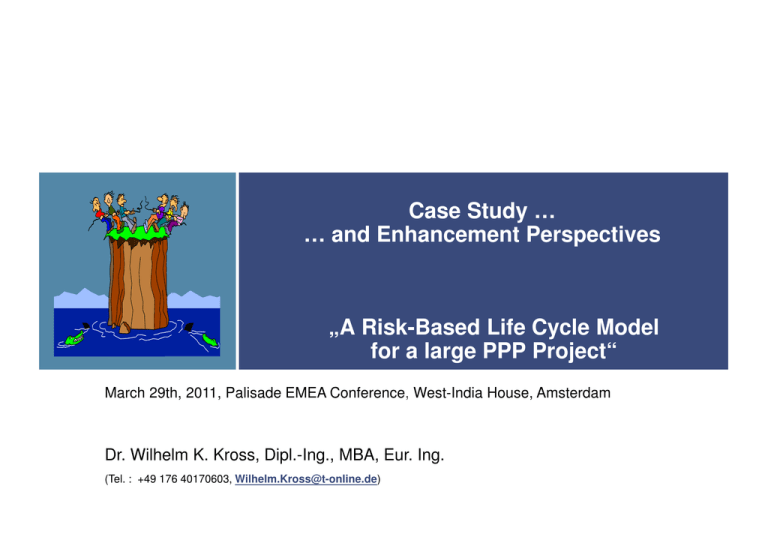

Case Study … … and Enhancement Perspectives „A Risk-Based Life Cycle Model

advertisement

Case Study … … and Enhancement Perspectives „A Risk-Based Life Cycle Model for a large PPP Project“ March 29th, 2011, Palisade EMEA Conference, West-India House, Amsterdam Dr. Wilhelm K. Kross, Dipl.-Ing., MBA, Eur. Ing. (Tel. : +49 176 40170603, Wilhelm.Kross@t-online.de) Recent and new Issues in structuring larger PPP projects Naïve and flawed approaches, and dysfunctional financing mechanisms • Public private partnership projects seen as an alternative financing and operating structure, mostly seen in the fields of communal services • Schools, community halls, buildings, roads, IT infrastructure, hospitals, waste facilities, bridges, tunnels, army barracks, etc. • Many similarities when compared to earlier design – build – operate – transfer project structures • A political topic, with differing trends in differing countries • Risk management approaches often a little naïve, particularly in forfaiting contract structures • Recent financial crisis triggered additional impediments • Bank consortiums unable or not willing to enter customized project financing structures • Fundamental prerequisites to entering negotiations with private equity investors unaddressed • “Soft factors” still playing a major role • Larger projects either impeded, or initiated with inadequate contracts and poor risk management • Entirely new approaches required to “enable” larger initiatives as prospective PPP projects • Structuring of a front-to-end, “life-cycle” understanding of the respective initiative • Employing certifiable management systems for each phase, and smooth transitions • Employing structured technical insurance products • Optimizing the PSC on the basis of risk-based life cycle models, with quantified residual risk • Specifying features in contractual SLAs that, from a risk and cost perspective, are truly sensitive • Enabling investor / operator consortiums to approach the financial market with a new quality of information on the true risk, and opportunities • Considering an up-front minority investment on behalf of the public partner, with buy-out options © 2011 Dr. Wilhelm K. Kross 1 Historical evolution and trends in risk management Risk management in strategy optimisation is not a reality yet ? Regression Analytics Swamps = Malaria ca. 3000 B.C. Provisions, Interest Risk in Contracts Life Expectancy ca. 1750 Selective Management Medical Field, Toxicology Insurance, Risk Pricing Statistics Probabilistic Approaches Regulatory Approaches Economics Systems / Processes Decision Analyses Start Computerization Market Risk, Credit Risk Project Risk Portfolio Management Integrative Approaches Social Risk, Reputation Option Pricing Real Options Risk in Psychology Risk Communication Operational Risk Management Processes Maturity and Excellence Strategy Optimization © 2011 Dr. Wilhelm K. Kross Today ... Organization Designs Supply Chains 2 Known distortions in the understanding and perception of risk Empirical research in managerial risk controlling and management Source : Hillson (2005). „Describing Probability : The Limitations of Natural Language“. PMI Global Congress 2005 EMEA Proceedings Risk Tendency Source : Shapira (1995). „Risk Taking : A Managerial Perspective“. Russel Sage, NY, NY I would ... Others would ... I should ... Very Successful © 2011 Dr. Wilhelm K. Kross Successful A Little Success A Little Failure Failure Considerable Failure 3 Strategic enhancement of traditional risk management focus Components of an organizational risk and opportunity management Time Benefits e.g. Capital cost assessment and optimization, taking risk into account Benefits from opportunities Risk adjusted process- / project optimization “Right-sizing“ of risk-reduction initiatives Support of strategic decision making Efficient risk management as competitive advantage Supporting investment decisions Evaluation of planning accurateness Securing the business operations Avoidance of deviations Support of gap / sensitivity analyses (risk adjusted prognoses for organization, division, and projects) Avoidance of surprises through timely intervention Compliance to regulatory minimal requirements Avoidance of losses Compliance with regulations IdW-Standard, IFRS, SEC and stock exchange rules, 8th EU Directive KonTraG, SOX, Corporate Governance Codex Austria Norm, ISO Standards, TÜV and DIN Standards SolvV, MaRisk, MiFID, FRUG Environmental and human health laws and regulations … etc. … Level of development of risk management © 2011 Dr. Wilhelm K. Kross 4 Critical success factors also include „project management“ Projects are the prevailing structure for strategy implementation To be handled with care though: • Project structure is used for accounting approaches, also as an implied line function, year end reporting determines the project end, incomplete project life cycles, resultant costs within the framework of project- management / optimization is largely ignored • Operational risk is not explicitly reported, unclear degrees of conservatism • Small crises are rolled into large projects and have the potential of jeopardizing the entire project • No clear delineation between project / line functions, historical liabilities are delegated into the project, project manager is confronted with conflicting goals and objectives • Projects are set up in a too large scale, then implied line structures in stead of project structures, operational work-arounds and poor compromises later dominate the order of the day • Complexity of individual activities and work packages is not reviewed explicitly, resulting in roll-over management, many activities 97% complete • Project financing models overall only consider the development phase, not the life-cycle • Transition from development to resultant operational phases are structured inadequately • Project manager not holding down the required authority for large initiatives, mega-projects are set up to fail, undesired results not tracked in knowledge base • Inadequate project manager qualification approaches, inconsistence competence and process models instead of management sills, soft factors are partially neglected • Risk ownership in projects all too often not related to true structural power and competences © 2011 Dr. Wilhelm K. Kross 5 Lessons learnt in so-called IT mega-projects Real-life initiatives requiring new focus of PM and change management From the beginning… Project Objective Projects are set up too large, structured too rigidly and executed in an overly decentralized manner (Quasi-business line function instead of project management) Failure Planned Project Progress Budget Consumption Professional restrictions are not identified and prioritized right from the project start (Vague maximum objectives as “basis for negotiation“) Work packages are not managed in respect of cost-benefit considerations - and risk consciousness as well as trade-offs Achievement of Objectives (Project progress = budget consumption ≠ residual complexity) Project Initiation Complexity Business Concept Implementation and Interfaces …to the end IT Architecture Concept Integration Concept Process Improvement Decision / Performance Analyses Project Failure 70% Residual Complexity in Interfaces Increasing deviation from the original project scope, subprojects are developing a life of their own Increasing complexity through reactive detection of project issues and problems Ad-hoc problem solving replaces project management 180% Professional Requirements 120% Residual Professional + 150% Technical Requirements Project Initiation Business Concept © 2011 Dr. Wilhelm K. Kross Project ends with a hard compromise or with a “termination by decision“, overdue change is poorly or not implemented Implementation and Interfaces 6 Project planning and project management in Germany Particular risks of projects in the public sector • Auxilary requirements: small and medium size company tendering, setting an example, constructional art, no official „black listing“, hardly any pre-qualification criteria • Further risk factors inherent in the EU tendering and budgeting laws and regulations – Lead time for tender documentation, tender procedure complaints, litigation, budget reallocation, susceptibility to blackmail by service providers due to the long lead time in tendering processes – No explicit risk provision, unreliable reference data, critical path is intransparent, no optimsation of insurance concepts – Reverse-engineering of the cost estimates to the level of „ES-Bau“ • Pre-programmed failure: delayed start, documentation becomes more important than true performance, inappropriate monitoring of external project management, service providers assume an independent reality, bold letters, increased formalism, formalism in the process of tallying the contract specifications, mobilisation of an army of lawyers, …. € € Risk loading Risk adjusted costs to receive budget approval © 2011 Dr. Wilhelm K. Kross Risk and assumption stripped costs of ES Bau stripped costs advanced Risk adjusted costs advanced for budgeting of AöR Refrence base for risk loading of EW-Bau 7 PPP project planing and PPP project management in Germany Many opportunities are systematically destroyed for PPP-Projects • Narrow minded set for business case, partially using incorrect risk allocation – Minimum requirement of proof of significant cost savings – Thereby not taking into account explicit consideration of the risk factors of EU tendering law and German budgeting laws and regulations in a comparison model – Time-to-market is not an official decision criterion – Distrust on the part of the public sector “possible loss of control” to the private sector (?) • Mostly forfaiting combined with limited intervention clauses, very little project financing models – Many risk factors remain in the public sector; lowest risk model for bankers, investors, developers and operators; sensible for small standardized projects based on attractive transaction costs – For financing arrangements, many risk factors remain unnoticed, hardly any explicit risk analysis, risk aggregation is often incorrect, management quality is largely negligible, rating prognoses of project implementation companies tend to be arbitrary • Insurance concepts are integrated unsatisfactorily, suboptimal overall direction • Transitions from development to operational phase are mostly suboptimal, also cost allocation between development and operational phases are not always sensible • Too many steps are not standardized, thus in turn creating unnecessary transaction costs © 2011 Dr. Wilhelm K. Kross 8 Employing appropriate risk and opportunity management focuses Framework to integrate and evaluate cause / consequence relationships Factory Supplier Warehouse Wholesaler / Retailer / Retailer Customer Target Structure and Work Flows Enterprise modelling Extent of Damage Production Factors and Resources 1 catastrophic 2 Risk analysis negligible 3 4 high 5 8 6 9 low 7 medium high 1 day Financial Key Indicators 1 Fire: production hall 2 … 4 Interruption: power supply 5 … 8 Burglary: canteen 9 … Probability of Occurrence 1 week 1 month 6 months Product development Procurement Balance Sheet P&L Controlling Data © 2011 Dr. Wilhelm K. Kross Business impact analysis Production Distribution No impact Significant impact Negligible impact Catastrophic impact 9 Risk and cost reduction in the planning of a project Traditional approach to project planning (simplified example: building construction) Preparation Kick-Off Project structuring Concept / methodology Tender Detailed planning Tender award Excavation Foundations, building Installations, adjustment Application approvals Permitting process Escalation of approvals Compensation negotiations Completion, Review Sub-optimal approach, inevitable suboptimal results, some hidden problem areas: Unclear degree of consertativeness, hidden buffers, all individual estimations are probably too high or low Inconsistent degree of detail, no overview of the complexity hubs or the influence of risk factors Sensitivity analysis and scenario optimisation require signifinant additional time, and in all likelyhood are rather complex © 2011 Dr. Wilhelm K. Kross 10 Risk and cost reduction in the planning of a project Probabilistic enhancement of project planning 70% 30% Marginal additional effort, however, robust and comprehensible results, fewer hiddel problem areas: Use of available data as well as moderated three point estimates to bridge inherent data gaps Explicit reflection of the influence of risk or future decisions, dependencies and correlations are explicitly reflected Monte-Carlo simulation in standard software, sensitivity analyses and scenario optimization at the press of a button © 2011 Dr. Wilhelm K. Kross 11 Risk and cost reduction in the planning of a PPP project Probabilistic analysis, iterative optimization of life cycle costs Probabilistic project model incl. uncertainties and variability in duration and resource utilization per activity Simulation and regression analyses to identify cost and time drivers, impact of core risk factors, interdependencies, optimization potentials Extension toward a risk-based life cycle cach flow model Risk adjustied optimization of life cycle costs Costs risk adjusted Budget PSC Time © 2011 Dr. Wilhelm K. Kross Quality 12 Fundamental new insights from risk-based life-cycle model Entirely new sets of information, enabling informed decisions • Major risk and cost drivers identified, as well as their inter-relationships throughout the life-cycle • Quantitative data and information base, with an appreciation of its true quality • Multi-scenario decision base, including an appreciation of risks and issues • Early insights into the likely impact of good and poor decisions, and assumptions • Energy efficiency aspects appropriately integrated in design specifications • Valuable insights for the design of intelligent risk transfer mechanisms in contract designs, e.g. transferred risks and SLAs as a function of contract duration • Optimizable approach to designing insurance programs • Early appreciation of early detection mechanisms for likely risks and potential issues • Residual risk and opportunity profiles demonstrable to private equity sector participants • Valuable know-how upgrade in actually developing and operating the probabilistic models • And more … for this project, and others to come © 2011 Dr. Wilhelm K. Kross 13 Next steps: integration of certifiable (?) management systems Generic framework for the introduction of risk controlling & management 1. Definition of unacceptable risks, available budgets, risk management and corporate communication strategy 2. Internal and external loss database Software selection and system solution Risk reporting requirements 3. Possible events, gap and hazard analyses Consequence chains Cause / effect relationships 4. 1. Corporate Policy 2. Operational Risk Indicators 3. Processes and Workflow 4. Approaches to Proactive / Reactive Risk Management Performance assessment models Responsibilities, skills and training 5. Risk Transfer Scenarios 5. Cost comparisons Comparison of cost effectiveness Scenario optimzation 6. Conditional probabilities Consequence chains Total cost of risk optimization 7. (Un) acceptable residual risk Cost effectiveness and budget availability Provisions for expected cost 8. Scenario analysis and prioritization Planned reduction and / or insurance and / or outsourcing of exposure scenarios 9. Decision support and communication tools Comparison of scenarios / description of processes / residual risk per scenario 6. Gradually Refine Quantification Approaches 10. Integration into a holistic internal model Integration into continuous improvement cycles Integrated management, aligned risk culture © 2011 Dr. Wilhelm K. Kross 7. Derive Conclusions for Scenarios 8. Planning and Implementing 9. Results / Priority List 10. Subsequent Iterations, Continuous Improvement, Interfacing Certifiable Frameworks (PMBOK, BS25999, ON 49000, CObIT, etc.) 14 Challenges in future-oriented corporate risk management Adjustments to a dynamic environment inclusive of strategy changes © 2011 Dr. Wilhelm K. Kross 15 Overdue enhancements of financial risk management framework Simulation of future performance, not extrapolated historic performance DVaR Absatzmenge Absatzpreise Materialpreise Personalkosten Sonstige Kosten R1 R2 R3 R4 R5 Free Free Cash Cash Flows Flows 5.000 Trials Plan-GuV Gesamtleistung 56.040 T€ Materialaufw and 12.952 T€ Personalauf w and 21.146 T€ sonst. betr. Aufw and 15.683 T€ +/-15% +/-4% ,034 +/-4% Abschreibungen 2.140 T€ Betriebsergebnis (EBIT) 4.119 T€ Finanzergebnis RAC +/-4% ,026 1 +/-4% z.B. Betriebsunterbrechung R6 356 T€ Forderungsausfall R7 Produkthaftung ,017 R8 ,009 % -5‘000 T€ a.o. Ergebnis 0 T€ Gew inn vor Steuern 4.475 T€ Gew inn nach Steuern 2.569 T€ ,000 -200,00 -100,00 0 56,00 100,00 200,00 250,00 Careful: Non-quantification of risk = quantification with zero ! © 2011 Dr. Wilhelm K. Kross 16 Required enhancements of financial risk management framework Demonstration of future performance (e.g. of a large medical facility) Defensible risk analysis and robust business concept Negotiate and implement financing vehicle Implementation project and pilot operation Fully trained initiation, optimized work flow („bankable business plan“) („structured solution“) („robust & transparent“) („efficient & effective“) Overall concept Updated business plan Final work flows, rooms, 2-3 months of pilot Cooperation contracts Proof of multi-fold architectural plan, etc. operation (one shift), (pre-negotiated) securitization Project structuring, „trouble-shooting“ Tenders, cost proposals Seed finance Work breakdown, Start of research programs Detailed negotiations Include public support Project schedule, Transfer to double shift Purchase of property funds and guarantees Management structure, operation considering Detailed risk analytics Optionalities, SLAs & Communication, applied learning / efficiency Process optimization guaranteed capacity of Project office, etc. Take up full operation Project optimization supplier/insurance Permitting processes Fast-tracked downpayment Proof of estimates, e.g. Insurance concept Site preparation Actives management of Operational capacity, Detailed negotiation Raw building, finishes SLAs, co-operations Robust project plan, with investors Pilot installations Systematic realization of Robust work flows, Structuring of special Technical equipment any synergy effects Buffers, contingencies, purpose vehicle, early Personnel planning, Extension to 3 shift Risk bearing capacity contracts with investors employment contracts operation depending on Business plan with Negotiation of Training of staff demand / patients sensitivity analyses financing packages in test-/pilot operation Accelerated settlement of Contract negotiation, Outbuildings, parking, high-interest loans tender documents gardening etc. Transfer of project at the Formal kick-off Acceptance, transfer end of contract © 2011 Dr. Wilhelm K. Kross 17 Conclusions and further recommendations Life-cycle project risk management as a decision support process Results Risk Management must be set up for specific circumstances, consisting of various interlayered analysis and management levels Significant problems already resolved, not too narrow minded approach, no reinvention of the wheel Historic often overemphasized controlling, tail wagging the dog , probabilistic approach often sensible Software-credibility does not solve the problem, however, software enables new forms of optimization Risk management on the systems-, processes-, projects-, portfolio-, initiative-, enterprisewide and supply chain levels is currently experiencing a fundamental change in mindset Cultural paradigm change, toward incentive schemes for the delegated responsibility Creation of interface to optimization frameworks, beyond enterprise boundaries, integrated logistic networks Truly significant is the handling of “soft“ factors Human understanding and attempts at manipulating the initial evaluation, subsequent implementation, delegation of responsibility, strategic stakeholder communication, throughout the entire life cycle Entrepreneurial focus in prioritization framework, creating a transparent risk culture, enhance risk awareness, facilitate flexibility, create risk ownership structure Probabilistic financial modeling can become a true enabler Lessons learnt from private equity based mega-project financing reflect that innovative project financing approaches are a realistic perspective for larger-scale PPP projects One can make better decisions for the right reasons ! © 2011 Dr. Wilhelm K. Kross 18 Any further questions or comments? Dialogue is possible by e-mail too … Building professionalism in project management® Project Management Institute Frankfurt Chapter Dr. Wilhelm K. Kross, Dipl.-Ing., MBA, Eur. Ing. Past President Postfach 1705, D-61287 Bad Homburg, Germany Tel. +49 (0) 176 / 4017 0603 Wilhelm.Kross@PMIFC.de www.PMIFC.de © 2011 Dr. Wilhelm K. Kross 19