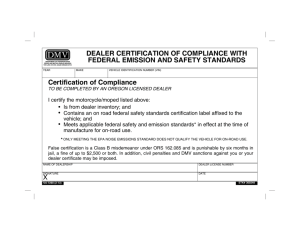

OMB APPROVAL Estimated average burden

advertisement