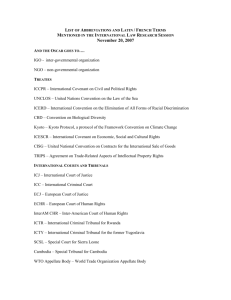

International Investment Instruments: A Compendium

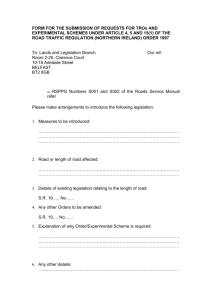

advertisement