Net Present Value Risk Analysis Martin Hopkinson

advertisement

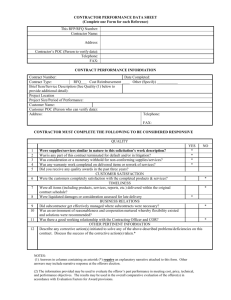

Net Present Value Risk Analysis an example of using risk management to shape a project’s solution Martin Hopkinson Net Present Value Risk Analysis CI05 M01 I02 Slide No. 1 Common-practice Project Risk Management Single Pass Process Project Objectives Brainstorm, Checklists etc. Prob Impact Matrix Risk Registe r Actions Net Present Value Risk Analysis Slide No. 2 Full Process - PRAM Guide (APM, 2004) Multi-pass Process Net Present Value Risk Analysis Slide No. 3 Road Bridge Project Two options for the location of a new road bridge Town Town Option 2 is the higher capital cost 2 1 City Town Regional authority invites tenders from industry Net Present Value Risk Analysis Slide No. 4 Conditions of the Invitation to Tender • The contractor may bid for either Option 1, Option 2 or both options • Selected contractor will be awarded a 20-year contract • The contractor will bear the costs of building the bridge, but will have exclusive rights to collect tolls until the end of the 20-year period. You are the project risk manager employed by one of the contractors in receipt of the invitation to tender What is your advice? Net Present Value Risk Analysis Slide No. 5 A Useful Point about Risk Analysis “The biggest uncertainty in a risk analysis is whether we started off analysing the right thing and in the right way” David Vose (2008) – Risk Analysis 3rd Edition Risk analysis should be designed to answer specific questions. The first task is to verify that the right questions have been identified. What are the right risk questions at this stage in the road bridge project? 1. Should the company pursue this opportunity? 2. If so, what are the most important sources of uncertainty to manage? Net Present Value Risk Analysis Slide No. 6 Should the Company Pursue this Opportunity? Recommended approach – Net Present Value Risk Analysis n NPV = ΣC n t / (1 + D) t=0 Ct = the net cash flow over a period of time (typically 1 year), t = the period of time during which that cash flow takes place, D = the discount rate (rate of real terms loss in the value of cash expressed as a percentage - typically per annum) and n = the number of periods of time periods (typically years) over which NPV is calculated Net Present Value Risk Analysis Slide No. 7 Inputs to the NPV Risk Model c/a = Contract award date Net Present Value Risk Analysis Slide No. 8 @RISK for Excel Net Present Value Risk Model First cycle of the risk management process - Risk Model demonstration Net Present Value Risk Analysis Slide No. 9 Outputs from the NPV Risk Model Answer to Question 1: A polite no bid letter Net Present Value Risk Analysis Slide No. 10 Outputs from the NPV Risk Model Net Present Value Risk Analysis Slide No. 11 A Graphical Representation of the NPV Risk Model Net Present Value Risk Analysis Slide No. 12 Improved Conditions of Invitation to Tender • National government will fund 50% of the capital costs up to a maximum of £50M • The contractor may bid for either Option 1, Option 2 or both options • Selected contractor will be awarded a 20-year contract • The contractor will bear the costs of building the bridge, but will have exclusive rights to collect tolls until the end of the 20-year period. As your risk manager, what is your advice? 1. Rerun the first pass risk model with the changed condition 2. Develop a revenue risk model 3. Compare Options 1 and 2 Second cycle of risk management process Net Present Value Risk Analysis Slide No. 13 Output from the Rerun First Pass Risk Model Net Present Value Risk Analysis Slide No. 14 @RISK for Excel Net Present Value Risk Model Second cycle of the risk management process - Risk Model demonstration Net Present Value Risk Analysis Slide No. 15 Output from the Second Cycle of Risk Analysis Option 2 is the better choice Net Present Value Risk Analysis Slide No. 16 Risk Management Process Third Cycle - Commercial Strategy Sources of uncertainty 1. 2. 3. Revenue Cost Opening date Influenced by Future traffic trends Economic growth Future city development Regional authority Bridge design Contractor Toll charges Mutual agreement Bridge design Contractor Contracting strategy Contractor Materials Economic conditions Planning consents Regional authority Construction time Contractor Net Present Value Risk Analysis Slide No. 17 Summary of Important Points • Risk Management can be used to shape the project solution • An iterative top-down approach is required to do this • The most important sources of uncertainty may be those associated with economic benefits rather that project delivery • NPV risk analysis can be used to make choices between mutually exclusive options • Understanding relevant sources of uncertainty is important • The commercial solution should align liability for cost with influence over key sources of uncertainty Net Present Value Risk Analysis Slide No. 18 The Project Risk Maturity Model – Level 4 The risk management process leads to the selection of risk-efficient strategic choices when setting project objectives and choosing between options for project solutions or delivery. Sources of uncertainty that could affect the achievement of project objectives are managed systematically within the context of a team culture conducive to optimising project outcomes. Net Present Value Risk Analysis Slide No. 19