[33.02.04] Tax Avoidance Settlement incentive 1. Legislation

advertisement

![[33.02.04] Tax Avoidance Settlement incentive 1. Legislation](http://s2.studylib.net/store/data/010385586_1-b615f994558f67e6deb922465e71185f-768x994.png)

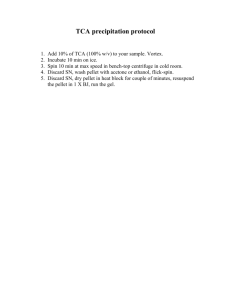

Revenue Operational Manual 33.02.04 [33.02.04] Tax Avoidance Settlement incentive Updated June 2015 1. Legislation Section 811A(2A) TCA 1997, as inserted by section 87(1)(b)(i) Finance Act 2014, allows a taxpayer, who, on or before 23 October 2014, entered into a transaction to avoid tax, to settle with Revenue by paying the tax or duty due and a reduced amount of interest. This opportunity is strictly time-bound. After 30 June 2015, Revenue’s existing policy in relation to challenging pre-24 October 2014 tax avoidance transactions will apply. That policy is to actively challenge tax avoidance transactions and to litigate such cases in the Courts where Revenue is of the view such a transaction is not effective in achieving the intended tax advantage. 2. Availing of the settlement incentive To avail of this opportunity, a taxpayer must make a “qualifying avoidance disclosure” (“QAD”) in writing to the Revenue Commissioners on or before 30 June 2015. There will be no extension to this date. Any disclosure received after that date is not a qualifying disclosure. QADs must be made to the QAD Unit in Large Cases Division. Any taxpayer who has a query in relation to this settlement incentive should be told to contact the QAD unit directly. Their contact details are: Qualifying Avoidance Disclosure Unit, Large Cases Division, Ballaugh House, 73-79 Mount Street, Dublin 2. Email: qad@revenue.ie Phone: 01-6131507 3. Publications An e-brief will issue shortly confirming the details of the incentive such as the benefits of making a QAD and how to make a QAD. In brief, these are: 3.1. Benefits of making a QAD Where a taxpayer makes a QAD: the interest that would otherwise be payable is reduced by 20%, the 10% or 20 % surcharge (under section 811A) will not apply, and 1 Revenue Operational Manual 3.2. 33.02.04 No penalty will apply if Revenue accepts that a disclosure is a QAD that relates to a tax avoidance transaction. How to make a QAD A QAD is very similar, in form and content, to a qualifying disclosure under the Code of Practice for Revenue Audit and Other Compliance Interventions. A QAD must be made in writing and must: provide complete information about, and full particulars of, the tax avoidance transaction; contain a declaration that, to the best of the taxpayer’s knowledge, information and belief, the disclosure is correct and complete; be accompanied by payment of all the tax due; be accompanied by payment of 80% of any interest due; and be signed by or on behalf of the taxpayer. Disclosures should be made using a Form QAD1 or Form QAD2 (continuation sheet), which will be available on the website, and submitted to the QAD unit in LCD. 3.3. What Qualifies? The settlement opportunity is available in relation to transactions which were put in place to avoid tax and which commenced on or before 23 October 2014. The types of transactions that qualify are: 1. Tax avoidance transactions within the meaning of section 811 of the TCA 1997 (“section 811”), that is, transactions where a nominated officer of the Revenue Commissioners has formed an opinion under that section. 2. Transactions that, had the Revenue Commissioners formed an opinion under section 811, would have led to a liability to tax under that section. It may not be immediately obvious to a taxpayer, who has engaged in a tax avoidance transaction and who has not received a notice of opinion under section 811, whether or not a qualifying avoidance disclosure may be made in relation to that transaction. Appendix 1 provides some further guidance on this point. 3. VAT avoidance transactions that are being challenged or could be challenged by Revenue under the “Abuse of Rights” principle. 2 Revenue Operational Manual 33.02.04 Appendix 1 Further guidance for paragraph 3.3, sub-paragraph 2 It may not be immediately obvious to a taxpayer who has engaged in a tax avoidance transaction, but who has not received a notice of opinion under section 811, whether or not a qualifying avoidance disclosure may be made in relation to that transaction. The following is intended to provide some further guidance on this point: (i) A qualifying avoidance disclosure may be made in respect of a transaction that had the Revenue Commissioners been fully aware of all relevant facts and circumstances and had they considered these facts and circumstances, they could have formed an opinion under section 811. This applies both where Revenue is already aware of the transaction, even if this awareness is limited, and where Revenue is not currently aware of the transaction. (ii) A qualifying avoidance disclosure may also be made in relation to a transaction that is being challenged (including where assessments have been made or amended) under legislation other than section 811, but which, had Revenue formed an opinion under section 811, would have given rise to a tax liability under that section. The settlement opportunity does not apply where tax fraud arises (e.g. where a taxpayer claims that a loan or investment was taken out or made when, in fact, this was not the case). Paragraphs (a) and (b) give examples of some of the transactions that are being, or could be, challenged under legislation other than section 811 and which could qualify for the settlement opportunity. These examples are not intended to be exhaustive. (a) Transactions that fail to meet a bona fide commercial test and/or a requirement that the transaction is not part of a scheme or arrangement the main purpose, or one of the main purposes, of which is the avoidance of tax. This includes transactions that are being challenged or that are capable of being challenged under the following provisions: Section 242A(2)(c) or(4)(b)TCA 1997: tax treatment of certain royalties Section 247(4A) TCA 1997: relief to companies on loans applied in acquiring interest in other companies Section 248(3) TCA 1997: relief to individuals on loans applies in acquiring interest in companies Section 248(3) as applied by section 250 TCA 1997: extension of relief under section 248 to certain individuals in relation to loans applied in acquiring interest in certain companies Section 267K(1) TCA 1997: interest and royalties directive Section 291A(7)(c) TCA 1997: intangible assets Section 436A TCA 1997: certain settlements made by close companies Section 546A TCA 1997: restriction on allowable losses Section 586(3)(b) TCA 1997: company amalgamations by exchange of shares Section 587(4)(b) TCA 1997: company reconstruction and amalgamations 3 Revenue Operational Manual (b) 33.02.04 Section 80(4) SDCA 1999: reconstruction or amalgamations of companies Section 598(8) TCA 1997: disposal of business or farm on ‘retirement’ Section 600(6) TCA 1997: transfer of a business to a company Section 624(1)(b) TCA 1997: exemption from charge under section 623 in case of certain mergers Section 739H(1B) TCA 1997: investment undertakings: reconstructions and amalgamations Section 41(2) SDCA 1999: conveyance in consideration of sale Section 36 CATCA 2003: dispositions involving power of appointment Transactions where the dispute centres or could centre on the interpretation of the legislation. This includes transactions that are being challenged, or that are capable of being challenged, under the following provisions: Section 81A TCA 1997: restriction of deductions for employee benefit contributions Section 130(3) TCA 1997: matters to be treated as distributions Section 590 TCA 1997: attribution to participators of chargeable gains accruing to non-resident company Section 806 TCA 1997:charge to tax on transfer of assets section 807A TCA 1997: liability of non-transferors Section 811B TCA 1997: tax treatment of loans from employee benefit schemes Section 812 TCA 1997: taxation of income deemed to arise from transfers of right to receive interest from securities Section 813 TCA 1997: taxation of transactions associated with loans or credit Section 814 TCA 1997: taxation of income deemed to arise from transactions in certificates of deposit and assignable deposits Section 815 TCA 1997: taxation of income deemed to arise on certain sales of securities Section 816 TCA 1997: taxation of shares issued in place of cash dividends Section 817 TCA 1997: Schemes to avoid liability to tax under Schedule F Section 817A TCA 1997: Restriction of relief for payments of interest Section 817B TCA 1997: treatment of interest in certain circumstances Section 817C TCA 1997: restriction on deductibility of certain interest Section 8 CATCA 2003: disponer in certain connected dispositions Section 44 CATCA 2003: arrangements reducing value of company shares 4