Changing minds, stimulating innovation

advertisement

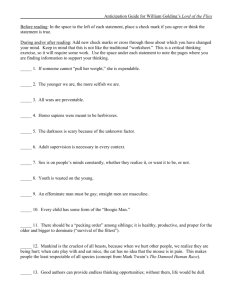

Strategis Partners Changing minds, stimulating innovation Building a better process to support executive decision making Jay Horton www.strategispartners.com.au Palisade Asia Pacific User Conference Friday 14th September 2007 0 This morning’s presentation in a nutshell Decision making in all organisations contains non-rational processes Multiple forms of rationality need to be harnessed to make better decisions The effective decision process is one that changes minds and stimulates innovation 1 Charles Handy “I was in the grip of the myth of science, the idea that everything, in theory, could be understood, predicted and, therefore, managed.” Charles Handy, The Empty Raincoat, 1994 2 Your decision maker may feel nervous about the relying on quantitative methods for decision making Source: I’m feeling insecure. David Maister, Managing the Professional Service Firm, Free Press, 1993. I’m feeling threatened. I’m taking a personal risk. I’m impatient. I’m worried. I’m exposed. I’m feeling ignorant, and don’t like the feeling. I’m skeptical. I’m concerned that they won’t understand what makes my situation special. 10. I’m suspicious. 1. 2. 3. 4. 5. 6. 7. 8. 9. 3 … since like all of us, his decision making is influenced by non-rational and emotional drivers Decision making biases We are risk averse We anchor in the status quo We are overconfident, believing in our own expertise 4 These non-rational drivers create hidden traps for decision makers The major types of bias in decision making Bias Explanation Example Anchoring Giving disproportionate weight to the first information you receive A CEO projects his own view of the manufacturing expansion strategy for Indonesia by recalling his own prior manufacturing experience in the U.S. In emerging economies, a “western-centric” model is a recipe for project failure Status quo Favouring alternatives that perpetuate the existing situation An engineering design team develops an asset replacement plan for the next 20 years based on a “like-for-like” replacement Sunk costs Making choices in a way that justifies past, flawed choices A construction materials executive backs a marginal quarry project, to protect his earlier decisions. But the investment fails to pay-off anyway Confirming evidence Seeking information that supports your A CEO considering restructuring asks the outsourcing supplier for existing point of view strategic advice. Supplier, of course, advises that outsourcing is the way to go Over-confidence Being overly influenced by vivid memories when estimating and forecasting Project costs never come in lower than the original estimate; in one case they exceeded the estimate by a factor of two (or $250m) 5 In many organisations organized anarchy describes much decision making 1. Analysis is performed after the decision has been made 2. Information and analysis is used as signal and symbol 3. Decision analysis is subject to strategic misrepresentation 4. Much information gathered has little decision relevance 5. Much information and analysis is ignored 6. More information is always requested 7. Complaints about not enough information to make a decision 6 … so it is often not useful to think simply of an organization as a single, unified, rational decision making unit Axioms of Decision Analysis Real-world Contradiction 1a. At least two alternatives can be specified The boss has already made up her mind 1b. Possible consequences of each alternative can be identified “We know there are some things we do not know. But there are also unknown unknowns, the ones we don't know we don't know.” U.S. Secretary of Defense Donald Rumsfeld, 2002 2. The probabilities of the consequence of each alternative can be specified “Goldman Sachs lost a packet when something happened that their computers told them should occur only once every 100 millennia.” The Economist Magazine, August 16th 2007 3. The utility of all consequences of any alternative can be specified There are organizations “without consistent, shared goals.” Cohen, March, and Olsen, 1972 7 Is financial risk modelling itself non-rational? General Formula for Project Value n Present Value = ∑ t =0 E (CF ) t (1 + k ) t The discount rate k represents the cost of capital In 2004 Fama and French concluded that the problems with the CAPM are serious enough to invalidate its application, such as for estimating the cost of capital 1 1. Eugene F. Fama and Kenneth R. French, “The Capital Asset Pricing Model: Theory and Evidence,” Journal of Economic Perspectives, V.18-3, 2004. 8 This morning’s presentation in a nutshell Decision making in all organisations contains non-rational processes Multiple forms of rationality need to be harnessed to make better decisions The effective decision process is one that changes minds and stimulates innovation 9 A single view of the problem can be dangerous Under conditions of uncertainty, multiple, potentially contradictory views of the problem may be a better representation of the available knowledge than any single model Failures of imagination and groupthink may be limiting the quality of your organisation’s decision making 10 Multiple “lenses” are needed to steer the corporation of the future - the analytic and the imaginative “What we’ve got at GM now is a general comprehension that you can’t run this business by the left, intellectual, analytical side of the brain. You have to have a lot of right side, creative input.” GM’s Vice Chairman Bob Lutz 11 Quantitative data tells an important side of the story. Qualitative information tells another QUANTITATIVE FACTORS 1 QUALITATIVE FACTORS 2 Size of the computer model Soundness of the assumptions Number of colour graphics Reputation of the analysts Weight of the report Accuracy of the forecasts Cost of the software Quality of the insights Consultants’ fees Veracity of the theory Size of the team Integrity of the model 1. Not everything that can be counted, counts. 2. Not everything that counts can be counted. 12 The process of decision modelling is inextricably tied to the process of convincing others of its integrity “I don’t know what’s in your mathematical model I don’t know what’s been left out of the model I don’t know who supplied the data I don’t know if the model is correct” “So tell me why should we base our major decision on your modelling results?” 13 Minds, of course, are hard to change How minds change: seven key factors 1 Resonance Redescription Rewards Research Reason Real world events INFLUENCING DECISION MAKERS Overcoming Resistance 1. Howard Gardner, Changing Minds -The Art and Science of Changing Our Own and Other People’s Minds, Harvard Business School Press, 2004. CHANGE 14 This requires the analyst build a dialogue with stakeholders The best analysts communicate obsessively Top Management Internal Experts Communication Channels Own Team External Experts Suppliers 15 This morning’s presentation in a nutshell Decision making in all organisations contains non-rational processes Multiple forms of rationality need to be harnessed to make better decisions The effective decision process is one that changes minds and stimulates innovation 16 Three levels of decision support are relevant to good practice 1. The framework of principles, goals and objectives 2. The processes of organizational decision making 3. The tools for analysing decisions using both quantitative and narrative methods 17 What should be the goals of the decision process? “Planning means changing minds, not making plans” Arie de Geus, “Planning as Learning” Harvard Business Review 1988. 18 In all organisations there is a need to stimulate innovation “Never, ever, think outside the box” 19 These goals are achieved through a series of conversations The organisational decision making process Decision Makers See See Opportunity Opportunity Approve Frame Approve Analysis Implement Decision Support Framing Analysis Interpret 20 Framing means defining what must be decided, determining the objectives, identifying alternatives, and establishing the logic for choice “The framing of a problem is often far more essential than its solution” Albert Einstein 21 “Assumption busting” starts with the decision making process 1. Over the past few years, what surprised you most about the way your organisation made its decisions? 2. What deficiencies in decision making need fixing? 3. What are our mavericks, outliers, and defectors telling us? 4. What must your organisation retain in its decision making process? 5. Five years into the future, what key characteristic of your decision process will appear to be the most antiquated? 22 Here are some ways to overcome the biases in decision making How to overcome bias Bias Explanation Overcoming the bias Anchoring Giving disproportionate weight to the Pursue other lines of thought in addition to your first one. Always view a first information you receive problem from different perspectives Be open-minded. Seek information from a variety of people and sources after thinking through the problem on your own Status quo Favouring alternatives that perpetuate the existing situation Ask if the status quo really serves your objectives Ask if you’d choose the status quo if it weren’t the status quo Downplay the effort or cost of switching from the status quo Sunk costs Making choices in a way that justifies past, flawed choices Get views of people who weren’t involved in the original decisions Remind yourself that even the best managers make mistakes Don’t encourage failure-fearing Confirming evidence Seeking information that supports your existing point of view Check whether you’re examining all evidence with equal rigour Being overly influenced by vivid memories when estimating and forecasting Be very disciplined in forecasting. Start by considering extremes, and then challenge those extremes Get actual statistics, not just impressions Over-confidence Ask a respected colleague to argue against your potential decision Avoid “yes-men” 23 Make use of the Decision Analyst’s communication toolset Framing Decision Pyramids Decision Tables List of Risks Influence Diagrams Modelling & Data Collection Decision making Evaluation Spreadsheets or other models Tree Rollback Tornado Diagrams Risk Profiles Decision Trees Rainbow Diagrams Probability Assessments Value of Information Assumptions Results Insights Recommendations 24 In conclusion, embrace a more complete decision process For you personally, there are big benefits if you: Take on an expanded multi-rational decision process; and make sure it is understood by all Listen to user needs and concerns Use mechanisms to counter biases; adopt “outsider” lenses Get models and processes verified / validated independently 25 Strategis Partners works with clients in all industries to help them make better decisions Our clients benefit through our expertise in: Scenario planning Strategy planning Decision and risk analysis Independent, strategic advice in over 100 engagements in Australia, Asia & Canada 26 Thank you, and questions “Most thought-provoking in our thought-provoking time is that we are still not thinking.” Martin Heidegger Copyright for the Lichtenstein works of art used in this presentation resides with the Estate of Roy Lichtenstein 27