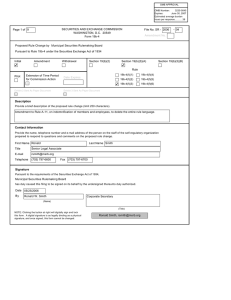

Amendment No. (req. for Amendments *) SECURITIES AND EXCHANGE COMMISSION 04 - *

advertisement