Ohio Northern University

advertisement

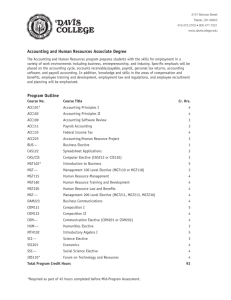

Ohio Northern University Sample Curriculum for Mathematical Statistics Major with Actuarial Science Concentration For students entering in the fall of odd numbered years FALL – Freshman Calculus 1 Statistics for Professionals 1 Transitions Experience Writing Seminar Gen Ed Elective (Science) Crd 4 3 3 3 3 16 SPRING – Freshman Calculus 2 Statistics for Professionals 2 Freshman Seminar Gen Ed Elective (Communication Arts) Gen Ed Elective (Humanities) Gen Ed Elective (Science) FALL – Sophomore Calculus 3 Theory of Interest Extradisciplinary Seminar Gen Ed Elective (Fine Arts) Financial Accounting Foundations Crd 4 3 3 3 3 16 Crd 3 3 3 3 3 15 SPRING – Sophomore Applied Linear Regression and Correlation Foundations of Mathematics Gen Ed Elective (Humanities) Elective Financial Analysis For Business Planning Crd 3 3 3 3 3 15 SPRING – Senior Senior Capstone Elective Elective Elective Elective FALL – Junior Probability Theory Statistical Computing and Data Management Intermediate Financial Management Categorical Data Analysis Elective FALL – Senior Nonparametric Statistical Methods Macroeconomics Elective Elective Elective SPRING – Junior Mathematical Statistics Analysis of Variance with Experimental Design Gen Ed Elective (Humanities) Microeconomics Elective Junior Seminar Crd 4 3 1 3 3 3 15 Crd 3 3 3 3 3 15 Crd 3 3 3 3 3 1 16 Crd 1 3 3 3 3 13 Total Credit Hours: 121 (120 required for graduation) Notes: 1) Theory of Interest prepares students actuary exam FM/2, which would be taken in the Spring or Summer of the sophomore year. 2) Probability Theory prepares students actuary exam P/1, which would be taken in the Spring or Summer of the junior year. 3) Successful students can take an independent study course during the senior year which would prepare them to pass the MLC professional actuarial exam. 4) Recommended Business (RMI) Electives: a. Risk Management and Insurance b. Commercial Property and Liability Insurance c. Employee Benefits and Compensation Mgmt. d. Corporate Risk Management e. Business Analytics f. Life Insurance g. Advanced Property Insurance h. Advanced Liability Insurance i. Insurer Operations and Policy j. Investments and Wealth Management Ohio Northern University Sample Curriculum for Mathematical Statistics Major with Actuarial Science Concentration For students entering in the fall of even numbered years FALL – Freshman Calculus 1 Statistics for Professionals 2 Transitions Experience Writing Seminar Gen Ed Elective (Science) Crd 4 3 3 3 3 16 SPRING – Freshman Calculus 2 Statistics for Professionals 2 Freshman Seminar Gen Ed Elective (Communication Arts) Gen Ed Elective (Humanities) Gen Ed Elective (Science) FALL – Sophomore Calculus 3 Probability Theory Extradisciplinary Seminar Gen Ed Elective (Fine Arts) Financial Accounting Foundations Crd 4 3 3 3 3 16 Crd 3 3 3 3 3 15 SPRING – Sophomore Applied Linear Regression and Correlation Foundations of Mathematics Gen Ed Elective (Humanities) Elective Financial Analysis For Business Planning Crd 3 3 3 3 3 15 SPRING – Senior Senior Capstone Elective Elective Elective Elective FALL – Junior Theory of Interest Statistical Computing and Data Management Intermediate Financial Management Categorical Data Analysis Elective FALL – Senior Nonparametric Statistical Methods Macroeconomics Elective Elective Elective SPRING – Junior Mathematical Statistics Analysis of Variance with Experimental Design Gen Ed Elective (Humanities) Microeconomics Elective Junior Seminar Crd 4 3 1 3 3 3 15 Crd 3 3 3 3 3 15 Crd 3 3 3 3 3 1 16 Crd 1 3 3 3 3 13 Total Credit Hours: 121 (120 required for graduation) Notes: 1) Probability Theory prepares students for SOA/CAS professional actuary exam P/1, which would be taken in the Spring or Summer of the sophomore year. 2) Theory of Interest prepares students for SOA/CAS professional actuary exam FM/2, which would be taken in the Spring or Summer of the junior year. 3) Successful students can take an independent study course during the senior year which would prepare them to pass the MLC professional actuarial exam. 4) Recommended Business (RMI) Electives: a. Risk Management and Insurance b. Commercial Property and Liability Insurance c. Employee Benefits and Compensation Mgmt. d. Corporate Risk Management e. Business Analytics f. Life Insurance g. Advanced Property Insurance h. Advanced Liability Insurance i. Insurer Operations and Policy j. Investments and Wealth Management