of the main issues that have been considered by the Accounting Council in advising the Financial Reporting Council (FRC) to publish Financial Reporting Exposure Draft 53: Amendments to FRS 101 Reduced Disclosure Framework (2013/14) (FRED 53). 2 The FRC, in accordance with the Statutory Auditors (Amendment of Companies Act 2006 and Delegation of Functions etc) Order 2012 (SI 2012/1741), is the prescribed body for issuing accounting standards in the UK. The Foreword to Accounting Standards sets out the application of accounting standards in the Republic of Ireland. 3 In accordance with the FRC Codes and Standards: procedures, any proposal to issue, amend or withdraw a code or standard is put to the FRC Board with the full advice of the relevant Councils and/or the Codes & Standards Committee. Ordinarily, the FRC Board will only reject the advice put to it where: 4 . it is apparent that a significant group of stakeholders has not been adequately consulted; . the necessary assessment of the impact of the proposal has not been completed, including an analysis of costs and benefits; . insufficient consideration has been given to the timing or cost of implementation; or . the cumulative impact of a number of proposals would make the adoption of an otherwise satisfactory proposal inappropriate. The FRC has established the Accounting Council as the relevant Council to assist it in the setting of accounting standards. Advice 5 The Accounting Council is advising the FRC to issue FRED 53: Amendments to FRS 101 Reduced Disclosure Framework (2013/14). Background 6 The Accounting Council advised the FRC to update FRS 101 at regular intervals to ensure that the disclosure framework maintains consistency with EU-adopted IFRS3. 7 The Accounting Council also advised the FRC that the following principles should be applied when determining which of the disclosure requirements in EU-adopted IFRS should be applied by qualifying entities: (1) Relevance: Does the disclosure requirement provide information that is capable of making a difference to the decisions made by the users of the financial statements of a qualifying entity? (2) Cost constraint on useful financial reporting: Does the disclosure requirement impose costs on the preparers of the financial statements of a qualifying entity that are not justified by the benefits to the users of those financial statements? 3 Paragraph 20 of the Accounting Council’s Advice to the FRC in FRS 101. Financial Reporting Council 9 (3) Avoid gold plating: Does the disclosure requirement override an existing exemption provided by company law in the UK? IASB projects completed since those considered in the development of FRS 101 8 The IASB has completed six projects since those considered in the development of FRS 101: IFRS Date issued by IASB Endorsed by EU 1 IAS 32 Financial Instruments: Presentation – Offsetting Financial Assets And Financial Liabilities (amendment) Dec 2011 Dec 2012 2 Disclosures – Offsetting Financial Assets and Financial Liabilities (Amendments to IFRS 7) Dec 2011 Dec 2012 3 Government loans (amendments to IFRS 1) Mar 2012 Mar 2013 4 Consolidated Financial Statements, Joint Arrangements and Disclosure of Interests in Other Entities: Transition Guidance (Amendments to IFRS 10, IFRS 11 and IFRS 12) Jun 2012 Apr 2013 5 Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27) Oct 2012 Nov 2013 6 Recoverable Amount Disclosures for NonFinancial Assets (Amendment to IAS 36) May 2013 Expected Q4 2013 The amendments4 resulting from these projects were reviewed in the context of the reduced disclosure framework for any amendments that: 9 (a) alter disclosure requirements, as consideration will need to be given to whether changes should be made to the disclosure exemptions permitted in FRS 101; and/or (b) are inconsistent with current UK legal requirements, as consideration will need to be given to whether changes should be made to the Application Guidance: Amendments to International Financial Reporting Standards as Adopted in the European Union for Compliance with the Act and the Regulations to FRS 101. Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27) 10 4 The amendments resulting from this IASB project introduced into IFRS 10 Consolidated Financial Statements an exception from consolidation of subsidiaries for parents that are investment entities. These amendments require an investment entity to measure those subsidiaries at fair value through profit or loss in accordance with IFRS 9 Financial Instruments in its consolidated and separate financial statements. The amendments also introduce new disclosure requirements for investment entities into IFRS 12 Disclosure of Interests in Other Entities and IAS 27 Separate Financial Statements. The full IASB documents setting out the amendments for each project are available on the IASB website (www.ifrs.org). 10 FRED 53: Draft Amendments to FRS 101 (December 2013) – Accounting Council’s Advice Compliance with UK company law 11 Section 405(3) of the Companies Act (the Act) sets out the circumstances in which a subsidiary may be excluded from consolidation. Section 405(3) permits a subsidiary to be excluded from consolidation on the following grounds: (a) severe long-term restrictions substantially hinder the exercise of the rights of the parent company over the assets or management of that subsidiary; (b) the information necessary for the preparation of group accounts cannot be obtained without disproportion expense or undue delay; or (c) the interest of the parent company is held exclusively with a view to subsequent resale. 12 To enable qualifying entities that apply FRS 101 to take advantage of the consolidation exception in IFRS 10 whilst complying with the requirements of the Act, the Accounting Council advises that an amendment to the text of paragraph 31 of IFRS 10 is required to include the phrase ‘‘held exclusively with a view to subsequent resale’’ and the associated definitions should be inserted. Two additional paragraphs are therefore inserted into the Application Guidance: Amendments to International Financial Reporting Standards as Adopted in the European Union for Compliance with the Act and the Regulations to FRS 101 that amend paragraph 31 of IFRS 10 and insert the associated definitions. 13 This IASB project also resulted in amendments to IAS 27 Separate Financial Statements. IAS 27 requires that where a parent, that is an investment entity, does not consolidate its subsidiaries and measures its investments a subsidiaries at fair value through profit or loss in its consolidated financial statements (as required by IFRS 10), it shall account for these investments in the same way in its separate financial statements. This treatment in the separate financial statements is a departure from the requirements of the Companies Act for the overriding purpose of giving a true and fair view. Disclosure exemptions 14 The Accounting Council considers that the new disclosure requirements in IFRS 12 and IAS 27 are relevant to a user’s understanding of a parent entity’s financial statements, particularly as no consolidated financial statements would have been prepared in respect of the exempt subsidiaries. Further, the parent entity would also be a financial institution and these disclosures relate to its financial instruments. The Accounting Council advises that no exemption should be given in FRS 101 for these new disclosure requirements. Recoverable Amount Disclosures for Non-Financial Assets (Amendment to IAS 36) 15 The Accounting Council notes that FRS 101 already allows disclosure exemptions for qualifying entities against paragraphs 134(d) to 134(f) and 135(c) to 135(e) of IAS 36. These disclosures relate to cash-generating units that, either individually or in combination, have a significant amount of goodwill or intangible assets with indefinite useful lives allocated to them. These exemptions are only permitted if equivalent disclosures are included in the consolidated financial statements of the group. 16 The IASB have made amendments to the disclosure requirements of paragraph 130(f) of IAS 36 in relation to fair value, where fair value less costs of disposal is the recoverable amount of an individual asset or cash-generating unit. 17 The Accounting Council considers that, on balance, the additional detailed disclosure requirements of paragraph 130(f) of IAS 36 are unlikely to provide relevant information to users of the financial statements of qualifying entities, given that general information on impairments will be disclosed through the requirements of paragraphs 130(a) to (e). Financial Reporting Council 11 18 In addition, this detailed information would be available in the consolidated financial statements, and if no disclosure is made in the consolidated financial statements on the grounds of materiality, the relevant disclosures would need to be made at subsidiary level5. 19 The Accounting Council noted, however, that should an exemption be permitted for paragraph 130(f) in its entirety, basic information about the basis of measurement of the fair value would be lost, and an imbalance between the disclosure requirements relating to fair value less costs of disposal and value in use would exist. Therefore the Accounting Council advises that an exemption should not be allowed against the requirements of paragraph 130(f)(i) and entities should provide disclosure of the level of the fair value hierarchy used in measuring fair value. The Accounting Council advises that qualifying entities should be allowed an exemption against subparagraphs 130(f)(ii) and 130(f)(iii), provided that equivalent disclosures are included the consolidated financial statements of the group. Paragraph 8(l) of FRS 101 is amended to include this exemption. Editorial amendment to paragraph 6 of FRS 101 20 It has been brought to the attention of the Accounting Council that the drafting of paragraph 6 of FRS 101 does not accurately reflect the requirements of Schedule 1 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410) (the Regulations) in that it refers to financial liabilities that are held at fair value that are part of a trading portfolio or are derivatives, rather than financial instruments. 21 The Accounting Council advises that paragraph 6 should be amended and paragraph 4A is inserted to remind users of FRS 101 that financial statements prepared under FRS 101 are not IAS Accounts but Companies Act Accounts, and therefore qualifying entities must comply with the Act and the Regulations. Date from which effective and transitional arrangements 22 The effective date of FRS 101 is for accounting periods beginning on or after 1 January 2015 with early application permitted. 23 The amendments resulting from both the Investment Entities (Amendments to IFRS 10, IFRS 12 and IAS 27) project and the Recoverable Amount Disclosures for Non-Financial Assets (Amendments to IAS 36) project have an effective date for accounting periods beginning on or after 1 January 2014 with early application permitted as set out in IFRS 10 and IAS 36. 24 The Accounting Council advises that the draft amendments to FRS 101 have the same effective date as currently stated in FRS 101 and early adoption is permitted to the extent that a qualifying entity can apply the amendments of the underlying IFRSs (ie IFRS 10 and IAS 36). 5 As required by paragraph AG10 of the Application Guidance to FRS 100 Application of Financial Reporting Requirements. 12 FRED 53: Draft Amendments to FRS 101 (December 2013) – Accounting Council’s Advice Financial Reporting Council 13 Section 395(1) 3 Section 148(2) 1963 Act 1986 Act Paragraph 55 of Schedule 1 to the Regulations Paragraph 36(4) of Schedule 1 to the Regulations 3 (amending paragraph 6 in FRS 101) Section 395(1)(b) 2 (inserting paragraph 4A in FRS 101) 3 (amending paragraph 6 in FRS 101) 2006 Act and the 2008 Regulations (unless otherwise stated) Paragraph reference in FRED 53 UK References Section 148(2)(b) 1963 Act Paragraphs 22A(2) and 22AA of Part IIIA of the Schedule Paragraph 31A of the Schedule 1986 Act [DRAFT] AMENDMENTS TO FRS 101 REDUCED DISCLOSURE FRAMEWORK 2006 Act and the 2008 Regulations (unless otherwise stated) UK References Paragraph reference in FRED 53 INTRODUCTION GAR 1992 ROI References GAR 1992 ROI References Paragraphs 46A(3), 46A(4A) and 46A(4B) of Part I of the Schedule Paragraph 46D of Part I of the Schedule Regulation 5(1) CIR 1992 Regulation 5(1) CIR 1992 Regulation 5(1) IUR 1996 Regulation 5(1) IUR 1996 The following tables set out the RoI legal references relevant to FRED 53. These references will be incorporated into Appendix IV RoI Legal References to FRS 101 when these proposals are finalised. Republic of Ireland legal references to FRED 53 Appendix I 14 FRED 53: Draft Amendments to FRS 101 (December 2013) – Appendix I 2006 Act and the 2008 Regulations (unless otherwise stated) Section 405(3) Schedule 1 to the Regulations Paragraph reference in FRED 53 11 20 UK References 1963 Act Sections 4, 5, and 6 and the Schedule 1986 Act THE ACCOUNTING COUNCIL’S ADVICE TO THE FRC TO ISSUE FRED 53 Regulation 11 GAR 1992 ROI References Paragraph 2(3) of Part II of the Schedule CIR 1992 Paragraph 2(3) of Part IV of the Schedule IUR 1996 Consultation stage impact assessment Introduction 1 As published in its Regulatory Strategy6, the Financial Reporting Council (FRC) is committed to a proportionate approach to the use of its powers, making effective use of impact assessments and having regard to the impact of regulation on small enterprises. Rationale for amending FRS 101 Reduced Disclosure Framework 2 FRS 101 allows qualifying entities within groups where the parent of that group prepares publicly available consolidated financial statements which are intended to give a true and fair view to apply the recognition and measurement requirements of EU-adopted IFRS whilst reducing disclosure requirements. 3 Paragraph 20 of the Accounting Council’s Advice to the FRC to FRS 101 states that FRS 101 should be updated at regular intervals to ensure that the disclosure framework maintains consistency with EU-adopted IFRS. 4 It has been a year since the publication of FRS 101 and a number of IASB projects have since been completed and the FRC considers it an appropriate time to perform a review of the requirements of FRS 101. Cost / benefit analysis 5 For those groups that have chosen to prepare individual accounts in accordance with EUadopted IFRS, FRS 101 offers a cost saving due to the reduced number of disclosures that require preparing and auditing. Feedback from listed groups supported the introduction of FRS 101, highlighting the benefits of consistent reporting across the group, and noting that the cost of producing full EU-adopted IFRS disclosure for individual group entities would be disproportionate to the use made of subsidiary financial statements, which often have few users that are external to the group. 6 Any change in accounting requirements will lead to some costs of transition, however the FRC believes that the amendment set out in FRED 53 will not increase these transitional costs. 7 The FRC believes that FRS 101 provides proportionate disclosures for group entities and generates opportunities for cost savings, particularly for those entities required to prepare group accounts in accordance with EU-adopted IFRS. These cost savings should imply greater returns for investors. 6 http://www.frc.org.uk/Our-Work/Publications/FRC-Board/FRC-Regulatory-Strategy-Our-Role-and-Approach.aspx Financial Reporting Council 15 This draft is issued by the Financial Reporting Council for comment. It should be noted that the draft may be modified in the light of comments received before being issued in final form. For ease of handling, we prefer comments to be sent by e-mail to: ukfrs@frc.org.uk Comments may also be sent in hard copy to: Mei Ashelford Financial Reporting Council Aldwych House 71-91 Aldwych London WC2B 4HN Comments should be despatched so as to be received no later than 21 March 2014. The FRC’s policy is to publish on its website all responses to formal consultations issued by the FRC unless the respondent explicitly requests otherwise. A standard confidentiality statement in an e-mail message will not be regarded as a request for non-disclosure. The FRC does not edit personal information (such as telephone numbers or postal or e-mail addresses) from submissions; therefore, only information that you wish to be published should be submitted. The FRC aims to publish responses within 10 working days of receipt. The FRC will publish a summary of the consultation responses, either as part of, or alongside, its final decision. 16 FRED 53: Draft Amendments to FRS 101 (December 2013) Cover.qxd 05/12/2013 11:32 Page 2 The FRC is responsible for promoting high quality corporate governance and reporting to foster investment. We set the UK Corporate Governance and Stewardship Codes as well as UK standards for accounting, auditing and actuarial work. We represent UK interests in international standard-setting. We also monitor and take action to promote the quality of corporate reporting and auditing. We operate independent disciplinary arrangements for accountants and actuaries; and oversee the regulatory activities of the accountancy and actuarial professional bodies. The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indrectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it. © The Financial Reporting Council Limited 2013 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN. Cover.qxd 05/12/2013 11:32 Page 1 Exposure Draft Audit and Assurance Financial Reporting Council December 2013 FRED 53 Draft Amendments to FRS 101 Reduced Disclosure Framework (2013/2014) Further copies, £8.00 (post-free) can be obtained from: FRC Publications 145 London Road Kingston upon Thames Surrey KT2 6SR Tel: 020 8247 1264 Fax: 020 8547 2638 Email: cch@wolterskluwer.co.uk Or order online at: www.frcpublications.com UP/ASBD-BI13542