Document 10405256

advertisement

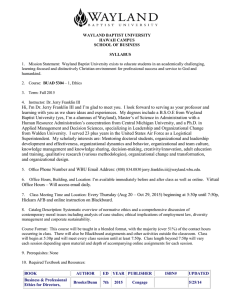

WAYLAND BAPTIST UNIVERSITY FAIRBANKS CAMPUS SCHOOL OF BUSINESS SYLLABUS 1. Wayland Mission Statement: Wayland Baptist University exists to educate students in an academically challenging, learning-focused, and distinctively Christian environment for professional success, and service to God and humankind. 2. Course Prefix, Number, Section, and Title: ACCT 2305 Principles of Accounting I 3. Term: Fall 2014: Aug 18- Oct 29, 2014 4. Name of Instructor: Mrs. Daniela Marton Bassett, BS, MS. 5. Office Phone Number and WBU Email Address: cell phone 907-371-6846 Email: Daniela.marton@libero.it 6. Office Hours, Building, and Location Hours of Operation: 8:30 - 4:30 Mon-Thur., 8:30 – 1:00 Fri Address: 2623 Wabash Av. Eielson AFB Phone: 377-4398 Fax: 372-3244 7. Class Meeting Time and Location: Wednesday Bldg. 2631 / Rm 319 6-10pm 8. Catalog Description: Fundamental principles of accounting applied to individual proprietorship; journals, ledgers, working papers, adjusting and closing entries, financial statements, deferrals, accruals, plant and intangible assets, and accounting systems. Credit not awarded toward degree for both ACCT 2305 and ACCT 3307. 9. Prerequisites: MATH 1304 or consent of School. 10. Required Textbook(s) and/or Resource Material: BOOK AUTHOR ED YEAR PUBLISHER Accounting & Cengage Now Access Code Warren, Reeve, & 25th 2014 Duchac Cengage Learning ISBN# 1285584279 11. Optional Materials: Excel Software to solve assignments. 12. * Course Outcome Competencies: Describe the nature of business, the role of accounting therein and importance thereof. List the rules of debit and credit. Analyze and summarize financial statements. Explain what is meant by the fiscal year and the natural business year. Prepare a financial statements from a worksheet: Balance Sheet Income Statement Statement of Owner’s Equity Statement of Cash Flows Define an accounting system and describe its implementation. Journalize and post transactions in an accounting system. UPDATED 10/14/13 Prepare a chart of accounts for a business. Summarize basic procedures for achieving internal control. Prepare bank reconciliation. Contrast the accrual and cash basis methods of accounting. Understand the classifications for receivables and how to journalize any and all transactions related thereto. Compute the cost of inventory using various costing methods. Discuss ethical consequences of decisions in accounting and business. Compute the cost of tangible and intangible assets. Understand various depreciation/amortization methods and their impact on the financial statement. Define current liabilities and understand the recording of current liabilities. 13. Attendance Requirements: No make-up exams except for documented emergencies! Exceptions will be made for TDY and deployments provided the instructor is notified ahead of the time. No late assignments will be accepted! Homework assignments are due at the beginning of class on the due date. Any exams or assignments that appear to be the same as that of any other student will result in a grade of zero for both students. Independent work on assignments is critical if the student is to understand the concepts and applications presented in this course. In all written assignments, good grammar, spelling and style are expected and will affect your grade. This includes the written portions of all exams. You are expected to come to class prepared to discuss the assigned material. You are responsible for determining what was missed in the event of an absence. Except for police, fire, medical and other emergency personnel (and with the Professor’s prior approval) all cell phones, beepers, pagers and other electronic devices will remain in the OFF position during class. All absences must be explained to the instructor, who will then determine whether the omitted work may be made up. Any student who misses 25 percent or more of the regularly scheduled class meetings may receive a grade of F in the course. Keep in mind that the syllabus—and total number of grade points—is subject to change and that it is the student’s responsibility to note changes that are announced in class. 14. Disability Statement: In compliance with the Americans with Disabilities Act of 1990 (ADA), it is the policy of Wayland Baptist University that no otherwise qualified person with a disability be excluded from participation in, be denied the benefits of, or be subject to discrimination under any educational program or activity in the university. The Coordinator of Counseling Services serves as the coordinator of students with a disability and should be contacted concerning accommodation requests at (806) 291- 3765. Documentation of a disability must accompany any request for accommodations.” (This statement is required on all university syllabi.) 15. * Course Requirements and Grading Criteria: Reading Assignments: Assigned chapters are to be read AFTER THE CLASS MEETING. Written Assignments: Students are expected to attempt the assigned problems before coming to class. Homework assignments will be checked for effort at the beginning of class. Format: Class will consist of lecture, discussion of topics assigned for reading and working assigned problems as a group. Examinations: Two exams will be given during the semester and final exam period. See tentative schedule. Essay: 3 to 5 pages scholarly article summary and review with original comments on the topic and references to additional material (news, web, other articles - scholarly or not). Detailed explanation will be provided at the beginning of the semester. Grading Criteria Examinations: Mid-semester Exam Final Exam Research Project: Essay Homework: Participation: 25% of final grade 25% of final grade 20% of final grade. 15% of final grade 15% of final grade 100% Students shall have protection through orderly procedures against prejudices or capricious academic evaluation. A student who believes that he or she has not been held to realistic academic standards, just evaluation procedures, or appropriate grading, may appeal the final grade given in the course by using the student grade appeal process described in the Academic Catalog. Appeals may not be made for advanced placement examinations or course bypass examinations. Appeals are limited to the final course grade, which may be upheld, raised, or lowered at any stage of the appeal process. Any recommendation to lower a course grade must be submitted through the Executive Vice President/Provost to the Faculty Assembly Grade Appeals Committee for review and approval. The Faculty Assembly Grade Appeals Committee may instruct that the course grade be upheld, raised, or lowered to a more proper evaluation. 16. Tentative Schedule (Calendar, Topics, and Assignments): This schedule is subject to CHANGE. Assignments are reviewed each class meeting and any changes will be noted at that time. Week 1 :Wed Aug 20 Topics: Introductions Describe the nature of business, the role of accounting therein and importance thereof. Analyze and summarize financial statements Reading assignment (Aug 21-26): Chapter 1 Homework: Exercises (to be determined) from Chapter 1 to bring on Aug 27 Discussion: Ethical consequences of decisions in accounting and business. Week 2: Wed Aug 27 Topics: List the rules of debit and credit. Journalize and post transactions in an accounting system. Reading assignment (Aug 28-Sep2): Chapter 2 Homework: Exercises (to be determined) from Chapter 2 to bring on Sep 3 Discussion: Ethical consequences of decisions in accounting and business. Week 3: Wed Sep 3 Topics: Explain what is meant by the fiscal year and the natural business year. Prepare a chart of accounts for a business Reading assignment (Sep 4 – Sep9): Chapter 3 Homework: Exercises (to be determined) from Chapter 3 to bring on Sep 10 Discussion: Ethical consequences of decisions in accounting and business. Week 4: Wed Sep 10 Topics: Prepare financial statements from a worksheet: Balance Sheet Income Statement Statement of Owner’s Equity Statement of Cash Flows Reading assignment (Sep 11 -Sep 16): Chapter 4 Homework: Exercises (to be determined) from Chapter 4 to bring on Sep 17 Discussion: Ethical consequences of decisions in accounting and business. Written assignment due in 4 weeks . Week 5: Wed Sep17 Topics: Define an accounting system and describe its implementation. Preparation for Midterm Exam Reading assignment (Sep 18 -Sep 23): Chapter 5 and 6 Homework: Exercises (to be determined) from Chapters 5 & 6 to bring on Sep 24 Discussion: Ethical consequences of decisions in accounting and business. Written assignment due in 3 weeks Week 6: Wed Sep 24 Midterm Exam Topics: Compute the cost of inventory using various costing methods. Reading assignment (Sep 25 -Sep 30): Chapter 7 Homework: Exercises (to be determined) from Chapter 7 to bring on Oct 1 Discussion: Ethical consequences of decisions in accounting and business. Written assignment due in 2 weeks Week 7: Wed Oct 1 Topics: Summarize basic procedures for achieving internal control Contrast the accrual and cash basis methods of accounting Prepare a bank reconciliation. Reading assignment (Oct 2 –Oct7): Chapter 8 Homework: Exercises (to be determined) from Chapter 8 to bring on Oct 8 Discussion: Ethical consequences of decisions in accounting and business. Written assignment due in 1 week Week 8: Wed Oct 8 Topics: Understand the classifications for receivables and how to journalize any and all transactions related thereto. Reading assignment (Oct 9 –Oct14): Chapter 9 Homework: Exercises (to be determined) from Chapter 9 to bring on Oct 15 Written assignment due on Oct 8: 3 to 5 pages scholarly article summary and review with original comments on the topic and references to additional material (news, web, other articles scholarly or not). Detailed explanation will be provided at the beginning of the semester. Discussion: Ethical consequences of decisions in accounting and business. Week 9: Wed Oct 15 Topics: Compute the cost of tangible and intangible assets. Understand various depreciation/amortization methods and their impact on the financial statement. Reading assignment (Oct 16 –Oct21): Chapter 10 Homework: Exercises (to be determined) from Chapter 10 to bring on Oct 22 Discussion: Ethical consequences of decisions in accounting and business. Week 10: Wed Oct 22 Topics: Define current liabilities and understand the recording of current liabilities. Preparation for Final Exam. Reading assignment (Oct 23 –Oct28): Chapter 11 Homework: Exercises (to be determined) from Chapter 11 to bring on Oct 29 Discussion: Ethical consequences of decisions in accounting and business. Week 11: Wed Oct 29 Final Exam and End of the class Party! 17. Additional Information: Faculty may include additional information as desired. I am always available by telephone, before class on Wednesday, 5 to 6 pm, and by appointment. *Required by Southern Association of Colleges and Schools