Commercial Paper

advertisement

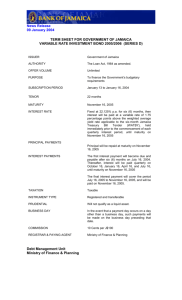

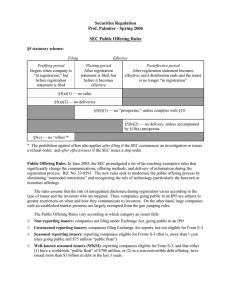

Matt Sieverson Meng Vue Basics of Commercial Paper Regulations Ratings Risks Issuing Companies (GMAC) Dealer Paper vs. Direct Paper Foreign Market Current Trends Short-term unsecured promissory notes Issued by large banks and corporations with high credit ratings to help fund their short-term debt obligations These notes are sold in the open market at a discount from face value, held until maturity of up to 270 days, and earn interest income on the difference between the buy price and face value Usually sold in lots of $100,000 at minimum Cheaper alternative then borrowing from a bank Avoiding Registration with SEC Under Section 3(a)(3) of the Securities Act of 1933, to be exempt from registration: Maturity of commercial paper must be less than 270 days Rollover Debt The proceeds from this type of financing have to be used to finance current assets such as receivables and inventories, not fixed assets such as plant and equipment Advantages Why? Issuers want to avoid registration because the process will be too time-consuming and expensive Each issuer’s commercial paper gets rated by Standard & Poor’s, Moody’s, and Fitch. Moody’s S&P Fitch Superior P1 A1 + or A1 F1 + or F1 Satisfactory P2 A2 F2 Adequate P3 A3 F3 Speculative NP B or C F4 Defaulted NP D F5 Interest Rate Risks Yield Curve Risks Credit Risks (Rollover Risks) Corporate issuers are one of two groups: financial or nonfinancial companies Financial companies issue around 78% of all commercial paper outstanding Captive finance companies GMAC by far largest issuer of commercial paper in United States (or used to be) Letter of Credit (LOC) Credit-supported commercial paper Direct paper Sold by issuing firm directly to investors Large majority are financial companies Cost-effective to establish their own sales force Dealer paper Hiring the services of an agent to sell commercial paper Historically dominated by securities houses June 1987 Fed grants subsidiaries of bank holding companies permission to underwrite commercial paper Commercial banks have a road into commercial paper market Samurai commercial paper Ministry of Finance approved issuance of commercial paper in 1987 Yen-denominated commercial paper in Japan by nonJapanese entities Euro-commercial paper Paper issued and placed outside jurisdiction of the currency denominated Several differences between U.S. paper and Euro Longer Maturity, issue without bank backing, almost always dealer placed, secondary market Subprime mortgages Asset-back commercial paper Commercial paper were held in special investment vehicles (SIVs) Federal Reserve buying paper Disruptions in the commercial paper market and the tightening of bank lending Drive everyday commerce for the American businesses Only buying paper with a rating at A1/P1/FI There is a cap